Analysts' ratings for Bloom Energy (NYSE:BE) over the last quarter vary from bullish to bearish, as provided by 16 analysts.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 8 | 5 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 6 | 3 | 1 | 0 |

| 2M Ago | 0 | 1 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

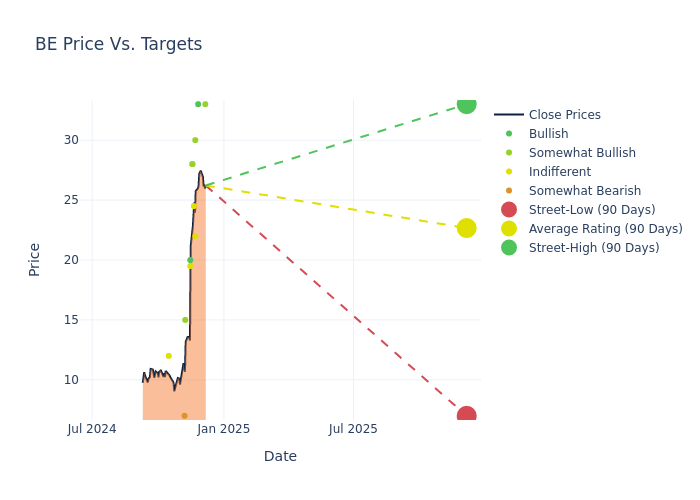

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $20.69, along with a high estimate of $33.00 and a low estimate of $7.00. This current average reflects an increase of 37.93% from the previous average price target of $15.00.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive Bloom Energy. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Biju Perincheril | Susquehanna | Raises | Positive | $33.00 | $20.00 |

| Manav Gupta | UBS | Raises | Buy | $33.00 | $21.00 |

| Lloyd Byrne | Jefferies | Raises | Hold | $22.00 | $12.00 |

| Kashy Harrison | Piper Sandler | Raises | Overweight | $30.00 | $20.00 |

| Samantha Hoh | HSBC | Announces | Hold | $24.50 | - |

| Chris Dendrinos | RBC Capital | Raises | Outperform | $28.00 | $15.00 |

| Stephen Byrd | Morgan Stanley | Raises | Overweight | $28.00 | $20.00 |

| Gregory Lewis | BTIG | Raises | Buy | $20.00 | $16.00 |

| Kashy Harrison | Piper Sandler | Raises | Overweight | $20.00 | $10.00 |

| Ameet Thakkar | BMO Capital | Raises | Market Perform | $19.50 | $12.00 |

| Biju Perincheril | Susquehanna | Raises | Positive | $16.00 | $13.00 |

| Ben Kallo | Baird | Lowers | Outperform | $15.00 | $18.00 |

| Julien Dumoulin-Smith | B of A Securities | Lowers | Underperform | $7.00 | $8.00 |

| Kashy Harrison | Piper Sandler | Lowers | Neutral | $10.00 | $11.00 |

| Biju Perincheril | Susquehanna | Lowers | Positive | $13.00 | $16.00 |

| Jordan Levy | Truist Securities | Lowers | Hold | $12.00 | $13.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Bloom Energy. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Bloom Energy compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Bloom Energy's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into Bloom Energy's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Bloom Energy analyst ratings.

Unveiling the Story Behind Bloom Energy

Bloom Energy designs, manufactures, sells, and installs solid-oxide fuel cell systems ("Energy Servers") for on-site power generation. Bloom Energy Servers are fuel-flexible and can use natural gas, biogas, and hydrogen to create 24/7 electricity for stationary applications. In 2021, the company announced plans to leverage its technology and enter the electrolyzer market. Bloom primarily sells its systems in the United States and internationally.

Bloom Energy: Delving into Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Decline in Revenue: Over the 3 months period, Bloom Energy faced challenges, resulting in a decline of approximately -17.46% in revenue growth as of 30 September, 2024. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Bloom Energy's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -4.45% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -3.44%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Bloom Energy's ROA stands out, surpassing industry averages. With an impressive ROA of -0.57%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a high debt-to-equity ratio of 3.93, Bloom Energy faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.