LONDON—Consumers who subscribe to streaming services to watch a particular show, then cancel, only to resubscribe later, make up 42% of U.S. TV viewers, according to a new survey from Ampere Analysis. The same survey, however, showed that Disney subscribers who had previously churned and then returned (aka ‘resubscribers’) to take the Disney+/Hulu/ESPN+ bundle are 59% less likely to churn within 12 months than those who take Disney+ alone.

This finding, Ampere says, suggests bundling streaming services will have a significant impact on the 42% who “regularly subscribe, cancel and resubscribe.”

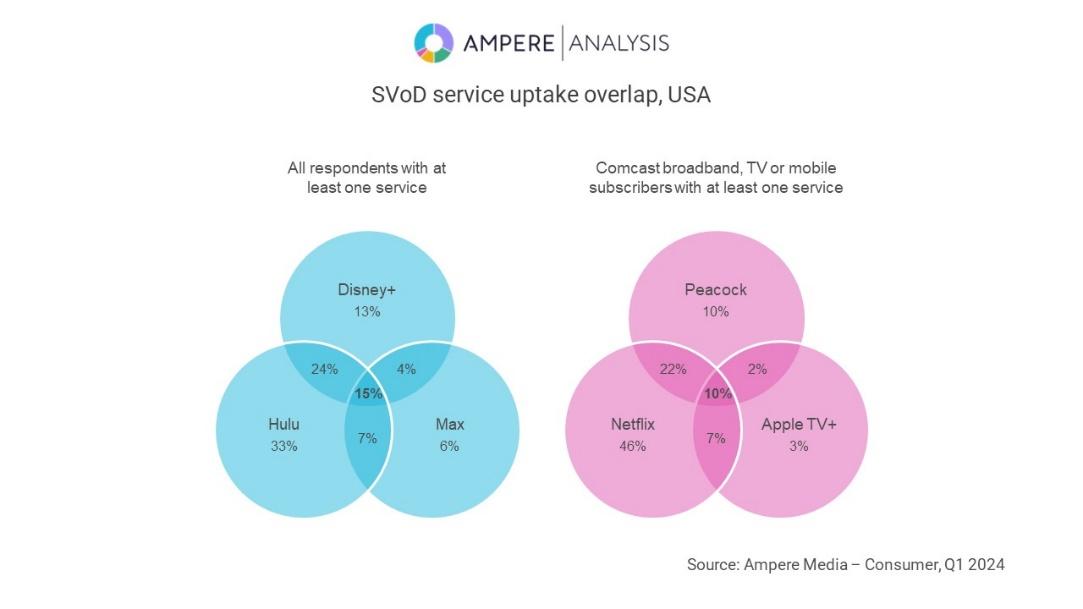

Bundling of streaming services has become increasingly popular in recent weeks with Disney/Warner Bros. Discovery and Comcast all beginning to offer multiple services through a single subscription. Ampere Consumer data indicates there is currently limited overlap in uptake between those services, suggesting great upsell and churn mitigation potential.

Ampere’s study indicates that the majority of those 42% skew younger (18-44 years old) and are more likely to be in family households. They are also avid media consumers, watching more TV and video each day, stacking more SVoD services, and consuming alternative media formats, such as video games and music services more frequently than the average US consumer. However, this wide media diet also means the cohort is 40% more likely than average to exhibit signs of "subscription fatigue" and 21% more likely to desire unified access to content across different services (known as "aggregation"). Ampere said.

Ampere said that in Q1, just 15% of the subscriber base of either Disney+, Hulu or Max currently take all three in the household, and just 10% of Comcast mobile, broadband and TV customers subscribing to Peacock, Netflix or Apple TV+ currently take all three. Therefore, there is a significant upsell opportunity for a wide audience, who will benefit from expanded content offered by bundled services at discounted rates, according to the researcher.

“As the SVoD market in the US has become increasingly saturated, new subscribers are harder to find, which makes retention all the more important,” said Daniel Monaghan, Research Manager at Ampere Analysis. “There is a sizeable group of consumers who frequently subscribe to SVoD platforms, cancel and resubscribe. Reducing this behaviour would boost platforms’ top and bottom lines. Analysis of Ampere data reveals that churn is far smaller for bundle-takers than non-bundle resubscribers for some offerings.

“For instance, resubscribers who took the Disney bundle in Q1 2023 were less than half as likely to churn within a year, compared to standalone Disney+ resubscribers,” Monaghan added. “We’re now seeing competing players following suit and joining forces to bundle their platforms, and our consumer data shows the overlap of uptake for those is currently very limited. This should stand them in good stead to both upsell their services and limit the churn of resubscribers and first-timers alike.”