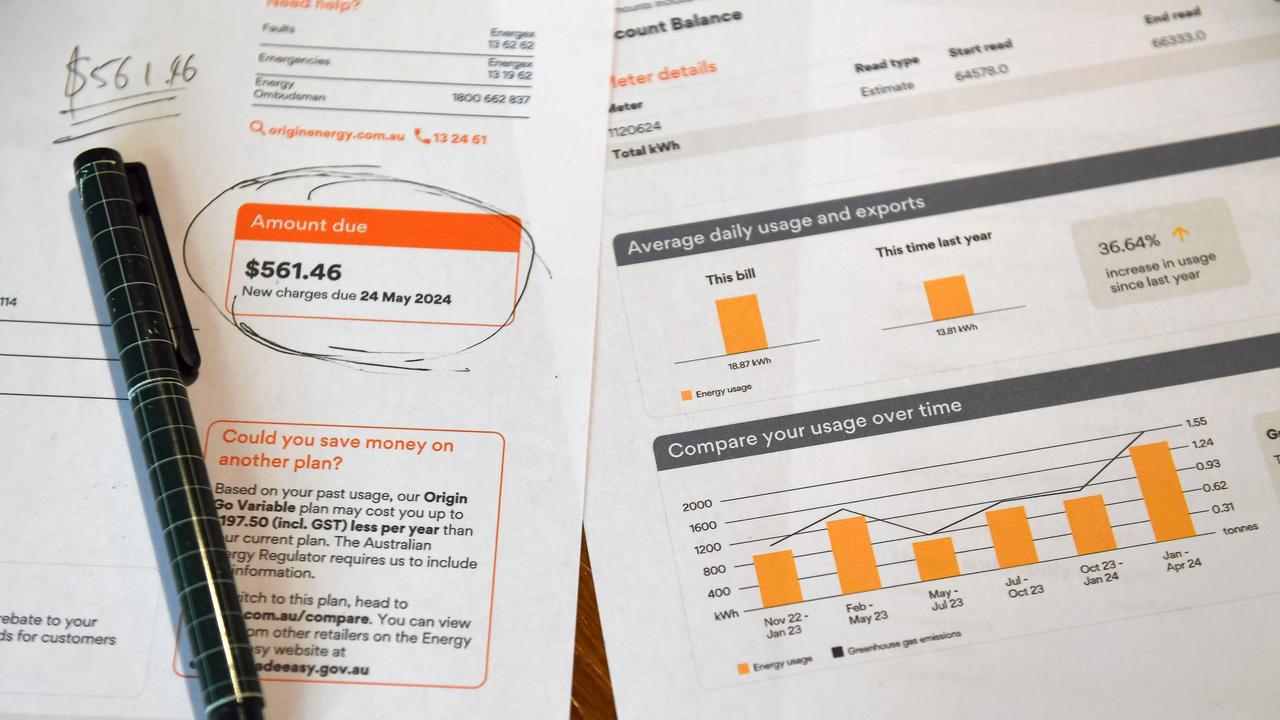

Australia's largest electricity and gas retail business is well aware that cost-of-living pressures are hurting its energy customers, after booking "solid" interim earnings.

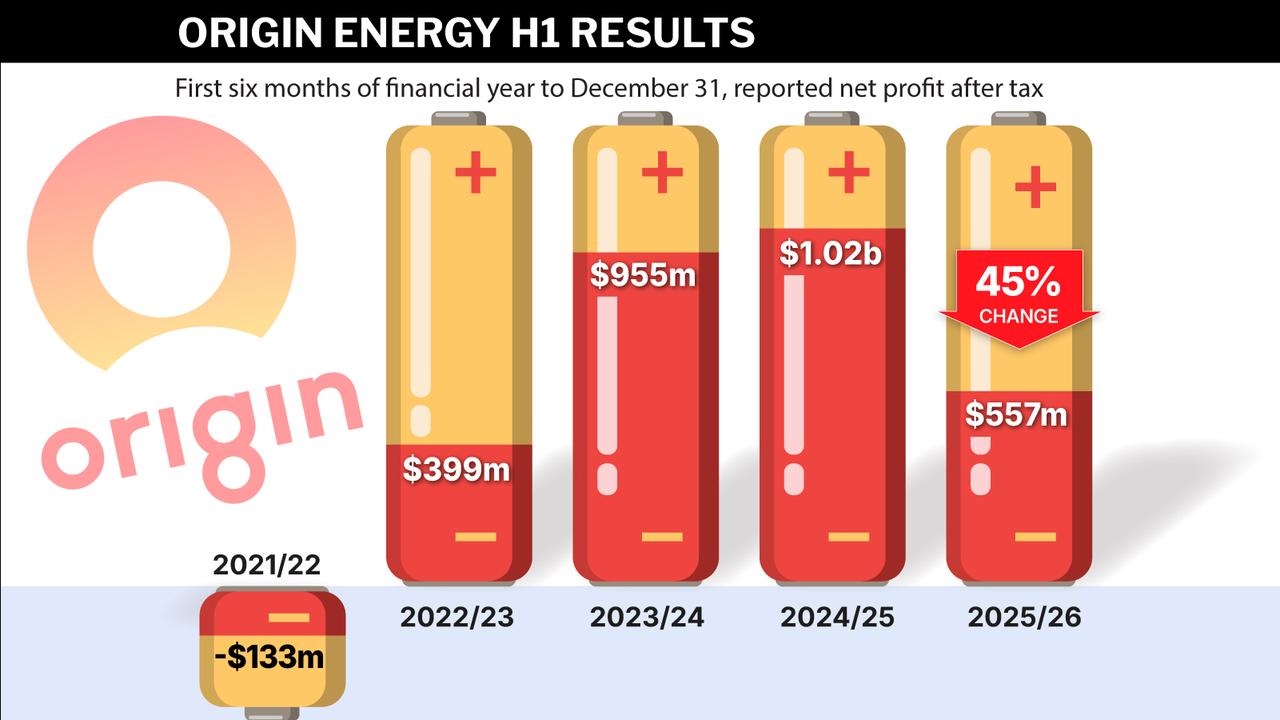

Origin Energy on Thursday reported lower earnings for the 2025/26 first half, but said this was to be expected for a company that's leading the nation's energy transition.

