Shares of Costco (COST) were getting hit, down 8.1% at Thursday’s low and off 6.6% at last check.

The moves came after disappointing November sales data. Specifically, November sales rose 5.7% year over year to $19.17 billion. That growth rate was slower than the 10.1% and 7.7% increases in September and October, respectively.

Further, today’s decline comes after Costco stock rallied roughly 2% on Wednesday and hit its highest level since September.

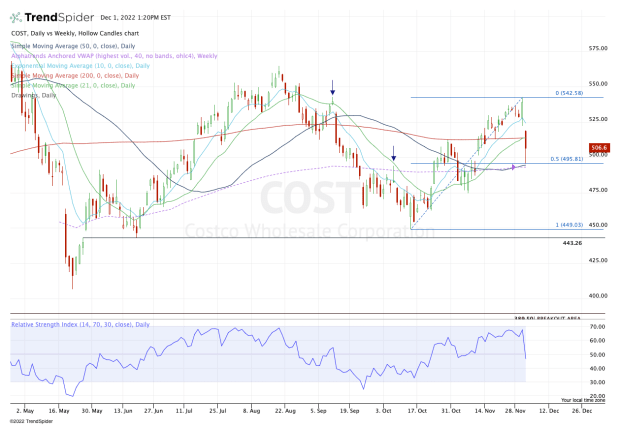

When we look at the chart, the shares were trading quite well until today. Costco stock was trading above all of its major daily moving averages while riding its 10-day moving average higher.

But it also comes on a day where other retail stocks are under pressure, like Dollar General (DG) after its disappointing earnings results.

Trading Costco Stock

Chart courtesy of TrendSpider.com

Costco stock took a tumble this morning, but where it found support was no surprise.

The shares traded down to a low of $495-and-change, bouncing within pennies of the 50% retracement of the recent range. Further, this is also where the 50-day moving average and the weekly VWAP come into play.

For traders, this was a very clear line in the sand. Had Costco stock broken below these measures and failed to reclaim them, it would have opened the door down to the $475 area.

Now that the stock is back over $500, the $515 level is in play. That’s where both the 21-day and 200-day moving averages sit. Above that puts the gap-fill level in play at $522.

On the flip side, the major support area that held this morning would be back in play should Costco stock trade back below $500.

While many retail stocks have been trading well lately, not all of them are. Dollar General and Costco are two examples today.

If Costco cannot stay above major support, traders will likely benefit from shifting their focus to those that are doing well instead.

Cyber Week Deal

Get Action Alerts PLUS for our lowest price of the year! The markets are tough right now, but this is the best time to have professional guidance to help navigate the volatility. Unlock portfolio guidance, stock ratings, access to portfolio managers, and market analysis every trading day. Claim this deal now!