/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

Expectations for quantum computing are rising fast, with global quantum computing revenues expected to reach around $9 billion by 2030. Up from $260 million in 2020, that points to over 40% annual growth for the decade.

Against that backdrop, D-Wave Quantum (QBTS) has announced a major $550 million agreement to acquire Quantum Circuits Inc., a developer of error-corrected superconducting gate-model quantum systems.

The deal is made up of about $300 million in D-Wave common stock and $250 million in cash. It's meant to combine D-Wave’s quantum cloud platform and annealing know-how with Quantum Circuits’ dual-rail, error-corrected gate-model technology. Management says this mix should accelerate its plan to build a scaled, fully error-corrected gate-model quantum computer. An initial dual-rail system is expected to be available in 2026.

With quantum computing still years away from mass commercial adoption and Wedbush calling the acquisition a “formidable ally,” does QBTS merit a spot in a portfolio at today’s levels, or is this latest acquisition-driven rally getting ahead of what the business can realistically deliver? Let’s find out.

QBTS’s Financial Check

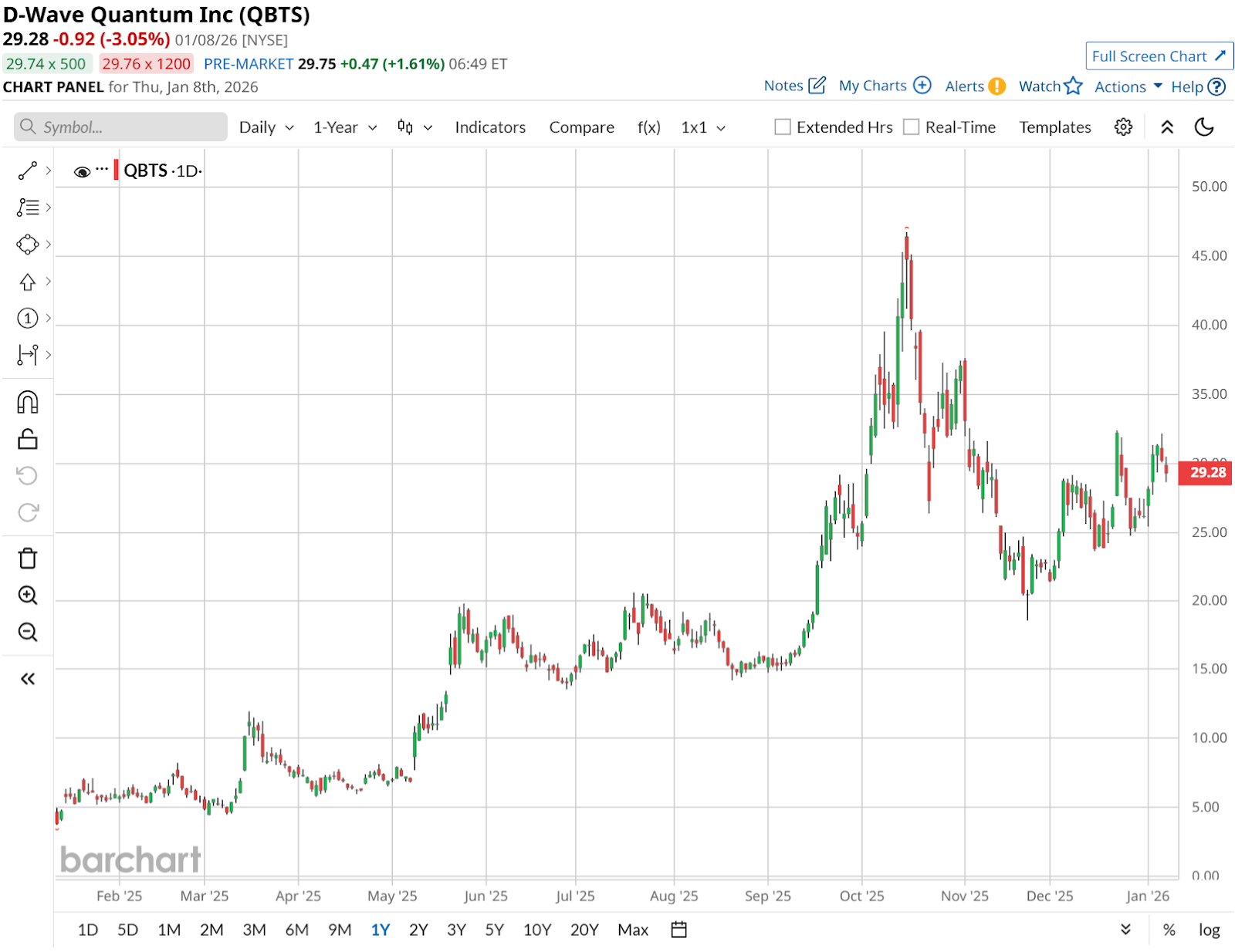

D-Wave Quantum (QBTS) makes money in a few connected ways. It provides cloud access to its annealing quantum computers, builds out gate-model systems, and sells software and services that companies can use for optimization and increasingly AI-related work. Over the past 52 weeks, QBTS is up roughly 360% and up 7.5% year-to-date (YTD), which shows a shift in sentiment.

