Amid a wider market rout, the total market capitalization of cryptocurrencies has fallen below $1 trillion, levels not seen since February 2021.

The combined market capitalization of cryptos has fallen to $969 billion, according to data from Coinmarketcap, a drop of about 200% from the market’s all-time high market capitalization of about $3 trillion, seen last November.

The largest digital currency Bitcoin (CRYPTO: BTC) is currently trading at $22,900, down about 18% compared to the previous day and about 25% in the last week and its market capitalization has fallen to $455bn from its peak of $1.3 trillion.

BTC had made an all-time high of $69,000 last November.

The second-largest digital currency, Ethereum (CRYPTO: ETH), has fallen about 21% in a day and is currently trading at $1190. Its market capitalization has fallen to $147bn.

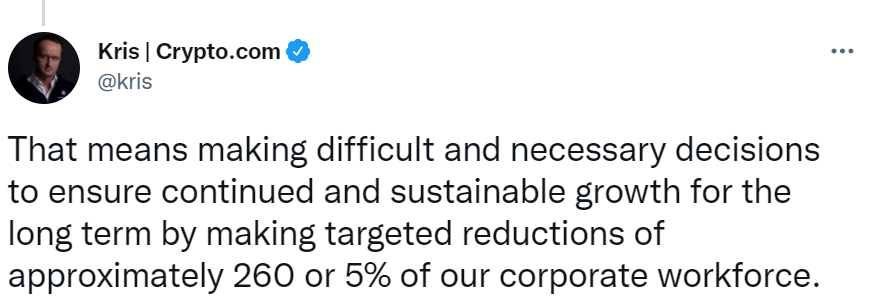

Meanwhile, amid bearish market sentiments, Crypto.com will lay off about 260 people, or 5% of its corporate workforce, the crypto exchange's CEO Kris Marszalek announced.

“(There are) lots of questions and speculation flying around regarding what http://Crypto.com is doing during the market downturn.. Some of you (the staff) have been with us since 2016/2017 and have seen us building steadily, with conviction throughout the 2018/2019 winter,” Marszalek said in a tweet.

He added that it was this conviction of the company’s staff with a focus on building throughout the bear market, despite crypto naysayers being out in full force, that made Crypto.com one of the fastest-growing companies in 2021, reaching 50 million users milestone.