The investment environment for almost all of 2023 has been dominated by megacap tech stocks.

Apple (AAPL), Meta (META), Nvidia (NVDA) and others have been powering higher. That’s helped elevate the S&P 500 and Nasdaq, while other stocks have struggled.

Now we have a rotation underway, with small-cap stocks surging and a handful of other sectors finally catching a bid. One of those sectors? Retail.

Don't Miss: Did Palantir Stock's Momentum Just Run Out?

The retail sector — whether viewed anecdotally or via the SPDR S&P Retail ETF (XRT) — has not done well this year. Despite a one-week 10% rally, the XRT is up just 1% so far this year and is down more than 8% over the past 12 months.

Within that group, CVS Health (CVS) and Walgreens (WBA) have struggled badly.

CVS stock is down 23.5% this year and almost 26% over the past 12 months. Walgreens stock is better, but down 15% in 2023 and 26% over the past year.

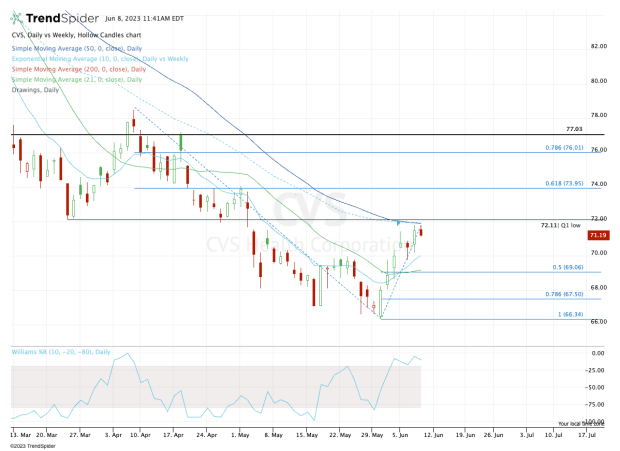

Trading CVS Stock

Chart courtesy of TrendSpider.com

Short-sellers like the setup in CVS stock. That’s as the shares ram into the first-quarter low near $72, along with the 10-week and 50-day moving averages.

If this were the opposite setup — CVS pulling back into the Q1 high, along with the 10-week and 50-day moving average combo — traders would be buyers in the scenario.

Don't Miss: Tee Up Topgolf Callaway Brands or Take Profits?

Further, CVS has been a relative weakness leader. So the setup is a bit precarious for longs, especially if the shares trade back down into the short-term moving averages and can’t find support.

A break of $70 pushes CVS below the 50% retracement of the recent rally, as well as the 10-day and 21-day moving averages. That opens up $67.50 and $66 on the downside.

As for the upside, a move over $72 opens the door to the 61.8% retracement up near $74, then potentially puts the $77 zone in play.

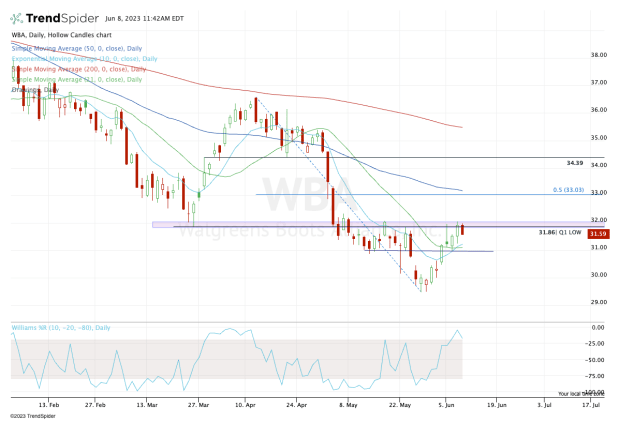

Trading Walgreens Stock

Chart courtesy of TrendSpider.com

Walgreens stock has a similar setup, as it rams into its first-quarter low but remains well below the 50-day moving average.

The bulls need to see Walgreens stock clear this week’s high at $32.05. If it can do so, it opens the door to the 50% retracement and 50-day moving average near $33. Above that puts $34.50 to $35 in play.

Don't Miss: How Far Can SoFi Stock Rally? Chart Provides a Clue.

From a technical perspective, Walgreens stock is okay if it can stay above $31. A break of this level puts the stock below recent support, as well as the 10-day and 21-day moving averages.

In that case, $30 or lower could be on the table.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.