Latest results show quarterly revenue of about $3.7M, up 100% from a year ago and up more than 20% from the prior quarter, while trailing annual sales are around $9M. Bookings momentum has also improved, topping $2.4M in a quarter, with more than $12M signed just after period-end.

At the same time, gross metrics look better, with GAAP gross profit of roughly $2.7M and gross margin in the low 70% range, up from the mid 50% range a year earlier, as higher-value systems like the upgraded Advantage2 deployment begin to scale.

But spending remains heavy. Operating expenses were just over $30M in the latest quarter, driven by higher costs for staff, fabrication, and stock-based compensation, and the business is still deeply unprofitable with an annual net loss around $144M and EPS near -1.35. In the most recent quarter, net loss came in around $140M, mostly because of more than $120M in non-cash warrant-related charges linked to the stock’s sharp move.

The Real Growth Story Behind QBTS

D-Wave recently demonstrated scalable on-chip cryogenic control of gate-model qubits, described as an industry-first step that reduces wiring complexity without hurting qubit fidelity. This means the same multiplexed control technology D-Wave already uses to manage tens of thousands of qubits and couplers in its commercial annealing QPUs with about 200 bias wires can now be used for gate-model architectures also. This removes a major roadblock to building large, commercially practical gate-model systems.

Additionally, D-Wave is widening the reach of its annealing business in both geography and real-world deployments. In Italy, it is backing the new Q-Alliance with a €10M contract tied to an Advantage2 annealing quantum computer, including a five-year agreement for 50% of the system’s capacity and an option to buy the full system. The goal is to make D-Wave hardware a key shared resource for Italian universities, industry, and government, which helps build long-term usage.

Regarding software, D-Wave has released an open-source quantum AI toolkit plus a demo that lets developers connect its quantum processors to modern ML architectures and even generate simple images, demonstrating that annealing quantum hardware can be used in AI-focused work.

Street Targets and the Road Ahead for QBTS

Consensus estimates for the current quarter (12/2025) call for average EPS of -$0.05 versus -$0.37 a year ago, a near 86.49% year-over-year (YOY) improvement. Zooming out to the full fiscal year 12/2025, the Street is at -$0.20 versus -$0.75 last year, implying a 73.33% improvement.

