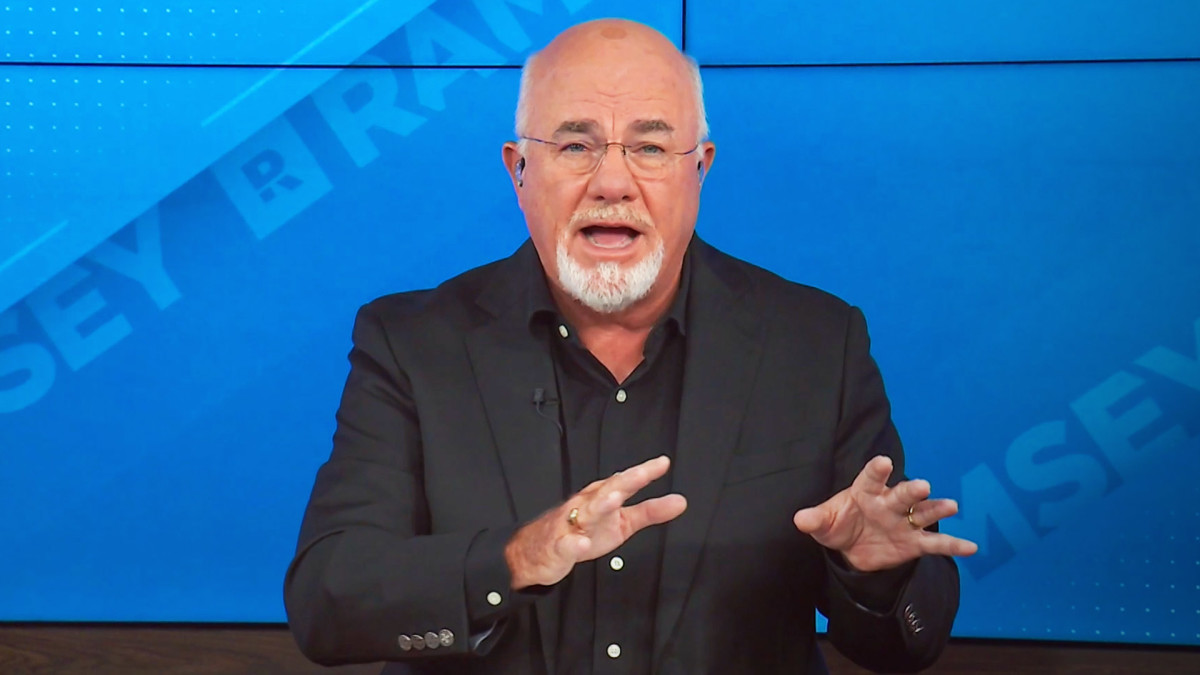

Personal finance personality Dave Ramsey has a number of basic principles he believes are important for people managing their money.

These include an approach that begins, in part, with saving for an emergency fund and then aggressively getting out of debt.

DON'T MISS: Lowe's has an answer for Target and Walmart's theft problems

But one financial tool Ramsey insists on people using is a manageable budget that isn't too intimidating. This goes for people earning money as employees with a paycheck and also for business owners, although the specifics in each case are a bit different.

"Making a budget might seem overwhelming at first, but hear this: You can do it. How? By breaking down the process a bit," Ramsey wrote on Ramsey Solutions. "Because no one eats an elephant by swallowing it whole. (You go one bite at a time.) And no one leaps into budgeting like a pro. (You take it one step at a time.)"

Ramsey says its important to simply think of a budget as a plan.

"It's not a restriction on spending — it’s a plan for what you'll do with your money. It’s a plan for what's coming in and what's going out," he wrote. "When you learn how to make a budget — and do it every month — you're giving your money purpose. You're taking control. Goodbye, money anxiety. Hello, money goals."

The bestselling author advises individuals to break down developing a budget into five steps.

- List Your Income

- List Your Expenses

- Subtract Expenses from Income

- Track Your Transactions

- Make a New Budget Before the Month Begins

Budgeting for a small business

Small business owners will inevitably confront the same types of challenges, but there are some differences between budgeting for an individual household and a business enterprise.

A man identifying himself as Joseph recently sought advice from Ramsey on this subject, according to KTAR News in Phoenix.

"Dear Dave," Joseph wrote. "I know when it comes to personal finance, you're a big fan of living on a written, monthly budget. Should you do a small-business budget the same way you do your household budget?"

In response, Ramsey immediately turned his attention to the differences between the two, mainly focusing on the amount of time for which one is planning.

"The concept you're working with is the same, but they're still a little bit different," Ramsey wrote. "When it comes to a small business, you're trying to project your income and expenses, thereby projecting your profit for the month and the next two months after that."

"Those three months make what we call a quarter," he added. "If you've been in business for a while, you can reach out further than that and usually do a reasonably accurate job of projecting the entire year."

Ramsey explained that with a small business budget, it remains important to try to estimate how much money is coming in and how much is going out.

"It all really just comes down to this: You still have to plan your income and your outgo," he wrote. "Some small-business owners tend to forego long-term planning and live hand to mouth and crisis to crisis. Sure, they may look at the profit and loss statements, but that’s kind of like looking in the rearview mirror while driving."

TheStreet

It doesn't have to be complicated

"Budgeting's not rocket science. The budgeting and planning don’t have to be super sophisticated, as long you're realistic about how much revenue you’re generating and your operating costs," Ramsey added.

Ramsey then discussed one reason businesses are unable to succeed.

"A lack of planning and handling money properly — making money behave by projecting revenue, expenses and those kinds of things — are the main reasons most small businesses fail," Ramsey wrote. "Then, the owners turn around and blame 'cash flow problems.'"

"That's a pretty vague term, and in most cases, it's a bunch of double-talk," he wrote. "It's usually coming from someone who borrowed money and couldn’t make the payments or had too much money going out and not enough coming in."

The radio host also mentioned how he communicates with his planners while running his own business.

"You've got to project into the future and think about what you're going to do and how you're going to make it happen. That's really all a small-business budget is," Ramsey wrote. "You're saying, 'Realistically, this is what we should make this month, and this is what we should spend this month.'"

"It's what I tell my team when they're doing budgets," he continued. "And when you think about it, it's not even goal setting so much as it's having a knowledgeable and informed conversation with the marketplace."

"I hope this helps, Joseph!"

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.