Costco Wholesale (COST) is down about 3% on Friday after reporting earnings on Thursday after the close.

And it’s simply blending into the sea of red we have in the stock market today.

The warehouse-club retailer delivered a top- and bottom-line beat, where revenue grew 15% year over year. Further, same-store sales grew 13.7% globally and 15.8% in the U.S., while e-commerce sales rose 7.1%.

Like other retailers, though, Costco’s profit margins were pressured as inflation chewed into the bottom line.

Costco is a go-to stock among the bulls. That said, it’s not immune to a selloff.

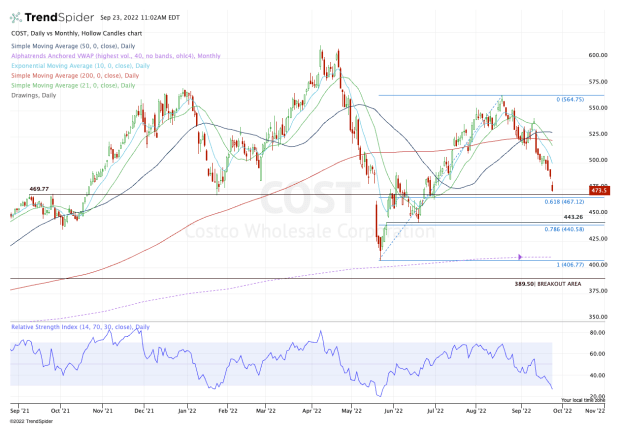

On the charts, I have two areas of significance I’d like to take a closer look at.

Trading Costco Stock on Earnings

Chart courtesy of TrendSpider.com

Costco stock put together a sharp rally off the May low, climbing almost 40% to its high in August. At one point, the stock rallied in six straight weeks.

But now all those gains are unwinding.

When it comes to support, the first area of interest is $467 to $470. In that zone, we have the 61.8% retracement and a key support/resistance pivot. Both observations can be seen in the chart above.

If that level fails, then the $440 to $443 area is of interest. That’s where we find the 78.6% retracement and a level that was a gap-fill, but marked the low in July that kickstarted that massive six-week rally mentioned above.

What happens if both levels fail as support?

Given that we’re in the midst of a bear market, anything is possible. If Costco stock breaks below both of these levels, it could open the door down to the $400 area.

Just above $400, we have the 2022 low, as well as the monthly VWAP measure. If we break this area, it could put the $390 breakout zone in play.

If Costco stock can reverse course soon, keep an eye on the gap-fill level from this morning, up at $494. Above that figure puts $500 and the declining 10-day moving average in play.