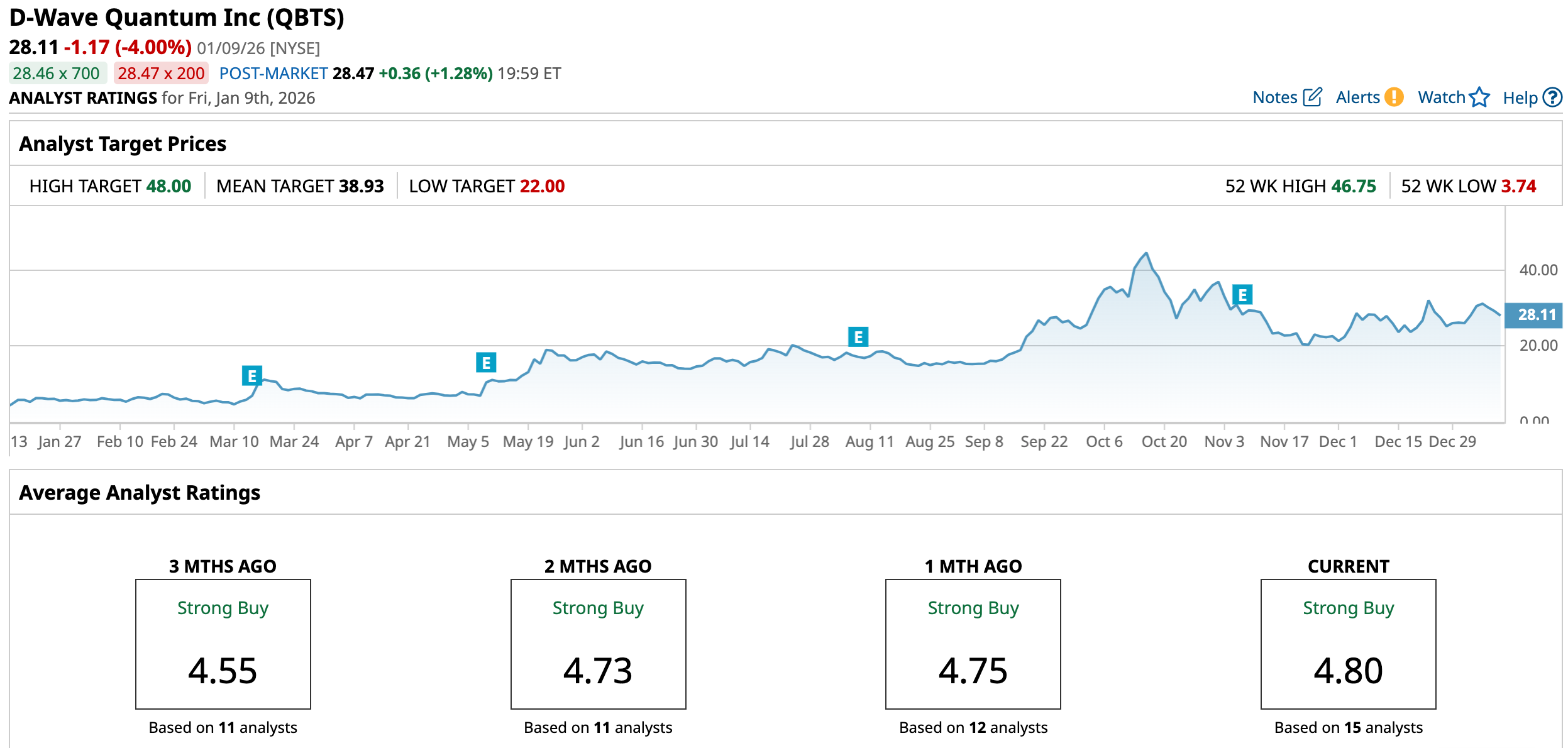

That trend toward smaller losses helps explain why price targets are still sitting well above the current trading range. Jefferies is at the high end with a $45 target, which was about 73% upside from where the stock traded at the time of that December call, showing more willingness to put numbers around the long-term commercial opportunity. Wedbush is also leaning into the deal as the key catalyst, with an “Outperform” rating and a $35 price target, and the analyst calling the Quantum Circuits acquisition a “formidable ally” that could speed the push toward a scaled, error-corrected gate-model system.

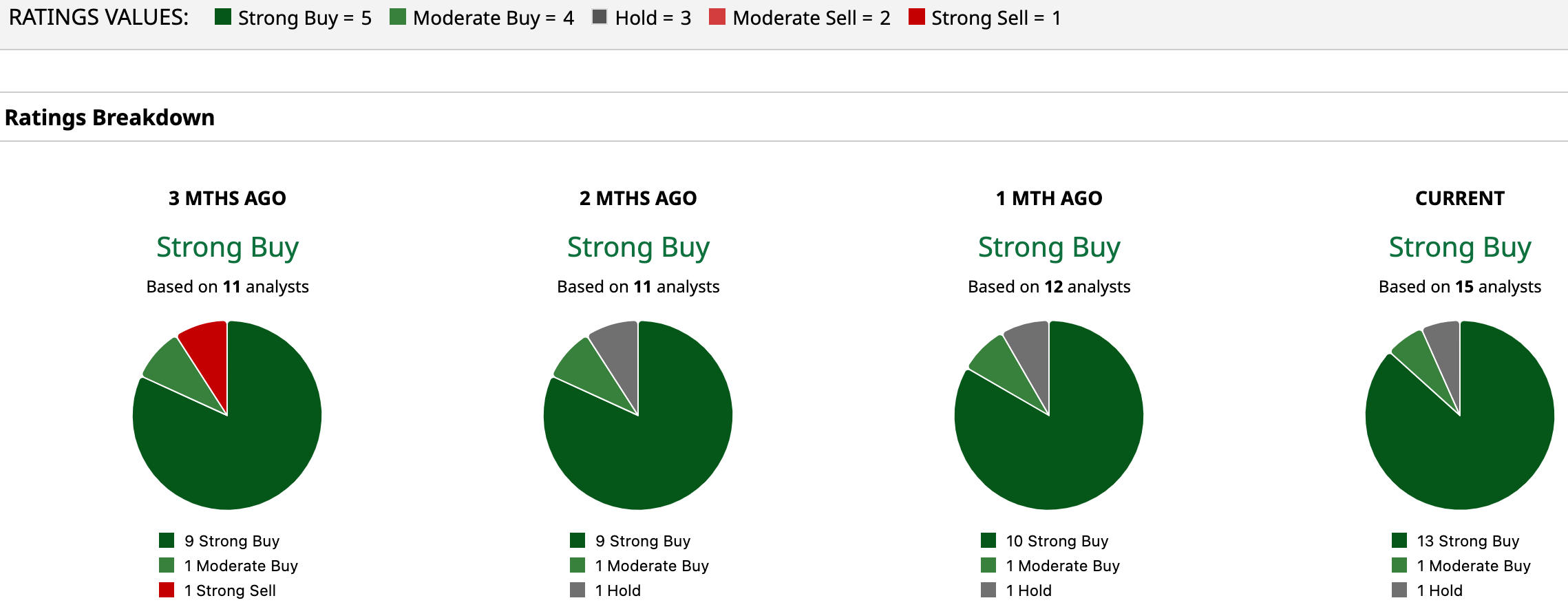

Of 15 analysts surveyed, 13 rate QBTS a consensus “Strong Buy," one as a “Moderate,” and one as a “Hold,” and the mean target is $38.93. Against the current price of $28.11, that implies a 38.5% upside.

Conclusion

For now, QBTS still looks like a high-octane, high-risk speculative buy rather than a core portfolio holding. The Quantum Circuits deal, the on-chip cryogenic control breakthrough, and the growing quantum AI and European footprints all point in the right strategic direction, and the Street’s “Strong Buy” stance with roughly 39% implied upside suggests the path of least resistance is still higher over the next year, especially if execution stays on track.