Copart, Inc. (CPRT) has consistently recorded strong growth over recent years, seen in its appreciable revenue increase of a CAGR of 21.2% over the past three years. Additionally, its earnings per share (EPS) have followed suit, rising at a notable 24.3% CAGR over the same timeline.

Financial analysts forecast favorable outcomes regarding Copart's impending quarterly results. The consensus revenue estimate of $1.03 billion for the fiscal second quarter ended January 2024, represents a year-over-year increase of 8.2%. Concurrently, the company's EPS is projected to rise by 13.9% from the comparative value last year, landing at $0.35.

The company's historical performance also reveals an impressive pattern of surpassing analysts' revenue and EPS estimates in the trailing four quarters.

Pertaining to the company's most recent quarter ended October 31, 2023, Copart reported a revenue of $1.02 billion, gross profit of $464 million, and net income of $332.50 million. These figures reflect a respective growth of 14.2%, 25.6%, and 35.3% from the prior-year quarter.

As an international forerunner in online vehicle auctions, Copart runs operations in 200+ locations across 11 countries, offering more than 250,000 vehicles online daily. The expansive global reach and market supremacy Copart enjoys suggest the probability of continued growth in forthcoming years alongside promising returns.

So, I think CPRT stock presents a worthwhile investment opportunity ahead of its earnings release. The earnings for the second quarter of fiscal 2024 are scheduled for release on February 22, 2024. A detailed examination of some fundamental performance indicators could provide valuable insight.

Analysing Trends: Copart Inc.'s Financial Performance from April 2021 to October 2023

