Costco Wholesale (COST) is looking to escape this week without too bad of a day on Friday. Shares are currently down almost 4% after the retailer reported earnings.

We saw Best Buy (BBY) and Target (TGT) both roar higher on earnings this week, so bulls were likely optimistic with Costco’s results on deck.

However, the stock rallied for six straight sessions coming into the report, climbing more than 10% in the process. That’s despite market-wide volatility wreaking havoc on most individual stocks.

The company beat on earnings and revenue expectations, but was cautious about supply chain headwinds pressuring margins going forward.

The stock is not cratering, just dipping. The results were strong and the stock ran hard ahead of the news. Now will support come into play?

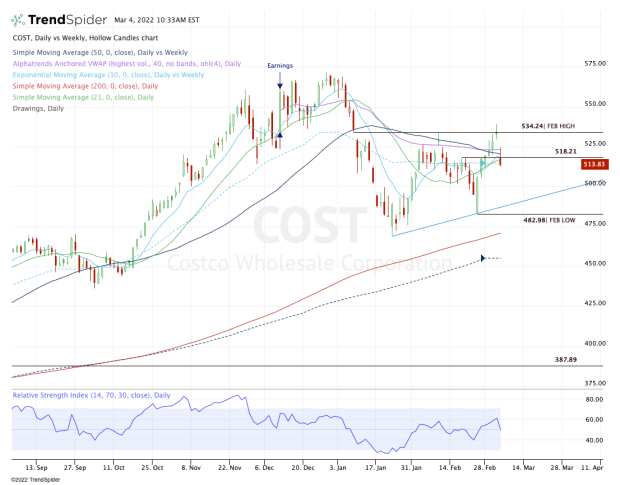

Let’s look at the chart to see what support levels to focus on now.

Trading Costco Stock

Chart courtesy of TrendSpider.com

Look at the way Costco traded on that nasty gap down on Feb. 24. Shares exploded off the lows, which was impressively above the January low, unlike most other stocks.

Further, shares rallied hard for six straight sessions and temporarily pushed through the $534.24 level. That was a key level because it was the January gap-fill and the February high.

It’s healthy for Costco stock to pull back after such a strong run, but bulls need to see some support come into play.

Specifically, I’d love to see the $515 to $520 area hold. Above $525 is even better.

If it could hold $525, it means Costco stock held above the 10-day, 21-day, 50-day and 10-week moving averages, as well as the daily VWAP measure and $518 (where prior resistance turned into support).

Phew. That's a lot of levels.

The very last line of that support range is the 10-week moving average, down at $515.

Should Costco ultimately hold strong, it keeps the $534 level in play, as well as this month’s high near $539. Above that would open the door to $550, then potentially all the way up to the $565 to $570 area.

However, the downside is where bulls need to be focused too, because the stock can continue lower if support fails.

In that scenario, keep an eye on $504 — the 61.8% retracement from the recent high to the February low — then $500.

Below $500 would open the door to uptrend support (blue line), followed by the February low near $483 and the 200-day moving average.