Corteva, Inc. (CTVA), a leading global agriculture firm, specializes in seeds, crop protection solutions, biological products, and digital tools for farming. Operating worldwide, it equips farmers with innovative offerings to boost productivity and sustainability. Headquartered in Indianapolis, Indiana, the company has a market capitalization of $50.76 billion.

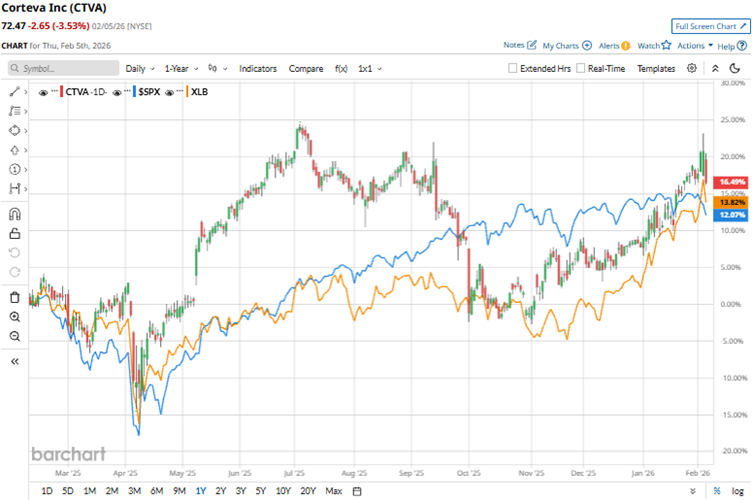

Over the past 52 weeks, the stock has gained 13.6%, while it is up 8.1% year-to-date (YTD). The broader S&P 500 index ($SPX) has increased 12.2% over the past 52 weeks, while it is marginally down YTD. Corteva’s shares had reached a 52-week high of $77.41 in July 2025, but are down 6.4% from that level.

Comparing the stock’s performance with that of its sector, we see that the State Street Materials Select Sector SPDR ETF (XLB) has gained 13.4% over the past 52 weeks and 11.4% YTD. Therefore, Corteva is underperforming its sector this year.

On Feb. 3, Corteva announced its fourth-quarter and fiscal 2025 results. Its Q4 revenue declined by 2% year-over-year (YOY) to $3.91 billion, while organic sales dropped by 4%. The topline weakness was primarily attributable to a 5% decline in volume, driven by seasonal shifts into the third quarter of 2025 and the first quarter of 2026 in the Crop Protection and Seed segments. Its non-GAAP EPS dropped 31% from the prior-year period to $0.22. This year, the company expects strong crop demand and production in the agriculture industry, but also forecasts pressure on commodity prices and farmer margins.

For the current quarter, Wall Street analysts expect Corteva’s EPS to remain unchanged YOY at $1.13 on a diluted basis. However, EPS is expected to increase 8.4% annually to $3.62 for fiscal 2026, followed by a 9.4% improvement to $3.96 in fiscal 2027. The company has a solid record of topping consensus estimates in all four trailing quarters.

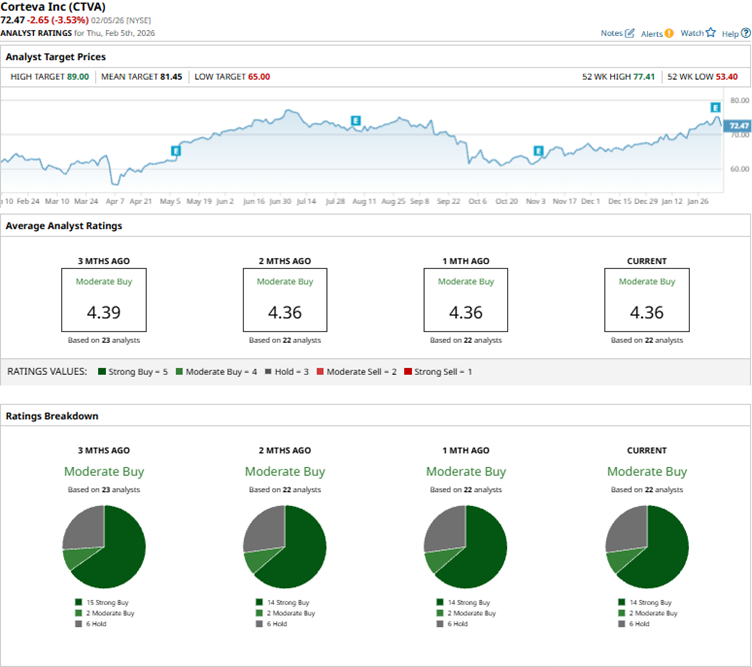

Among the 22 Wall Street analysts covering Corteva’s stock, the consensus is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, two “Moderate Buys,” and six “Holds.” The ratings configuration has become less bullish than three months ago, with the number of “Strong Buy” ratings decreasing from 15 to 14.

Post the fourth-quarter earnings release, analysts at RBC Capital raised the price target on the stock from $80 to $89, while maintaining an “Outperform” rating. Analysts remain bullish on the stock ahead of its Seed spin, which could serve as a catalyst.

Corteva’s mean price target of $81.45 indicates an 12.4% upside over current market prices. Moreover, the Street-high RBC Capital-given price target of $89 implies a potential upside of 22.8%.