Shares of CVS Health (CVS) at last check were down about 2% after reports said the drugstore and health-care giant might acquire Oak Street Health (OSH) for $10 billion.

While that has shares of CVS at multimonth lows, Oak Street Health is up more than 27%. Interesting, though, that Oak Street is not taking out its 2022 high of $30.89.

As previously reported by TheStreet:

“The deal, for both Oak Street's equity and debt, would likely rise past $10 billion if completed, and added to CVS's recent acquisition of Signify Health SGFY and its game-changing $69 billion Aetna deal in 2017.”

Tuesday’s decline in CVS stock adds to its recent pain. For what it’s worth, Walgreens (WBA) hasn’t been trading all that well either, even after it delivered a top- and bottom-line earnings beat last week.

CVS stock is now down 12.5% over the past month, while Walgreens stock is down 10.5%.

Trading CVS Stock

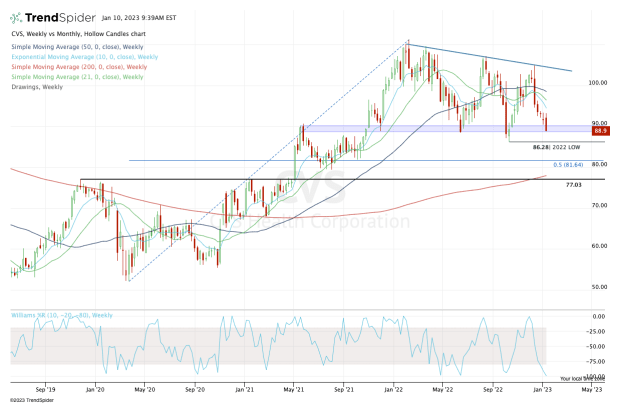

Chart courtesy of TrendSpider.com

Shares of CVS are now hitting their lowest level since mid-October. And they are not all that far away from hitting the 2022 low at $86.28. If the stock ends lower this week, it will mark CVS’s sixth straight weekly decline.

It thus should come as no surprise that the stock is below all its daily moving averages and all its short- and intermediate-term weekly moving averages.

You’ll also notice that the current decline was ushered in by a series of lower highs, a bearish technical development.

Today's decline has CVS stock trading into a notable area on the weekly chart, an area around $88 that has typically provided support. Notably, this was a key breakout area in 2021.

If CVS stock breaks below the 2022 low and can’t reclaim it, that may open the door down to the $80 to $82 area, where it finds the 50% retracement from the all-time high down to the 2020 low.

Below that area we have the 200-week moving average and a major breakout area near $77.

So somewhere between the admittedly wide range of $77 to $82 I expect CVS stock to find support if it breaks to new 52-week lows.

On the upside, $93 to $94 has been multiweek resistance. Along with the declining 10-week moving average, I expect these measures to remain resistance until proved otherwise.

Above that puts $97 in play, then $100.

For now though, keep a close on the $88 area.