A social security number should be a person’s most-guarded piece of personal information. We constantly hear stories of how people get scammed when they give away their SSNs and have their identity stolen. The Social Security Administration cautions people to never disclose their SSNs to strangers, especially on the phone or online.

But what if it’s a family member asking for your child’s social security number? This woman heard such a request from her father, who claimed he wanted to start a bank account for the baby. She shared her story with people, telling them how she worried her father might start opening lines of credit in her child’s name.

Generational differences can result in different opinions between parents and adult children

Image credits: Pressmaster / Envato (not the actual photo)

One woman’s father demanded she give him her baby’s social security number, which she found suspicious

Image credits: voronaman111 / Envato (not the actual photo)

Image credits: Mehaniq41 / Envato (not the actual photo)

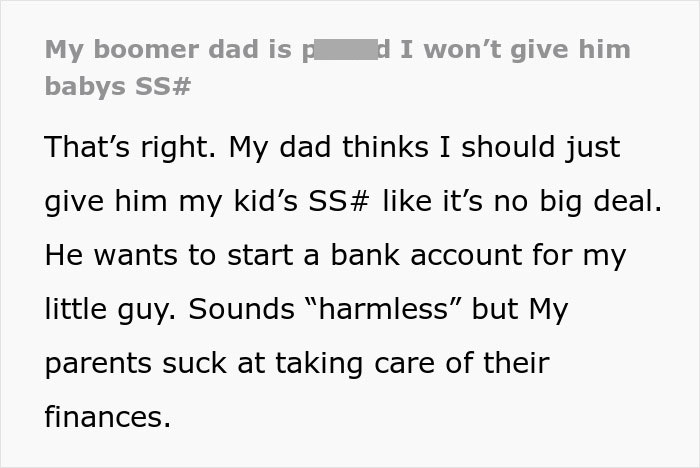

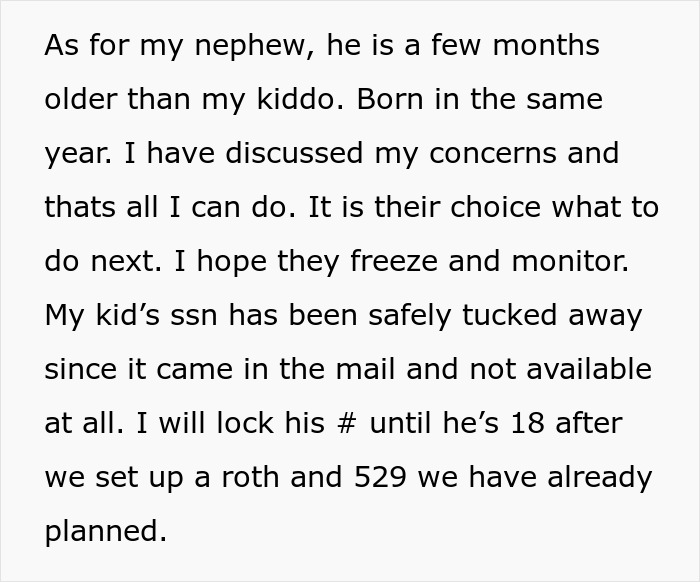

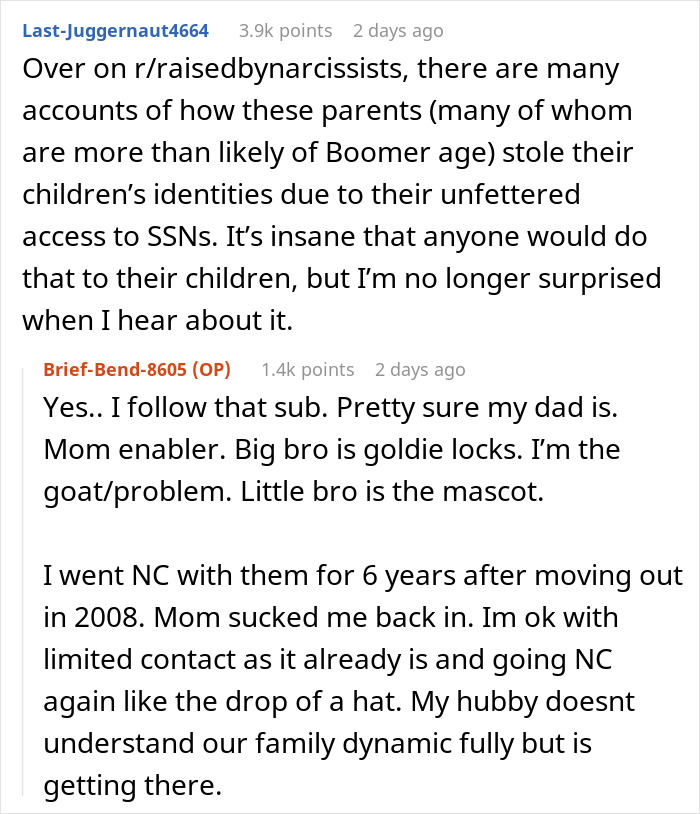

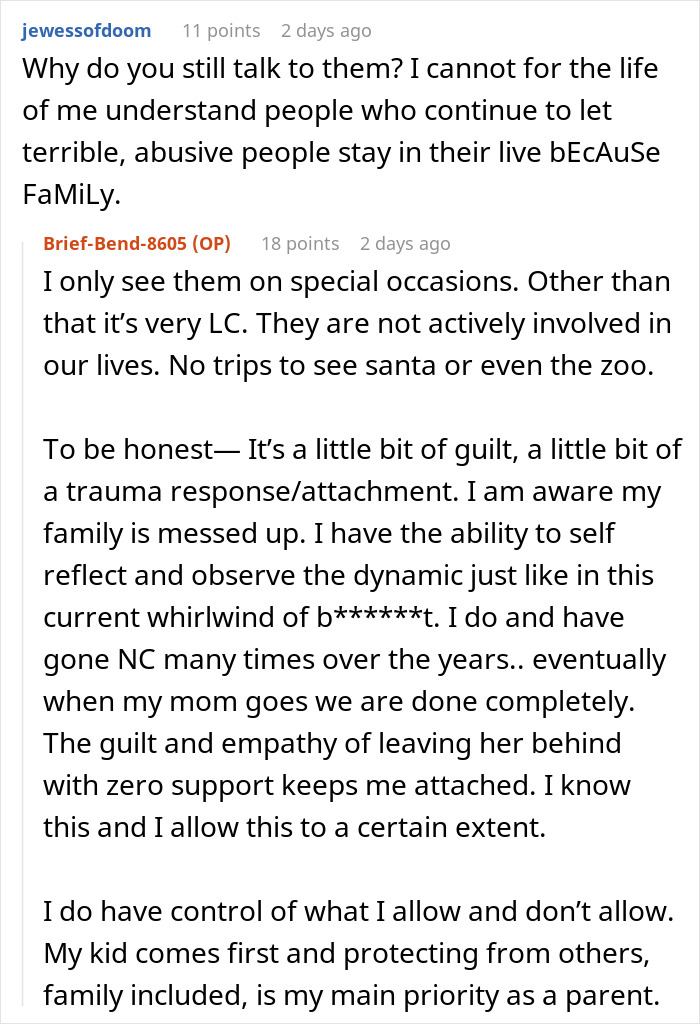

Image credits: Brief-Bend-8605

Using a child’s Social Security Number to take out loans or credit cards is identity theft

Image credits: AnnaStills / Envato (not the actual photo)

What the OP describes here would probably be child identity theft. Aura reports that between July 2021 and July 2022, more than 915,000 children were victims of identity theft. 67% of them claimed they knew the perpetrator personally.

What exactly is child identity theft? It’s when someone uses a child’s personal information, like their name or social security number, to obtain credit or employment. Attorney General of California Rob Bonta writes that such fraud is popular because it can go undetected for years. The child might only find out someone stole their identity when applying for a loan or credit card when they grow up.

Sadly, it’s not only extended family members that might do this. Parents sometimes opt to take out credit cards in their children’s name because they’re struggling financially. Whether that’s being unable to pay the bills, having to cover previous debt, having trouble with the law, or dealing with addiction or substance abuse, the reasons can be many.

