Many Americans correctly view their 401(k)s as the financial foundation they are building for future retirement plans.

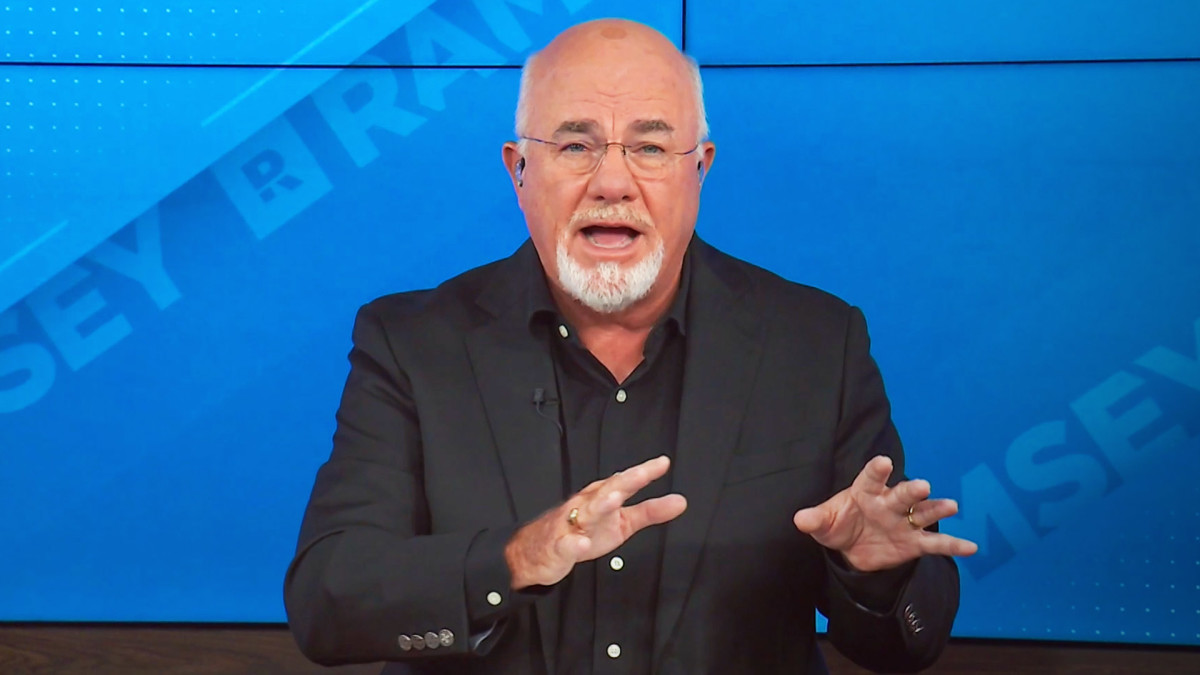

But personal finance author and radio host Dave Ramsey believes another retirement strategy is also of major importance and has advantages of its own.

Related: Dave Ramsey has new strong words on buying a home and real estate

One advantage of an employer-sponsored 401(k) plan is that its growth is tax-deferred. That is, contributions grow tax-free until the time comes to begin withdrawing money.

Another 401(k) feature people can take advantage of is employer matching, which gives a large boost to employees' retirement savings. In fact, employer matching really amounts to a 100% return on the amount of money you invest.

And the contributions made to a 401(k) from one's paycheck come from the pre-tax total, reducing an employees' taxable income,

For people under 50 years old, the 2024 investing limit is $23,000. If you're over 50, the limit increases to $30,500 per year.

While Ramsey believes a well-invested 401(k) is an important piece of retirement savings, he also emphasizes the importance of another investment tool people can use as to complement it.

Dave Ramsey explains the advantages of a Roth IRA

Ramsey says that a Roth IRA (Individual Retirement Account) is a vital investment device that works best when coupled with a 401(k).

One advantage is that when a person retires, they are able to use the money in their Roth IRA tax-free. Among other reasons, because many people fear that tax rates will be higher when they retire, this is seen as a big financial win.

While 401(k) plans are limited to a certain number of mutual funds in which to invest, Roth IRAs offer more flexibility. It's a good idea to work with an investment professional, Ramsey says, but people can choose from thousands of high-performing mutual funds and they can also diversify their holdings with different fund types.

When a person retires, the money they have saved in a Roth IRA will stretch further. That's because people can withdraw money without having to pay taxes on it. This contrasts with money withdrawn from a 401(k) that is counted as taxable income.

More on Dave Ramsey

- Ramsey explains one major key to early retirement

- Dave Ramsey discusses one big money mistake to avoid

- Ramsey shares important advice on mortgages

Ramsey argues that the flexibility offered in a Roth IRA is important because the thousands of mutual funds available allow a person to balance their holdings among four types: growth, aggressive growth, growth and income, and international.

Shutterstock/TheStreet

Ramsey says investing in two retirement accounts is not difficult

Having two different accounts for retirement is relatively easy to manage by using some simple math, Ramsey explains.

He recommends investing 15% of your gross income for retirement. So, if you make $50,000 per year, you ought to invest $7,500 of that into retirement savings.

The question most people have involves exactly how that money should be divided between a 401(k) and a Roth IRA.

"If your employer matches contributions up to 4% of your pay, for example, then you’d contribute $2,000 a year to your 401(k)," Ramsey wrote on his company's website. "The remaining $5,500 would go into your Roth IRA. Boom. You’re done!"

Related: Dave Ramsey explains the average American's retirement, 401(k) savings

Ramsey explains his view that a person's 401(k) and Roth IRA can combine to create an optimal investing strategy. The goal should be for investments in each to balance each other.

"They should work together to help you make the most of the stock market’s growth, while limiting your risk," Ramsey wrote.