A lot of folks have an assumption about a common money practice that may need a second look.

It's a simple concept that many people are not aware of.

DON'T MISS: Dave Ramsey Wants Parents To Stop One Money Habit That Could Hurt Their Kids

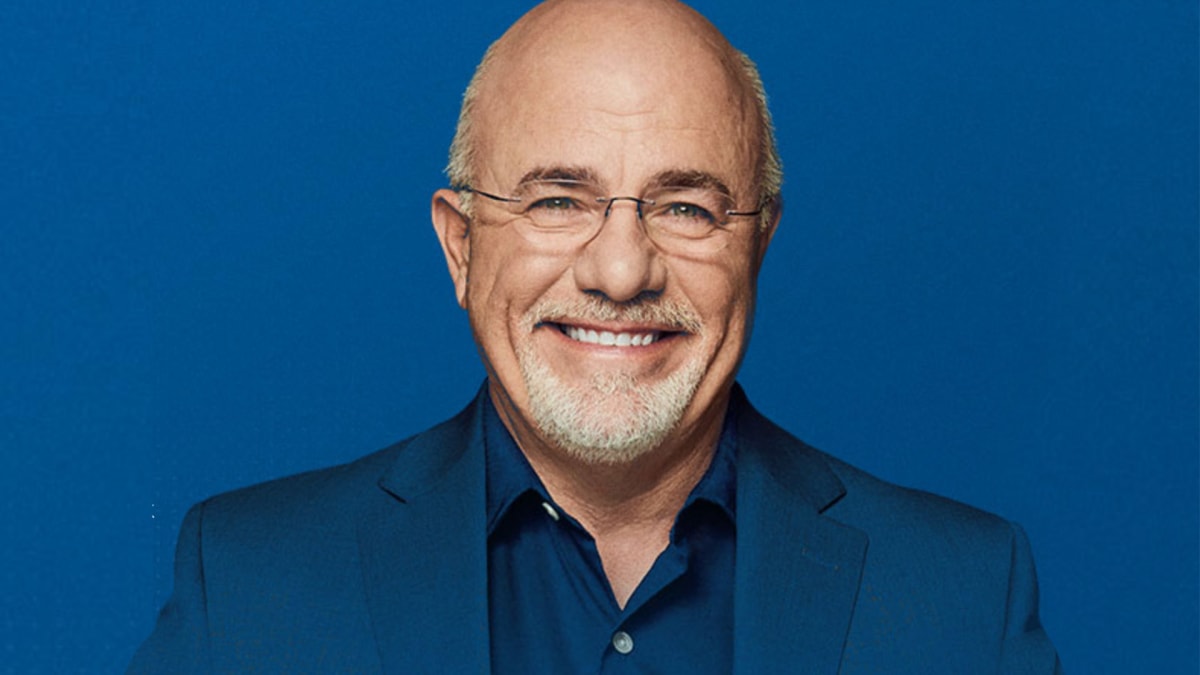

Personal finance personality Dave Ramsey recently settled an advice-seeker's dilemma about a banking solution for his small business.

"Dave," wrote the man, who said his name was Matt, according to KTAR News in Phoenix, Ariz. "As a small-business owner, should I work with multiple banks to avoid what happened with Silicon Valley Bank?"

In response, Ramsey first explained his thoughts on the Silicon Valley Bank collapse.

"You should work with multiple banks, but that has nothing to do with Silicon Valley Bank," Ramsey wrote. "SVB shouldn’t be a business model anyone follows. It was a crash of high-tech, start-up and venture-capital players. It was a 'players' bank."

"In other words," he continued, "It was a bunch of Silicon Valley posers misbehaving under the heading of a bank -- and it all came crashing down on their heads. But it didn’t have anything to do with the kinds of banks you or I do business with."

Ramsey described his view on banks, vendors and freedom of choice.

"Believe it or not, a bank is just another vendor," he wrote. "They are helping you, and they are a supplier to you -- whether it’s a checking account, debit card or anything else."

"Anytime you’re doing business, especially when it comes to key areas of your company, it’s always good to have more than one vendor in that category," Ramsey added. "That way, you’re not stuck if they decide to raise their prices or their quality of service declines."

The radio host mentioned how this trick applies to his own personal business.

Don’t get me wrong -- I’m not talking about jumping from vendor to vendor every time the wind blows. We have vendors we’ve worked with for 20 years at Ramsey Solutions.

But I’m also not going to let myself or my business become a prisoner of one provider. Currently, we have three banking relationships. We have a primary bank, and we’ve been with them for 35 years. We also have two other minor banking relationships.

Do you see what I’m saying, Matt? If you’ve only got one supplier for one of the key elements of your business and they suddenly go sideways, so do you! We deal with smaller, regional and local banks at my company too. That way, we get to talk with actual human beings who make reasonable decisions.

The big banks? No, thank you. Small businesses, especially, are just numbers to them. You get no respect, no mercy and no real help.

Ramsey also addressed the matter of building ties with people at local banks.

"Develop banking relationships with people in your own town and area," he wrote. "I’m talking about the kind of folks you could sit down with, have a cup of coffee, and engage in a real discussion about your needs and what’s going on in your business."

"A bank is a key vendor relationship for a small business, but make sure you protect yourself and diversify. Never have just one."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.