Costco (COST) stock slowly but surely has been starting to work in the bulls’ favor.

Is more upside on the way?

Retail has been a tricky sector for investors this year. While megacap tech has been booming, the SPDR S&P Retail ETF (XRT) has been struggling.

Thanks to its 14% rally from June 1 to June 16, the XRT ETF is now in positive territory this year, up 2.5% for 2023. Of course, that lags the 14% rally in the S&P 500 and the 30% year-to-date rally in the Nasdaq.

Don't Miss: Walmart Stock Has Been on Fire. Here's the Dip-Buying Opportunity.

But the longs are seeing more promising action out of Walmart (WMT), Amazon (AMZN), Lowe’s (LOW) and others.

For Costco’s part, the stock saw a positive reaction to the earnings report from about a month ago and has now quietly rallied in four straight weeks.

With the move, we’re seeing the shares of the warehouse-club retailer break out.

Trading Costco Stock’s Breakout

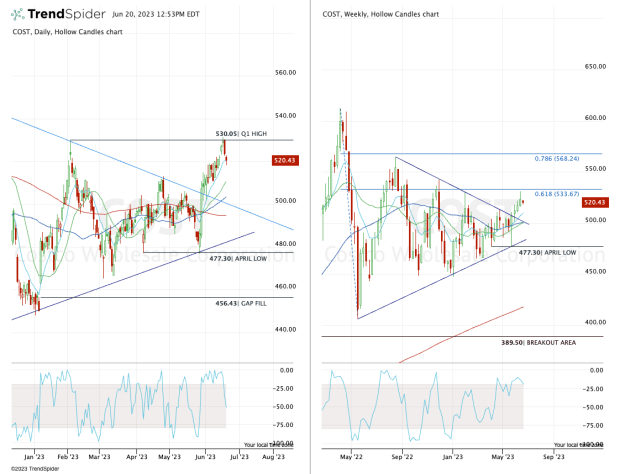

Chart courtesy of TrendSpider.com

Notice on the daily and weekly charts how Costco stock tested down to the April low and bounced hard from that level near $477. The ensuing multiday rally sent the shares above all the major daily moving averages, as well as downtrend resistance (blue line).

The breakout over downtrend resistance was significant, as Costco stock for a year had been wedging into a tighter and tighter range. Riding a wave of higher lows and lower highs, the stock was bound to eventually break out of this range.

Finally, the bulls won as the shares have broken to the upside.

Don't Miss: Can AMD Stock Make New Highs? First, Here's Where Support Must Hold

The recent rally sent Costco stock back to its first-quarter high near $530, where it was then rejected. Now the bulls are looking for the shares to find support at the rising 10-day moving average.

If it holds, look for a move back to $530. A rally through the $530 level and the 61.8% retracement near $533.50 could open the door all the way up to $550, then the 78.6% retracement near $568.

If, however, the 10-day moving average fails to hold, the 21-day and 50-day moving averages are back in play.

For the bulls, they may be inclined to wait for a test of the 50-day moving average in that scenario. Why? It’s closer to the psychologically key $500 level, but it also comes into play near the 50% retracement of the rally and a retest of prior downtrend resistance (blue line).

Sign up for Real Money Pro to learn the ins and outs of the trading floor from Doug Kass’s Daily Diary.