Before the new UK chancellor, Jeremy Hunt, rolled back almost all of September’s mini-budget measures, the first tax cut to go was Liz Truss’s plan to scrap a corporation tax rise.

The political turmoil caused by the mini-budget has had a negative effect on the public’s perception of this government, and it certainly hasn’t eased the concerns that businesses have over its changing tax policy. While markets have started to recover some lost ground from the past few weeks, the corporation tax U-turn seemed to do little to quell anxiety in the markets when it was announced ahead of the full mini-budget reversal on October 17.

For businesses, the problem with corporation tax has been uncertainty and this is what they will want Hunt to address now he is chancellor.

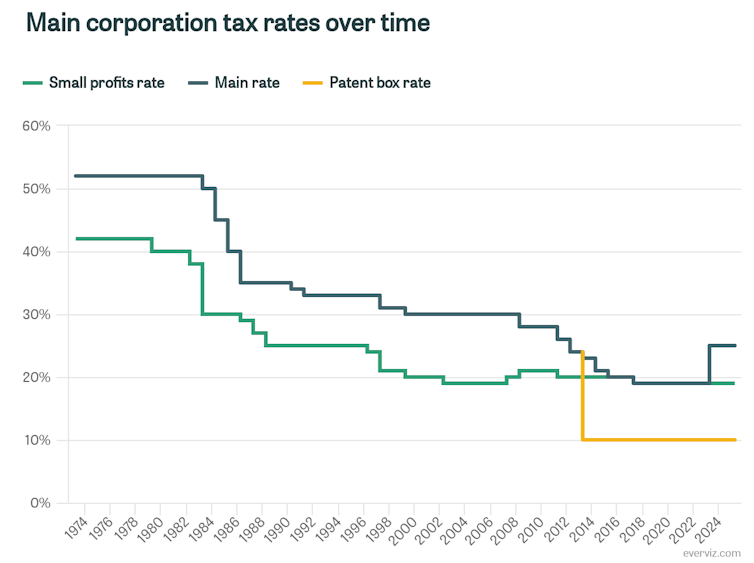

Many business leaders welcomed September’s mini-budget, seeing the measures as being the country’s best opportunity to grow the economy. The planned abolition of the rise of the corporation tax to 25% (that is, keeping the rate at 19% as it has been since 2017) was regarded as central to that, so the recent U-turn decision to continue with the increase has not been welcomed by business.

Indeed, the Confederation of British Industry (CBI) director general, Tony Danker, said after the U-turn that the government should “balance any rise in corporation tax with investment allowances” to “help achieve both stability and investment”.

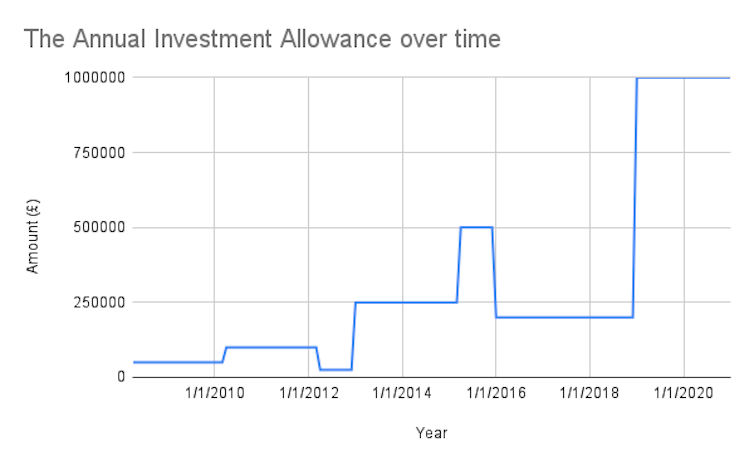

Investment allowances are a form of tax relief that businesses can use to buy equipment. The UK introduced the Annual Investment Allowance (AIA) in 2008 to stimulate economic growth by allowing companies to deduct up to £1 million per tax year from taxable profits for equipment purchases.

And its not just corporation tax rates that have been subject to a lot of changes, the AIA claimable amount has been adjusted multiple times since the AIA was introduced, although the £1 million figure was one of the few mini-budget items not reversed by Hunt on October 17.

But whatever the rates, thresholds and allowances of any taxes are, companies must be able to plan ahead for investment, resource allocation and shareholder remuneration. This is not possible when the government keeps changing its tax policies.

Downward trend

The chart below shows the history of the main corporation tax rate since the mid-1970s. It has maintained a generally steady trend, with multiple minor changes, but has gradually dropped to its current level of 19%. By proposing, reversing and then reinstating an increase to 25% (which would have been its highest level for ten years), that stability is compromised.

Comparing this with the recent changes in the annual AIA threshold (see table below), reveals further flip-flopping from the government.

This also suggests short-termism and a lack of coherency. It makes it difficult for companies to predict what the AIA threshold in the future could be so they can plan their spending. The government is keeping the corporation tax rate at 25% and retaining Kwarteng’s mini-budget policy of keeping the AIA threshold at £1 million.

But it must also decide whether anything will be done regarding the “super-deduction”. This is a temporary special rate of 130% allowances on expenditure, which is due to expire in March 2023. It allows a company spending, for example, £1 million on qualifying investments to deduct £1.3 million in taxable profits and therefore save 19% of that (£247,000) on its corporation tax bill.

The impact on people

It’s not only businesses that currently lack confidence. Much interest has centred around the public’s ability to deal with the current cost of living crisis. Rising energy and food prices have been the main concerns, and much of the backlash to September’s mini-budget was that it offered small comfort to low and middle-income earners who would be most affected by cost increases.

Confidence will now be further dampened by the new chancellor’s plans to delay the proposed 1p income tax cut indefinitely, keeping the basic rate at 20%.

But people also affect the revenue received from corporation tax in two ways. Firstly, a cut in the rate may have resulted in companies passing some of the benefits to their customers. The incidence of tax being borne on producer and consumer alike is a well-established economic concept. This might have stimulated consumer spending and subsequently increased tax revenues.

Secondly, consumer spending is falling due to inflation. When combined with rising interest rates potentially leading to significantly higher mortgage and rental payments, there is a real danger that a lack of disposable income will continue to hamper growth. This means revenues raised from corporation tax will fall short of the government’s targets.

The upcoming fiscal plan to be announced on October 31 will include a full Office for Budget Responsibility forecast covering the medium term. To maintain credibility and offer the public and business any reassurance of economic stability for the rest of this time, the government needs to produce a clear, united fiscal plan and remain committed to it.

As this moment, we don’t know how the Truss premiership will weather the current political storm, or if her leadership will even survive until the end of October. Two weeks currently feels like an awfully long time in UK politics. But to help mitigate economic disruption over the next few years, it is clear that someone needs to take firm charge of their fiscal strategy.

With Hunt scaling back most of the mini-budget, he clearly hopes to signal the start of a new chapter for the Tory government. Let’s hope this provides the certainty businesses need.

Gavin Midgley does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.