It’s been a great short stretch in the market, with the S&P 500 up almost 5% in the past three sessions and looking to snap a seven-week losing streak.

Warehouse-club retailer Costco Wholesale (COST) is trying to add to the bullish mix.

Costco dropped 16% last week after Target (TGT) and Walmart (WMT) reported disappointing results. On Friday, May 27, Costco is up a bit following its earnings report.

The shares opened 2% lower on the day, then reversed. If Costco finishes the session in positive territory, it will mark its fifth straight daily gain.

Costco’s earnings tend to be a bit more muted, since it updates investors each month. We thus tend to have a pretty good idea of what’s going on.

To little surprise, the retailer reported better-than-expected sales and earnings results, while membership revenue neared the coveted $1 billion mark in the quarter.

Many consider Costco a best-of-breed retailer.

But the stock is caught in a tricky area on the charts.

Trading Costco Stock

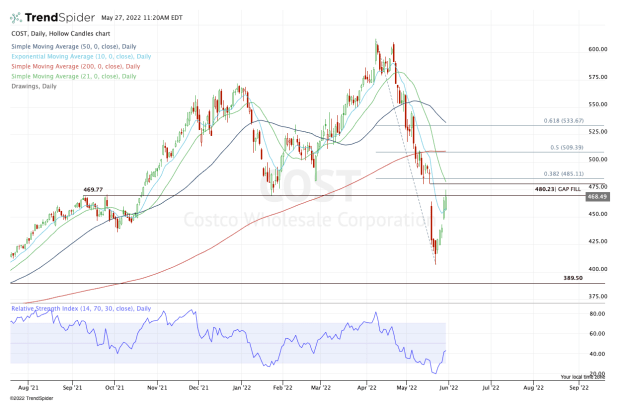

Chart courtesy of TrendSpider.com

Last week, Costco stock made a sharp break lower, leaving an unfilled gap at $480.23. The stock filled part of that gap yesterday and a bit more of it today.

Still, it hasn’t completely closed the gap, and it’s struggling to generate post-earnings momentum now amid a strong run in the overall market. Traders rightfully could be concerned about whether this stock may lose more steam in the days and weeks to come.

I admit I like Costco quite a bit. But I also like Walmart and Target, too, and look at what happened to them. Liking a company over the long term has little to do with how it will perform in the short term.

If I remove the ticker symbol from this chart and look at the company neutrally, I become a bit cautious. I see problems -- and opportunity as well.

Costco shares are struggling with the prior breakout level at $470. In January that became support, and then it failed just last week. In this area, we also have the declining 21-day moving average, as well as the 38.2% retracement of the current range.

On the flip side, here's the opportunity. If Costco can clear this area — first by closing above $470, then by clearing $485 — then we could be looking at a push up to the $510 area. There we find the 50% retracement and the 200-day moving average.

Above that opens the door to the 61.8% retracement near $535 and the 50-day moving average.

For now, keep a close eye on the $470 area. Above is an improvement and below it is more of a concern.