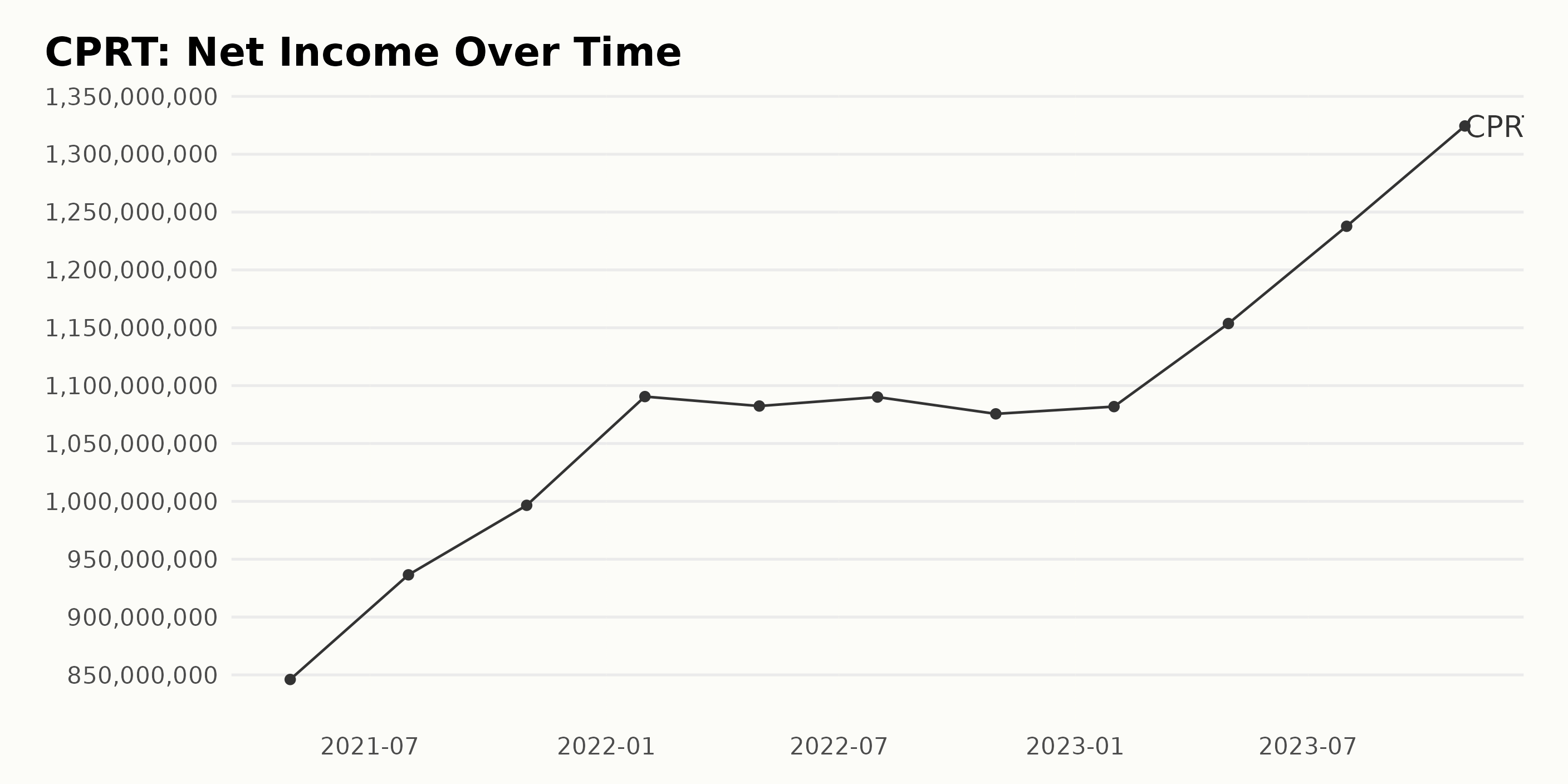

CPRT’s trailing-12-month Net Income has shown a continuing uptrend between April 2021 and October 2023. The data provided shows noteworthy fluctuations as follows:

- April 2021: $846.05 million

- July 2021: $936.49 million

- October 2021: $996.57 million

- January 2022: $1.09 billion

- April 2022: $1.08 billion

- July 2022: $1.09 billion

- October 2022: $1.08 billion

- January 2023: $1.08 billion

- April 2023: $1.15 billion

- July 2023: $1.24 billion

- October 2023: $1.32 billion

There was a noticeable increase from April 2021 to July 2021, indicating a growth rate of approximately 10.69%. Subsequent periods continued to show an uptrend in net income, albeit at varying rates. However, subtle fluctuations can be seen within the range of $1.08 billion to $1.09 billion between January 2022 and January 2023.

Following this, a significant growth phase ensued from April 2023 to October 2023, with net income witnessing a jump from $1.15 billion to $1.32 billion. The most recent data for October 2023 reports a Net Income of $1.32 billion. Measuring from the first value in April 2021, this represents a growth rate of approximately 56.26%, underscoring a substantial increase in the company's profitability over this period. The emphasis on more recent data signifies a powerful upward trend in CPRT's net income.