Bottom-line net profit for the half-year ended December 31 fell 45 per cent to $557 million, after revenue growth of nine per cent to $8 billion.

The underlying result, which excludes one-off items, was also lower at $593 million, from $924 million in the prior first half, and a bit better than market expectations.

The lower profit came after underlying earnings for Origin's gas business dropped, although this was partly offset by an improvement in the energy markets division.

Origin pointed to higher gross profit for electricity sales, a reduction in the cost to serve customers, against lower gas profits due to lower LNG prices and volumes.

However, chief executive Frank Calabria acknowledged that while the result was solid, many of Origin's energy customers are still facing higher living costs, including power bills.

"We take great pride in customers continuing to choose Origin as their energy retailers," he told shareholders in a video.

"We've now delivered more than 10 consecutive halves of customer growth."

Mr Calabria argued Origin was giving customers solutions, such as new home battery products.

"We know cost-of-living pressures remain and we are doing more to support customers in financial hardship," he said.

But while good power station reliability and strong contributions from renewables and batteries had helped to ease wholesale electricity prices, network costs was a key factor feeding into the bills of Origin customers.

Last October, Origin launched its Climate Transition Action Plan with a goal to cut greenhouse gas emissions by 40 per cent within five years.

It signed a deal with the NSW government to extend the operation of the Lake Macquarie based Eraring Power Station, Australia's biggest coal-fired facility, to 2029.

It has also been spending billions on new grid-scale battery projects.

Origin tightened its earnings guidance for the 2025/26 year and now expects earnings - before interest, tax, depreciation and amortisation - of between $1.55 billion and $1.75 billion.

It was previously forecasting earnings between $1.4 billion and $1.7 billion.

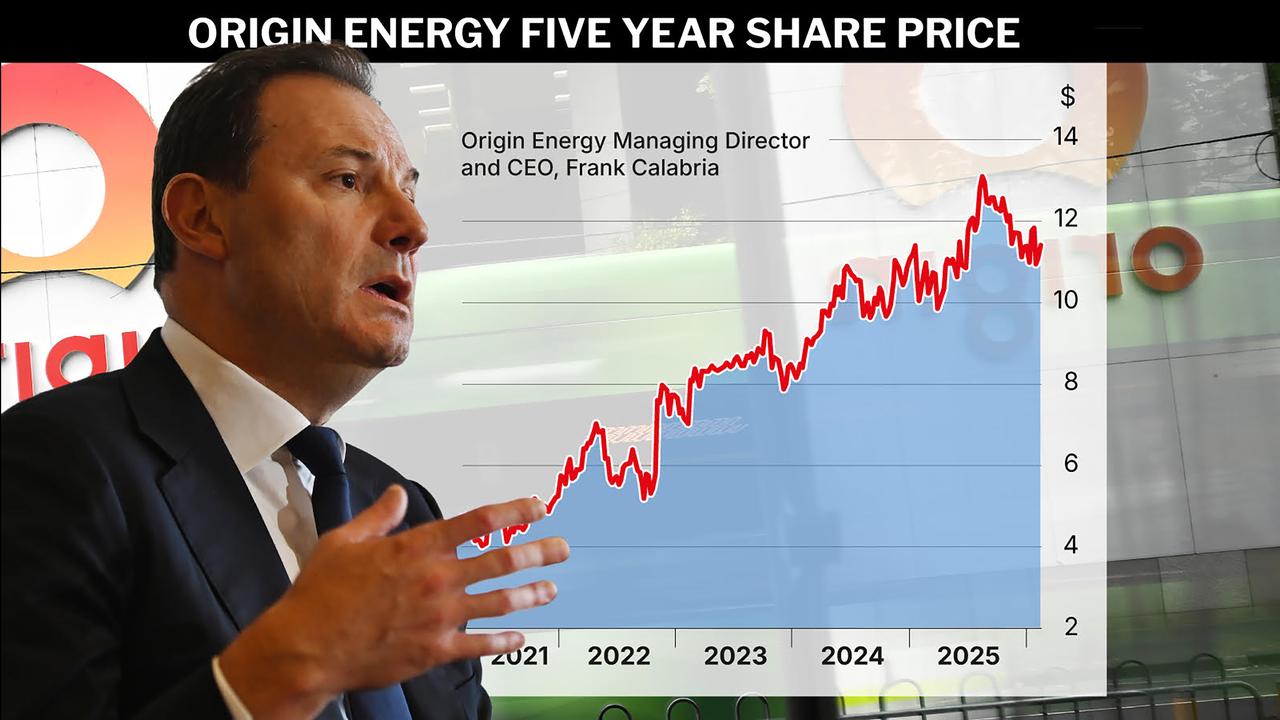

Origin, which has a market value of $19 billion, declared a first-half dividend of 30 cents per share, unchanged from 2025.

Its shares closed on Thursday at $11.50, up almost four per cent.