Binance and the crypto industry are catching their breath, relieved to see the cleaver that was over their head go away, at least for now.

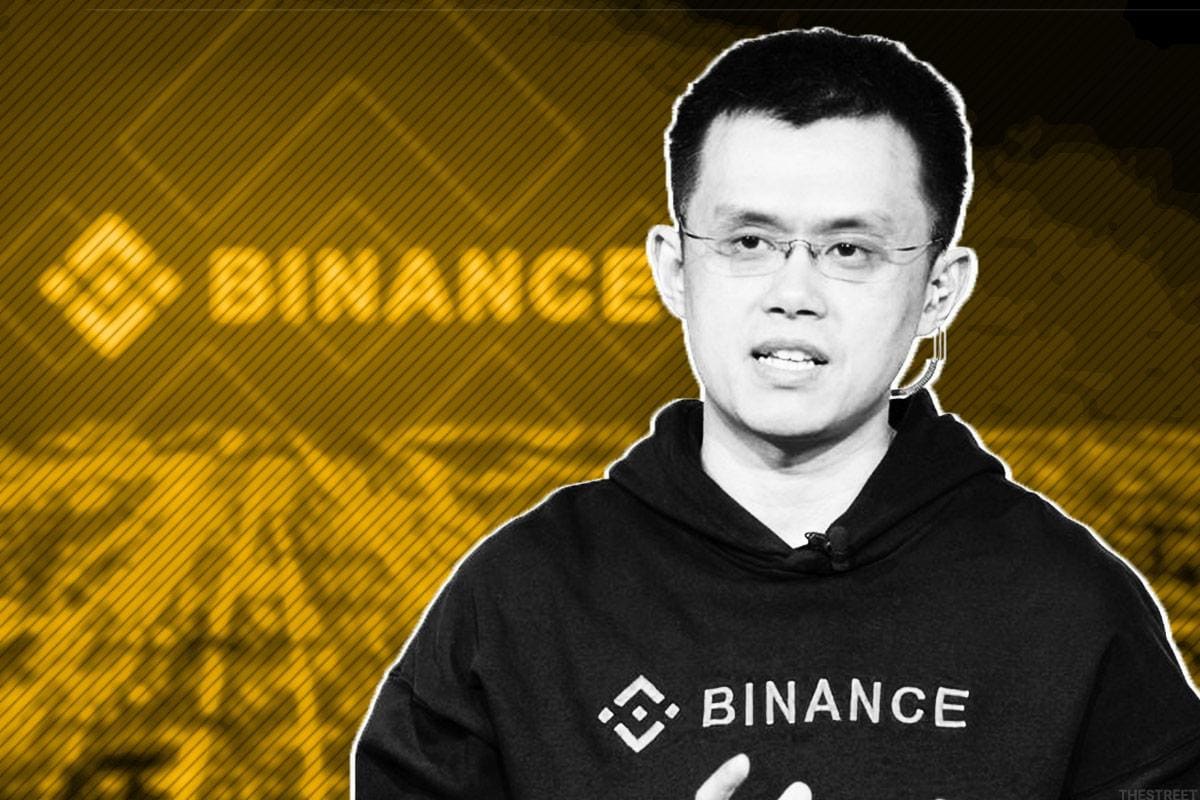

For several weeks, the crypto sphere has been waiting to hear the developments of the resounding lawsuit filed on Jun. 5 by the U.S Securities and Exchange Commission (SEC) against Binance and its co-founder and CEO Changpeng Zhao.

The powerful regulator accused the world's largest crypto exchange and Zhao of engaging in a "web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law," as SEC alleges.

It accuses the firm of mishandling client funds and lying to regulators, in an effort to circumvent US laws, putting client funds at risk. The SEC also alleges that Binance combined the funds of its customers with its own and secretly sent them to an entity separate from the company, controlled by its founder, Changpeng Zhao. The entity in question, which is called Merit Peak Ltd., allegedly received more than $20 billion, including customer funds.

Zhao and Binance "commingle customer assets or divert customer assets as they please," the SEC says. Basically, Binance and its CEO and co-founder allegedly committed fraud.

Protecting U.S. Customers

The Wall Street regulator is asking the court to side with it, that Binance doesn't have a license to operate in the US. This will result into an injunction that would make it hard for Binance to do business in the US, where the firm is currently offering its trading services.

The SEC is also seeking unspecified fines against the platform. In the meantime, the regulator is seeking a temporary restraining order to freeze Binance's U.S. assets and to repatriate some foreign assets in the US.

Binance is not licensed in the U.S. The platform, however, has a subsidiary, Binance.US, which caters to investors living on American soil.

Binance and Zhao will have some respite, since they have just reached an agreement with the SEC which will allow the platform to continue to operate in the United States for the time being. The agreement also provides that funds from clients of Binance.US will be placed in special digital repositories accessible on the U.S Exchange, according to court documents and an SEC statement.

The order helps ensure that Binance.US customers can withdraw their assets from the platform and that the assets that they keep on the platform are protected and remain in the United States through the duration of the litigation.

In addition, BAM, the entity that includes the trading and hedge fund operations of Binance in the United States, is "expressly" prohibited "from transferring any assets or funds, or from providing control over such assets or funds" to the parent company or to Zhao.

"Given that Changpeng Zhao and Binance have control of the platforms’ customers’ assets and have been able to commingle customer assets or divert customer assets as they please, as we have alleged, these prohibitions are essential to protecting investor assets,” said in a statement Gurbir S. Grewal, Director of the SEC’s Division of Enforcement.

"Further, we ensured that U.S. customers will be able to withdraw their assets from the platform while we work to resolve the alleged underlying misconduct and hold Zhao and the Binance entities accountable for their alleged securities law violations.”

A Warning from the Judge

Zhao, for his part, said that he was pleased to see that U.S. customers were receiving additional protection.

"Although we maintain that the SEC's request for emergency relief was entirely unwarranted, we are pleased that the disagreement over this request was resolved on mutually acceptable terms," the crypto billionaire said on Twitter on Jun. 17.

"User funds have been and always will be safe and secure on all Binance-affiliated platforms."

Judge Amy Berman Jackson, who is overseeing the case in the federal court in Washington, validated the agreement between the SEC and Binance.

She previously showed her skepticism of the SEC's strategy of regulating the crypto sector through enforcement actions, about which crypto players also criticize the regulator.

It's "inefficient and cumbersome," Judge Jackson said during a court hearing on the case on Jun. 13, urging the parties to negotiate about protecting U.S. funds.

The SEC has filed another complaint against Coinbase (COIN), the most popular crypto exchange platform in the United States. The regulator alleges that the platform is operating illegally, because, since 2019, it has been offering services for which it is not licensed.

The firm has officially welcomed the complaint because, it says, this will finally allow for clear regulation, for which itself and other crypto firms have been asking for a long time.

As for Binance, it is in the crosshairs of another U.S. regulator. In March, the Commodity Futures Trading Commission (CFTC) filed a lawsuit against Zhao and Binance for allegedly letting U.S. residents buy and sell crypto derivatives while the firm is not registered.

The federal agency is seeking to ban Zhao from doing business under its jurisdiction for life and to banish Binance from the US.