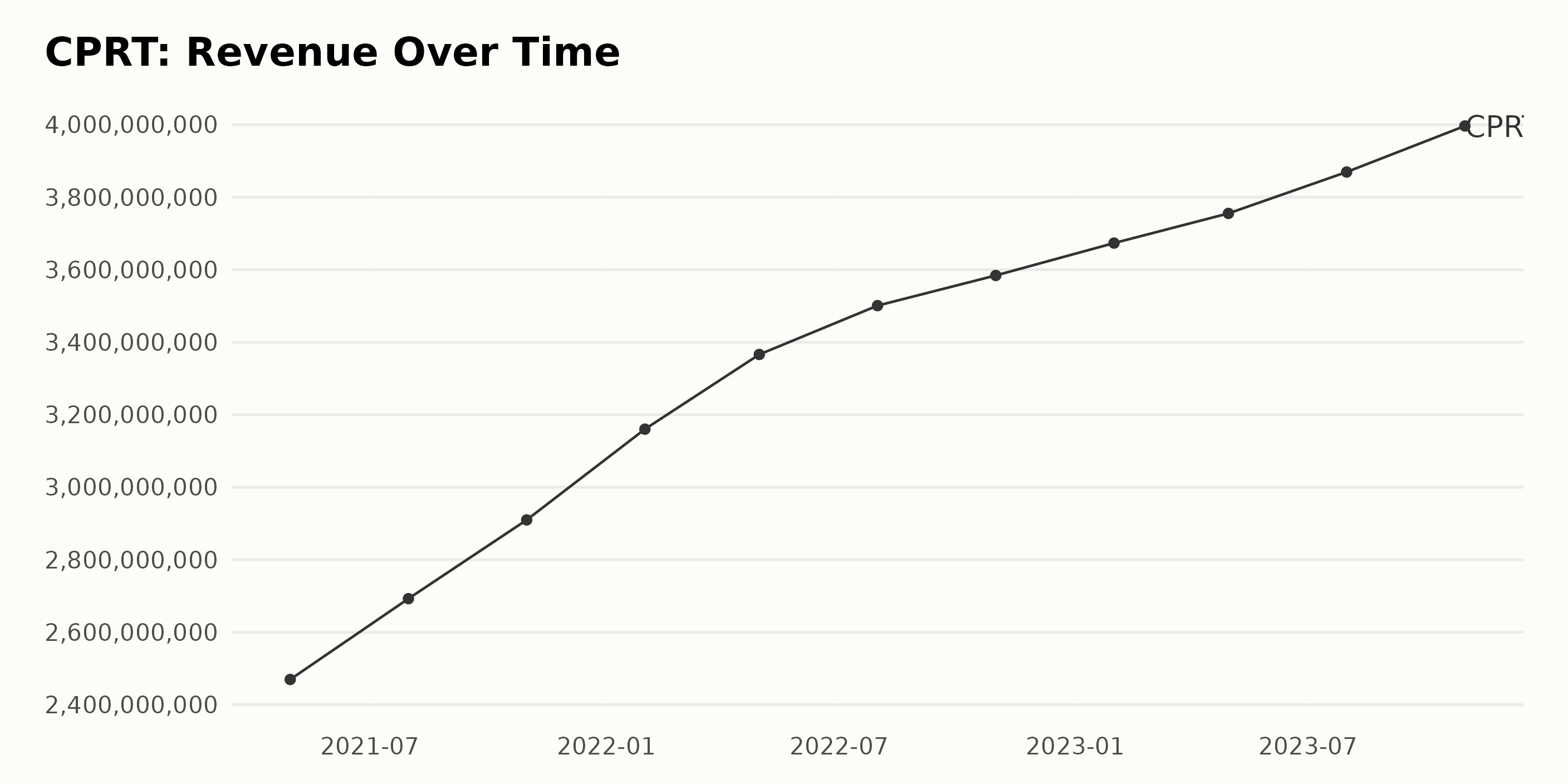

The trailing-12-month revenue of CPRT has demonstrated considerable growth throughout the period under review. This is evident in the stabilized, incremental upward trend with mild fluctuations. Here are the key points to consider:

- In April 2021, the Revenue stood at $2.46 billion.

- There was a stable increase over the next few months, reaching $2.69 billion in July 2021.

- The revenue yet again rose steadily, hitting $3.16 billion in January 2022.

- The increase continued, reaching $3.5 billion by July 2022.

- A slight acceleration in the Revenue can be observed toward the end of the series, with it climbing to $3.67 billion in January 2023 and $3.86 billion in July 2023.

- Lastly, the reported Revenue reached its highest in the series at $3.99 billion in October 2023.

Overall, from April 2021 to October 2023, Copart Inc.'s Revenue saw a growth rate of approximately 62.08%. Notably, the Revenue saw its most significant increase in the latter part of the series, emphasizing the company's promising recent performance. The steadiness of the upward trend may suggest a positive fiscal outlook for Copart Inc.

