Roblox Corporation (NYSE:RBLX) gapped up slightly higher on Monday in contrast to the S&P 500, which opened about 1.3% lower. The stock then back-tested a support zone at $48.13 and bounced up from the level as bulls came in to buy the dip.

Short interest in Roblox has been increasing, and paired with the very high level of insider ownership, these statistics could eventually make the stock a good short squeeze candidate. A massive 82.96% of Roblox’s 392.71 million share float is held by institutions and 18.93 million shares, meaning 6.69%, are held short. The number has increased from 17.77 million shares held short in December.

In terms of the share price increasing organically, analysts who weighed in on the stock following the gaming platform printing its fourth-quarter earnings results on Feb. 15 maintained positive ratings and largely believe the company has wide room for growth over the coming year. Roblox reported record revenue and daily active user metrics for its full fiscal year and an increase in users over the age of 13.

Interesting Fact: Roblox’s in-game currency, Robux, has become reportedly worth more than the Russian Ruble following the country’s invasion of Ukraine. One Robux is worth approximately $0.0125 USD compared to the Ruble, which on Monday plummeted to $0.01 USD.

See Also: What Is Metanomics? More On The Metaverse Phrase For A Trillion Dollar Opportunity

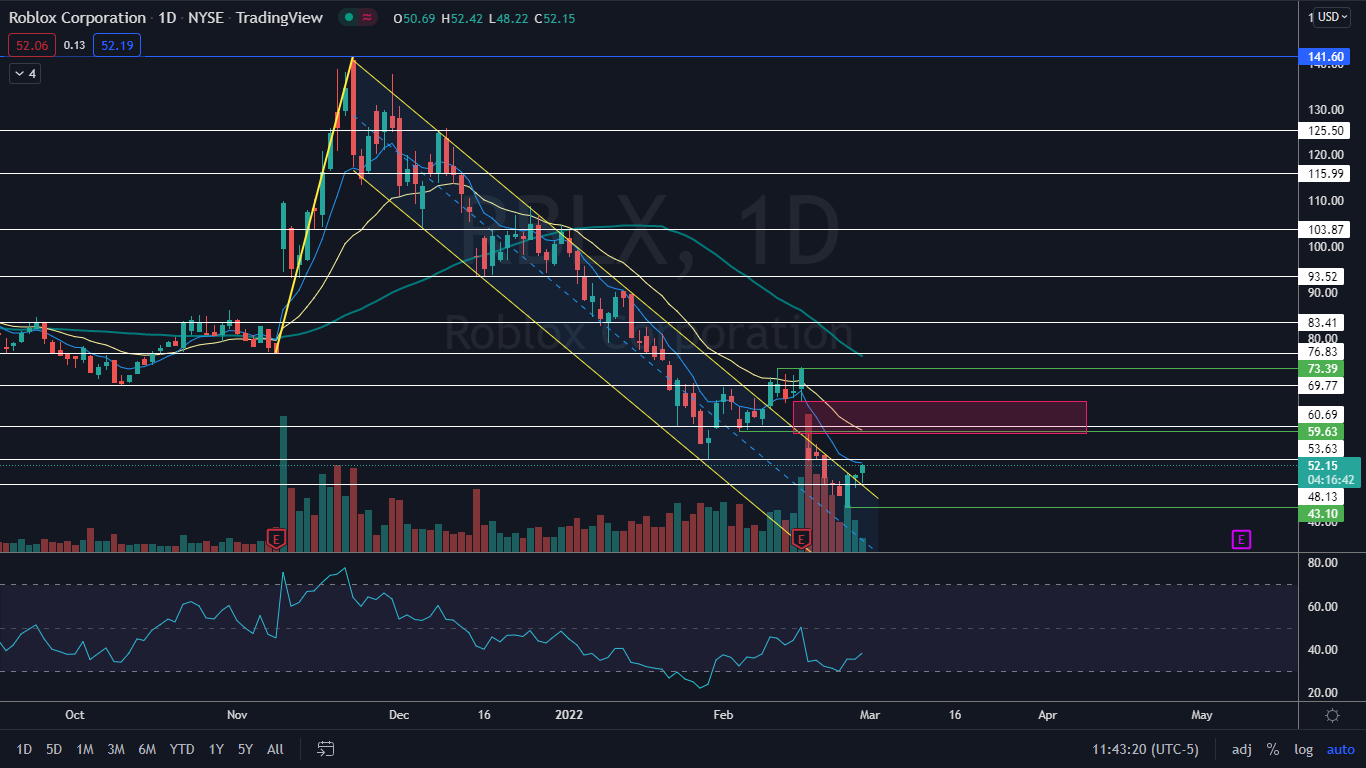

The Roblox Chart: On Feb. 9, Roblox broke up bullishly from a falling channel that had been holding the stock in a downtrend since Nov. 22. After the company printed its earnings, however, the stock fell back into the channel, which created a bear trap.

On Feb. 25, Roblox broke up from the channel again and on Monday the stock back-tested the upper descending trendline, which coincides with the support level just above $48, and held above it. At about 10:30 a.m. EST, increasing volume began to enter the stock on lower timeframes, which indicates the break of the channel was recognized.

Roblox has a gap on the chart that falls between $59 and $66.34. Gaps on charts fill about 90% of the time, which makes it likely the stock will trade up to fill the range. If Roblox does, it will represent about a 28% increase from the current share price.

Roblox is trading below the eight-day and 21-day exponential moving averages (EMAs), with the eight-day EMA trending below the 21-day, both of which are bearish indicators. At mid-day on Monday, the stock was attempting to regain the eight-day EMA as support, which would be bullish.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

- Bulls want to see big bullish volume come in and push the stock into the gap, which would negate the downtrend. There is resistance above at $53.63 and $60.69.

- Bears want to see big bearish volume come in and drop Roblox down below the Feb. 24 low-of-day at the $43.10 level. The stock has support below $48.13.