Costco Wholesale (COST) is one of the premiere retailers, but like some of its peers, it has struggled in 2022.

That's not only from the perspective of the stock price but also as inventories climb and inflation surges.

Walmart (WMT), Target (TGT), Amazon (AMZN) and others have all struggled with these issues.

Costco stock has performed much better over the past 12 months, with the stock up about 5%. Walmart and Target are down 4.8% and 32% respectively.

But over the past three months Costco has badly underperformed these two stocks. In that span, Costco is down 5.3% while Walmart and Target are up about 6%.

Let’s look at Costco stock as some key levels start to stand out.

Trading Costco Stock

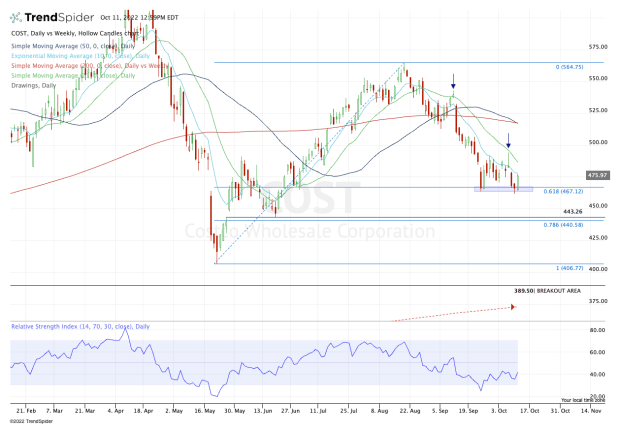

Chart courtesy of TrendSpider.com

On the chart my eyes immediately drift to two key areas. First is $465, then $440.

Near $465 is the 61.8% retracement from the stock’s August high down to the 2022 low. The last test of this area kickstarted a nice rally last month -- but the momentum fizzled when the stock ran into active resistance via the 10-day and 21-day moving averages.

Now the stock is rallying off $465 again, and the bulls will need to see how Costco handles active resistance. If it can clear the 10-day and 21-day moving averages, $500-plus could be in the cards.

If it can’t find its footing near $465, then the $440 to $445 zone may come back into play. Not only does this level mark the 78.6% retracement, but also a key gap area and pivot from June.

Should Costco stock decline to this area, the bulls will want to see a bounce.

If it doesn’t come to fruition -- as in a true bear-market capitulation -- perhaps the stock will revisit the lows and potentially even test below $400, where we find a key breakout area and the 200-week moving average.

While that’s a long way down from here, a test of $390 is only 36% off the all-time high.

As I said for Meta (META) earlier today: I don’t necessarily expect that to happen, but in a bear market we need to be prepared for all possibilities.

For now, watch active resistance on the upside and $465 and $440 on the downside.