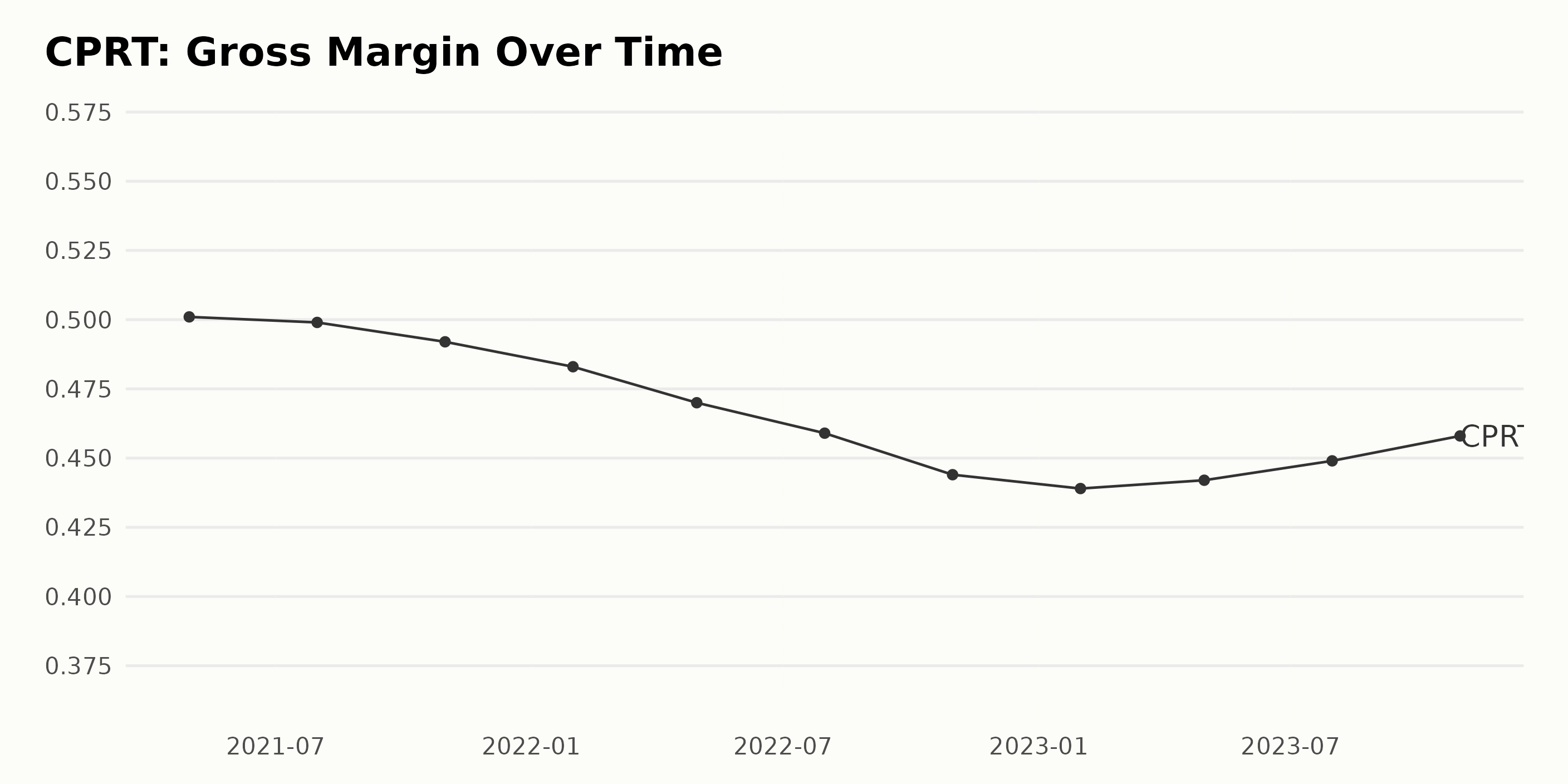

The gross margin for Copart Inc. (CPRT) has shown a fluctuating trend over the given period.

- Beginning on April 30, 2021, the Gross Margin was 50.1%

- By July 2021, it experienced a slight decrease to 49.9%

- In October 2021, there was another small reduction, bringing the value down to 49.2%

- This downward trend continued in January 2022, where the Gross Margin dropped to 48.3%

- April 2022 saw a more noticeable shrink, bringing the value to 47.0%

- The decline persisted through to July 2022, where CPRT reported a Gross Margin of 45.9%

- By October 2022, figures had fallen to a notably lower 44.4%

- There was a slight drop in January 2023, to 43.9%

- However, by April 2023, there was an upward shift observed, moving the value back up to 44.2%

- The upward trend continued into July 2023, bringing the Gross Margin to 44.9%

- The most recent figure, from October 2023, indicates a further increase to 45.8%

In summary, the Gross Margin of CPRT shows a general downward trend from April 2021 to January 2023, falling from 50.1% to 43.9%. However, there appears to be a recovery in the subsequent months, raising the value to 45.8% in October 2023.