Family Law Attorney Paula Brown Sinclair writes that there is no need to start building credit for children before they’re 18. “Your children are incompetent to contract until 18 anyway. The only advantage that comes to mind is more illegal activity,” she points out. “It is illegal and morally bankrupt as an idea.”

Business Attorney Pamela Koslyn also writes that claims to ‘save up for when the kid is grown up’ is only a facade for illegal activity. “Kids under the age of 6 don’t need credit or loans. It’s identity theft if you use their social security numbers with your name to get a loan for yourself. If you use their names and their SS#s, they can’t qualify for a loan.”

Whether it’s done by a stranger or a parent, it’s still illegal. And, just like in this case, child identity theft often causes a family to fall out. And because the perpetrators are parents, the adult children don’t take legal action against them. However, that doesn’t make this any less of a serious crime.

What parents can do to keep their children safe from identity theft

Image credits: nd3000 / Envato (not the actual photo)

The mother in this story mentions how she has had financial trouble with her irresponsible parents in the past, which is why she was suspicious. But many people trust their parents (or spouses) and might not be able to immediately recognize the signs that a family member might be stealing their child’s identity.

Experts say the most telling signs will be suspicious bills and notices arriving in your post box. These include tax notices from the IRS, credit card bills, calls about unpaid debts, student loan rejection letters, letters from the DMV that deny a child’s driver’s license, bank account application rejections, and letters about denied government benefits.

Parents who suspect their child’s identity might have been stolen can request a credit report. Typically, children shouldn’t have credit reports unless a parent freezes their credit. If there is an open credit report in the child’s name, they most certainly are a victim of identity theft.

The best way to avoid it is to safeguard their social security number and limit its use. And the OP already seems to have made her decision on that. The relationship with her parents might be fraught, but, as money coach Bonnie Koo writes, people should prioritize the financial health of their nuclear family, not their financially irresponsible elder parents.

“It’s cyclic, so breaking that cycle by prioritizing your family’s financial health is the first step in ending that cycle,” she claims. “If you decide that you are willing and able to help those outside of your family, you have to get your affairs in order first. It’s that airplane analogy of putting on your oxygen mask first.”

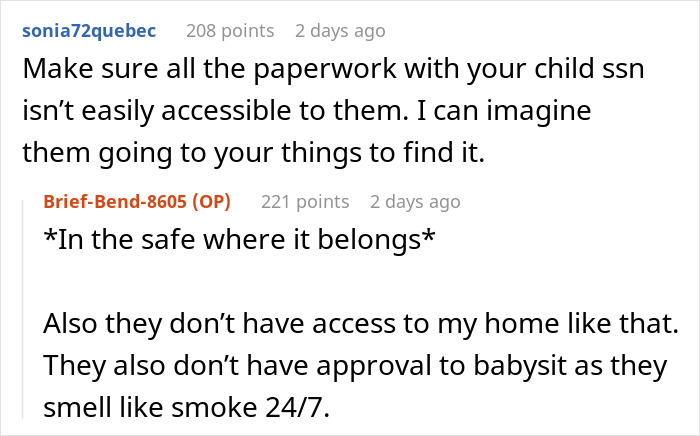

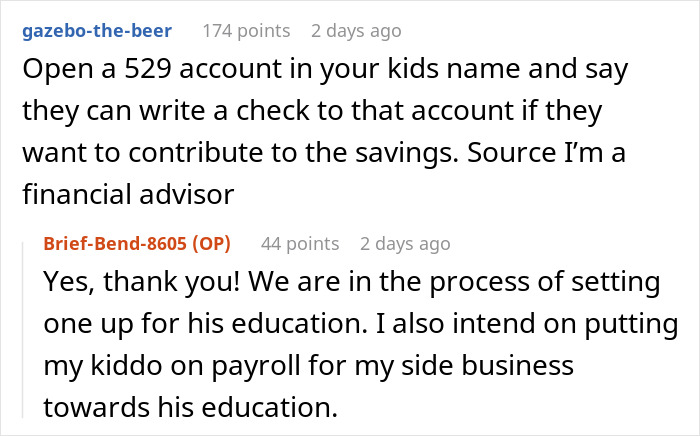

The woman clarified that she and her parents don’t exactly get along well because they caused her financial problems in the past

People cautioned the woman to stand her ground