KEY POINTS

- Hougan noted that he, too, felt fear as the market crashed, but he also saw the opportunity

- He said the weekend downtrend is similar to the crypto market's collapse in March 2020

- He noted that even with the plunge of global financial markets, crypto included, Bitcoin's fundamentals haven't changed

The weekend's rollercoaster ride for the cryptocurrency industry rocked small holders to the core, with many selling off their digital assets. However, an industry expert said such a market crash is not new, and instead should nudge owners to buy the dip.

Crypto makes hard landing

After soaring at the beginning of the year when the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin exchange-traded funds (ETFs), the crypto market fell hard over the weekend, shedding some $9,000 within hours.

Data from CoinGecko shows that $BTC, the world's top digital asset by market value, crashed from around $59,000 to $49,700 Sunday night as global financial markets tumbled significantly.

Ether, the Ethereum blockchain's native cryptocurrency that's only second to Bitcoin in market cap, suffered the brunt of the crypto market's bloodbath, declining by over 11% and losing its hard-earned flight above $3,000 in the past months. It plummeted to $2,100 at one point Sunday after already making it to $2,800 earlier in the day.

Other tokens were also in the red throughout Sunday, triggering massive liquidations across the board.

It's a COVID crash replay: Expert

Matt Hougan, the chief investment officer of Bitwise Asset Management, wrote Monday that the Sunday plunge of crypto prices is something early adopters have already seen before. In a series of posts on X, Hougan noted that it's not just crypto that went on a downward spiral. The broader global financial market has been tumbling "in unison over the past few days," he said.

He acknowledged that most crypto investors surely experienced mixed emotions, including fear and despair. "For many, the emotion that strikes hardest is anger. 'I thought crypto was supposed to be a hedge against global uncertainty!? What gives?'" he wrote.

Hougan admitted he felt the same too, but he felt another emotion that some crypto users may have missed amid the market turmoil – "something born from six-plus years of managing money in crypto full time: opportunity."

"I've seen this movie before," he added, noting how the crypto space reacted to March 12, 2020, when the world finally realized that COVID-19 was real and it was a big deal. Markets crumbled, and among the many assets that suffered the biggest losses, "Bitcoin fared the worst, falling 37% from $7,911 to $4,971," he said. "To be honest, it felt like we might never recover. Predictably, the media claimed Bitcoin had failed as a hedge asset," he noted.

On the other hand, the said $BTC plunge was the "best buying opportunity for Bitcoin in a decade," Hougan argued, adding that the pandemic drew out the best in the world's first decentralized cryptocurrency as it demonstrated how centralized institutions had limits. It was also a great reminder "that the future is digital."

17/ Maybe this time really is different, but I wouldn’t bet on it. In fact, I’m betting the other way.

— Matt Hougan (@Matt_Hougan) August 5, 2024

Finally, Hougan noted that the same scenario appears to have taken place Sunday night, and as was the case during the pandemic, "nothing fundamental changed about Bitcoin." He went on to urge long-time holders to not be surprised, as "what's happening now is straight out of the COVID playbook."

Other maxis urge community to HODL

Other Bitcoin maximalists and crypto advocates are also calling on the community to retain their $BTC holdings. Cameron Winklevoss, who co-founded the Gemini crypto exchange with his twin, Tyler, said $BTC doesn't need a "circuit breaker" since long-time holders have "HODL," which refers to holding crypto assets as long as possible regardless of market action.

Michael Saylor, the executive chairman of MicroStrategy, only had "HODL" to say along with a photo of a diamond hand – a term used by the community to describe investors who don't go for selloffs whenever a pricing dip occurs.

HODL pic.twitter.com/qIMam5yFaI

— Michael Saylor⚡️ (@saylor) August 5, 2024

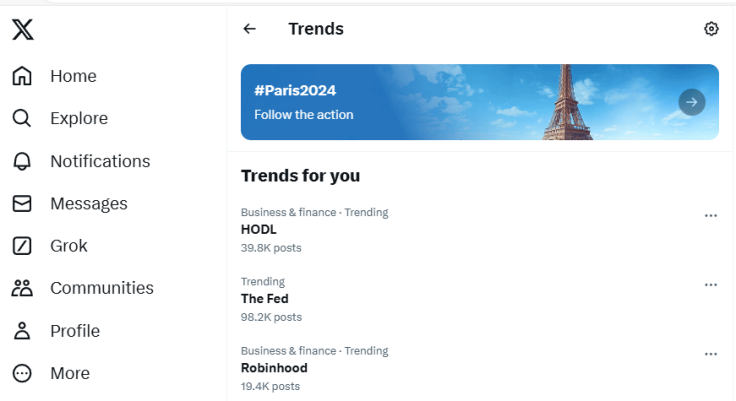

#HODL was a top trend on X late Monday as crypto prices started bouncing back to recoup some of the weekend's staggering losses.

As of writing, Bitcoin is back above $55,000, while Ether is trading at around $2,500. Many other cryptocurrencies have recovered the previous day's losses and are trading in the green.