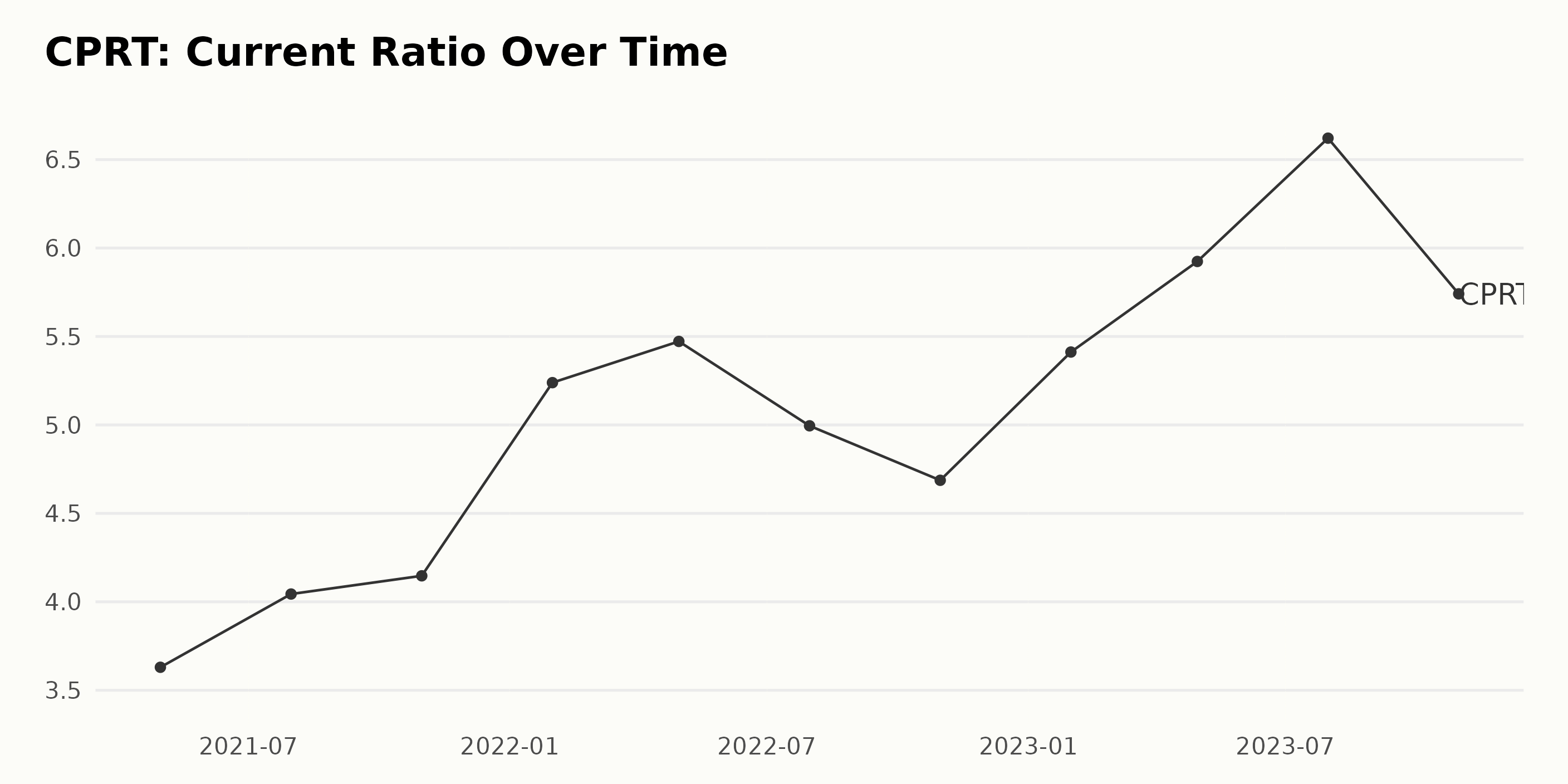

Below is the summarized trend and fluctuations of Copart Inc.'s (CPRT) Current Ratio:

- Starting from April 2021, with a Current Ratio of 3.63, Copart Inc.'s (CPRT) saw a gradual incline in its Current Ratio. It rose to 4.04 in July 2021 and further to 4.15 in October 2021.

