Credo Technology Group (NASDAQ:CRDO) is preparing to release its quarterly earnings on Monday, 2024-12-02. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Credo Technology Group to report an earnings per share (EPS) of $0.05.

The market awaits Credo Technology Group's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

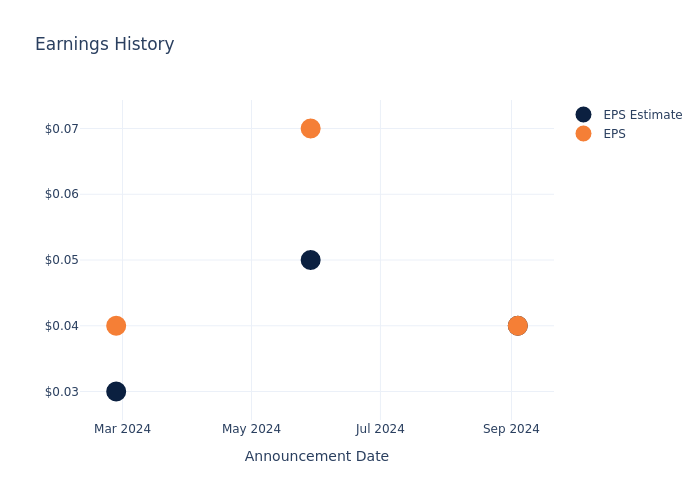

Past Earnings Performance

The company's EPS missed by $0.00 in the last quarter, leading to a 14.86% drop in the share price on the following day.

Here's a look at Credo Technology Group's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.04 | 0.05 | 0.03 | 0 |

| EPS Actual | 0.04 | 0.07 | 0.04 | 0.01 |

| Price Change % | -15.0% | 27.0% | 1.0% | -7.000000000000001% |

Tracking Credo Technology Group's Stock Performance

Shares of Credo Technology Group were trading at $45.71 as of November 28. Over the last 52-week period, shares are up 138.2%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on Credo Technology Group

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Credo Technology Group.

With 10 analyst ratings, Credo Technology Group has a consensus rating of Buy. The average one-year price target is $36.4, indicating a potential 20.37% downside.

Understanding Analyst Ratings Among Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Universal Display, Lattice Semiconductor and Qorvo, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Buy trajectory for Universal Display, with an average 1-year price target of $220.0, implying a potential 381.3% upside.

- Analysts currently favor an Buy trajectory for Lattice Semiconductor, with an average 1-year price target of $57.33, suggesting a potential 25.42% upside.

- Qorvo is maintaining an Neutral status according to analysts, with an average 1-year price target of $95.2, indicating a potential 108.27% upside.

Peers Comparative Analysis Summary

The peer analysis summary presents essential metrics for Universal Display, Lattice Semiconductor and Qorvo, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Credo Technology Group | Buy | 70.15% | $37.28M | -1.75% |

| Universal Display | Buy | 14.57% | $125.81M | 4.29% |

| Lattice Semiconductor | Buy | -33.87% | $87.69M | 1.03% |

| Qorvo | Neutral | -5.16% | $445.31M | -0.51% |

Key Takeaway:

Credo Technology Group ranks highest in revenue growth among its peers. It has the lowest gross profit margin. The company has the lowest return on equity.

About Credo Technology Group

Credo Technology Group Holding Ltd delivers high-speed solutions to break bandwidth barriers on every wired connection in the data infrastructure market. It provides secure, high-speed connectivity solutions that deliver improved power and cost efficiency as data rates and corresponding bandwidth requirements increase exponentially throughout the data infrastructure market. It has a geographic presence in Hong Kong, the United States, Mainland China, Taiwan, and the Rest of the World.

A Deep Dive into Credo Technology Group's Financials

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Credo Technology Group displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 70.15%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Credo Technology Group's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -15.98%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Credo Technology Group's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -1.75%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -1.53%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Credo Technology Group's debt-to-equity ratio is below the industry average at 0.03, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Credo Technology Group visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.