- The company experienced a significant leap in the first quarter of 2022 as the Current Ratio jumped to 5.24 in January and 5.47 in April.

- This upward trend continued into mid-2022 despite a minor dip in July (4.99) but followed by a slight drop in October (4.69).

- From 2023 onwards, the Current Ratio showed an oscillating pattern but maintained a generally upward trajectory. Notable peaks were seen in July 2023 at 6.62, an all-time high, before declining slightly to 5.74 in October 2023.

- As of the latest data point in October 2023, Copart's Current Ratio was 5.74, representing a growth rate of approximately 58% from the original value in April 2021.

In summary, over the roughly 2.5-year period, Copart Inc.'s Current Ratio demonstrated a clear trend of growth despite experiencing some fluctuations, particularly from 2023 onwards. It peaked in July 2023 reaching 6.62 and ended with a robust 5.74 by October 2023. Overall, Copart has shown a potential signal of financial stability reflected by the increased ability to cover its short-term liabilities.

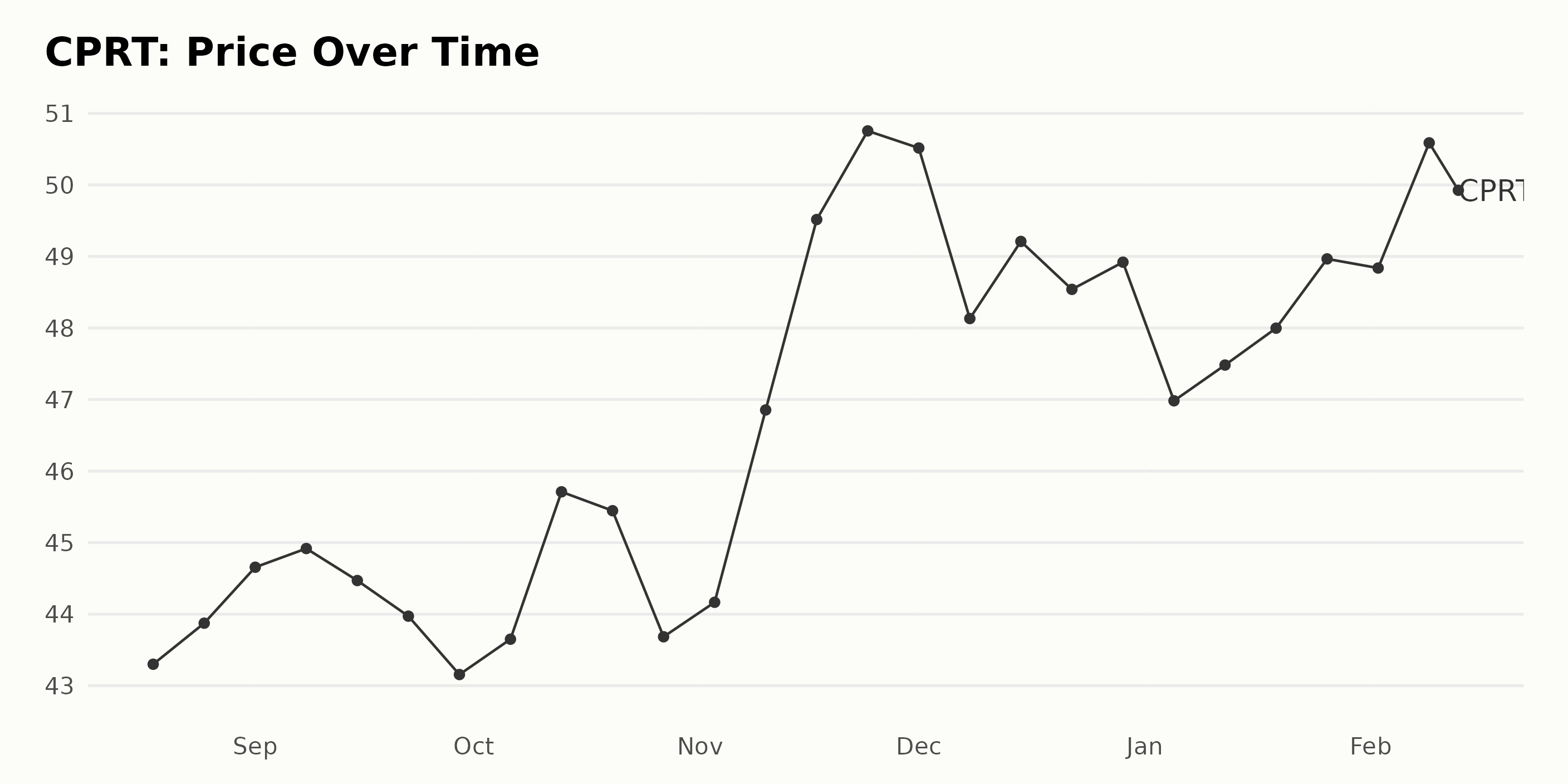

Analyzing Copart Inc.'s Share Price Trajectory: Volatility Amid Six-Month Growth

The data shows the share price of Copart Inc. (CPRT) from August 18, 2023, to February 13, 2024. Over this period, there is a general trend of growth in the share price with slight fluctuations:

- On August 18, 2023, the share price was $43.3.

- By August 25, 2023, it increased slightly to $43.87.

- The share price continued to rise in early September, reaching a peak of $44.92 on September 8, 2023.

- However, it then started to decline, falling to $43.16 by the end of September.

- In October 2023, the share price began to recover, reaching a high of $45.71 on October 13, 2023.

- There were minor ups and downs through the rest of October and into November, but the overall trend was upward. The price went as high as $49.52 on November 17, 2023.

- By the end of November, the share price had risen to $50.76.

- In December, there was some instability with the price fluctuating between $48.13 and $49.21.

- This pattern continued into early January 2024, with the share price ranging from $46.98 to $48.97.

- In February 2024, the share price reached a high of $50.59 on February 9, 2024, but then declined slightly to $49.93 by the 13.

The growth rate of Copart Inc. (CPRT)'s share price fluctuates throughout this period, suggesting volatility in the market. Nevertheless, an overall growth is observed as the share price increased from $43.3 in August 2023 to $49.93 in February 2024. Despite the intermittent drops, the general trend shows an upward trajectory. This suggests that the share price of Copart Inc. (CPRT) has experienced growth in these six months, although there may have been some moments of deceleration amid the growth. Here is a chart of CPRT's price over the past 180 days.

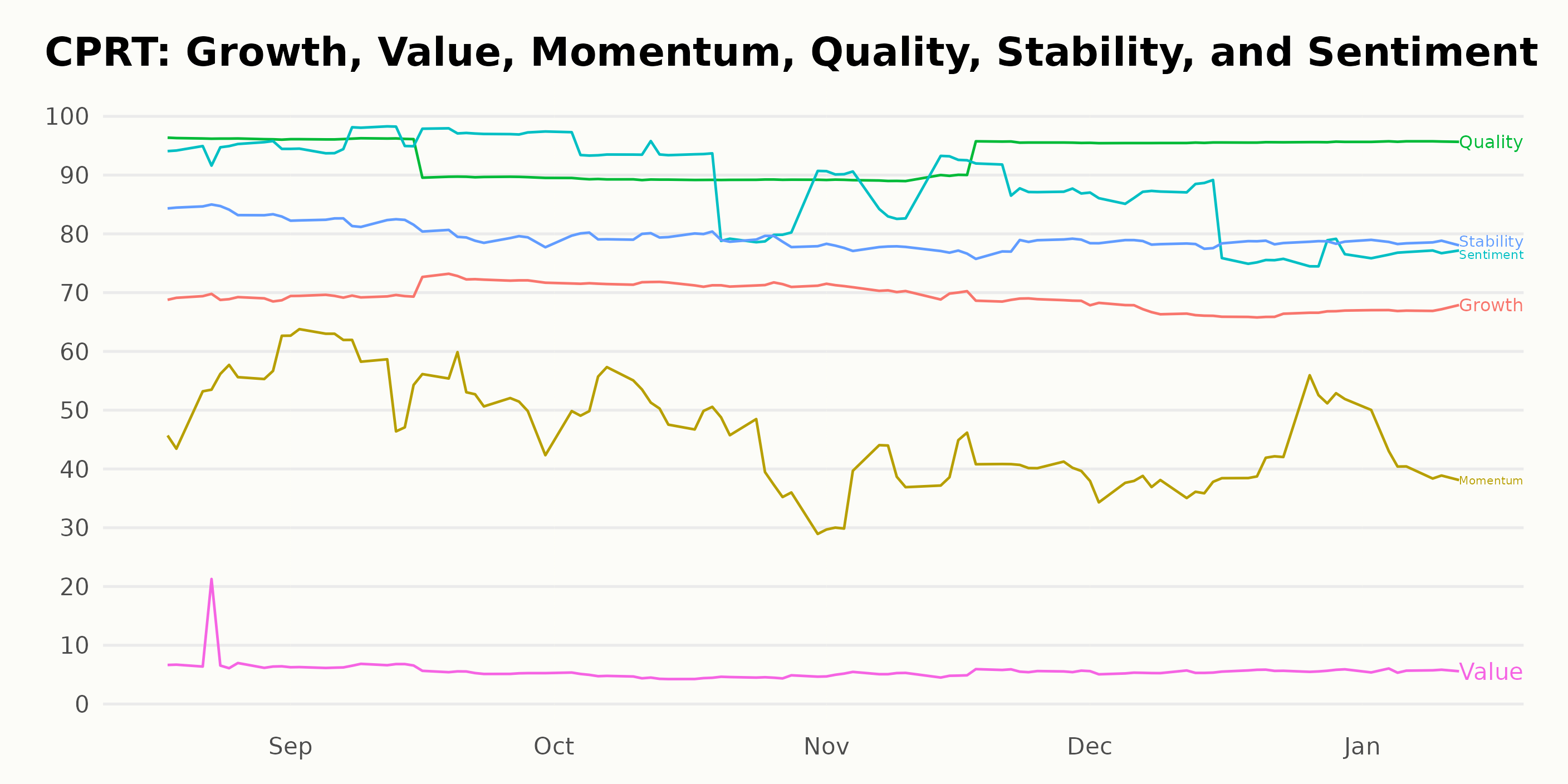

Analyzing CPRT's Consistently High Quality, Sentiment, and Stability POWR Ratings

CPRT has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #4 out of the 20 stocks in the Auto Dealers & Rentals category.

Based on the POWR Ratings for Copart Inc. (CPRT), the three most noteworthy dimensions over the examined period are Quality, Sentiment, and Stability due to their consistently high values.

- Quality: This dimension maintains a high score throughout the period with an initial rating of 96 in August 2023. It drops to its lowest point of 89 in October 2023 but quickly rebounds to a strong 96 by December 2023 and into January 2024.

- Sentiment: The sentiment score starts at 95 in August 2023 and slightly increases to 96 a month later in September 2023. However, a downward trend begins in October 2023, when the score falls to 89, eventually reaching its lowest at 77 by January 2024.

- Stability: Begins with a robust 84 in August 2023, however, over time it reflects a gradual but consistent decreasing trend, reaching the lowest point of 78 by November 2023 and maintaining this rating through the end of the year, before finally increasing to 79 in January 2024.

Overall, although each of these dimensions shows some fluctuation over time, they contribute consistently to the favorability of CPRT's overall POWR Ratings.

How does Copart Inc. (CPRT) Stack Up Against its Peers?

Other stocks in the Auto Dealers & Rentals sector that may be worth considering are Cars.com Inc. (CARS), AutoNation, Inc. (AN) and Credit Acceptance Corporation (CACC) -- they have better POWR Ratings.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

CPRT shares were trading at $48.99 per share on Wednesday afternoon, down $0.24 (-0.49%). Year-to-date, CPRT has declined -0.02%, versus a 4.54% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Copart (CPRT) Earnings: Analyzing Buy Opportunities StockNews.com