The UN Secretary-General, António Guterres, opened the UN Convention on Biological Diversity (COP15) in Montréal with a stark message: “Without nature, we are nothing. Nature is our life-support system, and yet humanity seems hell bent on destruction.”

The summit brought together delegates from over 190 countries to negotiate the post-2020 Global Biodiversity Framework, the implementation of which will require a transformation in the way we produce, consume and trade goods and services that rely on and impact biodiversity.

Companies and investors have, therefore, been paying close attention. Businesses and investors have a critical role to play in biodiversity and conservation efforts and need to invest in sustainable production and extraction methods.

On Dec. 14, the Finance and Biodiversity Day of the summit, speakers across the financial sector discussed various ways of aligning financial investments with the new biodiversity framework. In anticipation of these finance talks, a new global engagement initiative, Nature Action 100 was launched to drive investors’ action on nature-related risks and opportunities.

As a scholar in sustainable finance, I believe that while these initiatives and discussions are important, we need more targeted and urgent investments in nature-friendly solutions to reverse biodiversity loss.

“Without nature, we are nothing”

Numerous scientific studies point to alarming statistics on the rates of biodiversity loss. The Living Planet Report 2022 shows an average decline of 69 per cent in wildlife populations since 1970, thus emphasizing the dual crises of biodiversity loss and climate change driven by human activities.

Unlike the climate crisis that led to the signing of the Paris Agreement, biodiversity loss has received little attention until now. However, the risks from biodiversity loss are enormous.

According to an OECD report, ecosystem services from biodiversity, such as crop pollination, water purification, flood protection and carbon sequestration, are worth an estimated US$125-140 trillion per year. About US$44 trillion per year of this global output is dependent on nature .

Bending the curve of biodiversity loss

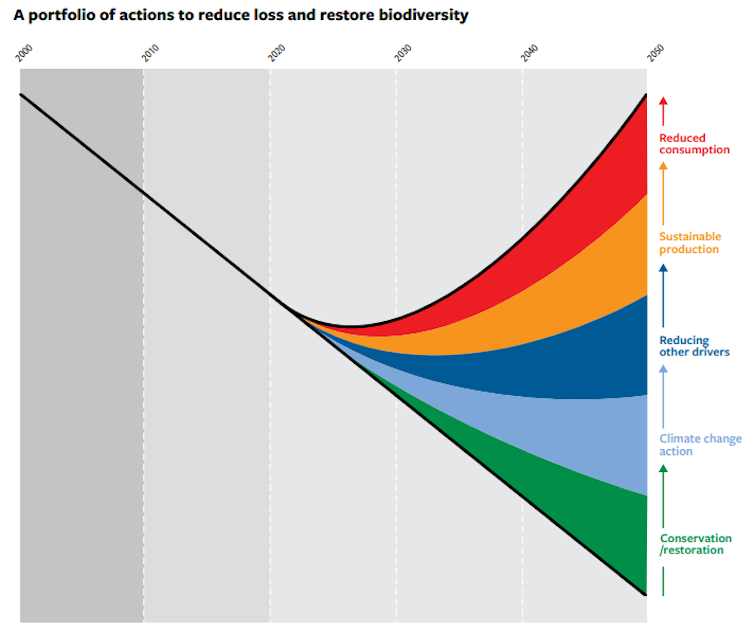

The Convention on Biological Diversity’s fifth Global Biodiversity Outlook summary report for policymakers, published in 2020, suggests a portfolio of actions to restore biodiversity.

These actions include the restoration of landscapes and marine and coastal ecosystems, redesigning agricultural systems through innovative productivity-enhancing approaches, deploying green infrastructure, enabling sustainable and healthy diets, rapidly phasing out fossil fuel use, and many more.

Businesses and investors have a critical role to play in each of these action domains, especially when it comes to shifting to more sustainable production and manufacturing processes, investing in energy efficiency and waste reduction, conservation of natural resources, and investing in climate solutions that also support biodiversity.

Biodiversity awareness in the world of finance

The awareness about biodiversity risks remains very limited within the finance community. This year, the non-profit CDP, which runs the world’s environmental disclosure system, included new questions to assess firms’ approaches to biodiversity.

The results show that three-quarters of 7,700 respondent companies do not assess their impact on biodiversity. Most companies in nature-damaging sectors, such as apparel and manufacturing, are still failing to take meaningful action to stop biodiversity loss and environmental degradation.

According to a 2021 OECD report, nature-related dependencies, impacts and risks are poorly understood and almost entirely uncompensated for in the financial sector. This leads to capital misallocation that ultimately undermines the wellbeing of society.

There are, however, positive signs. Thirty-one per cent of companies in the CDP survey have made a public commitment and/or endorsed biodiversity-related initiatives, and 25 per cent of respondents are planning to do so within the next two years.

The growing awareness is confirmed by the 2022 Global Risks Report, which found that biodiversity loss ranks third among the top 10 global risks by severity over the next 10 years.

Integrating biodiversity in financial decisions

One of the key challenges for investors and lenders is getting the relevant data to make evidence-based decisions to allocate funds. This is in line with the ever-increasing demand for environmental, social and governance (ESG) data disclosure.

The newly launched international initiative Taskforce on Nature-related Financial Disclosures is developing a risk management and disclosure framework for organizations to report and act on evolving nature-related financial risks.

Biodiversity is also attracting the attention of financial policymakers. In March 2022, the Network for Greening the Financial System, a coalition of more than 120 central banks and supervisors, published a new statement, acknowledging that biodiversity loss could lead to significant macroeconomic and financial stability risks.

The new investor-led initiative Nature Action 100 builds on similar initiatives to help investors engage with companies that are contributing to biodiversity loss. Engaging with companies to reduce their negative impact on nature can be a powerful tool for change, especially when coming from large investors and asset owners.

The International Sustainability Standards Board (ISSB) is now considering biodiversity in the development of new ESG disclosure standards. Addressing COP15 delegates, Emmanuel Faber, chair of the ISSB, announced the appointment of two special advisors to provide strategic counsel on issues relating to natural ecosystems and ‘just transition.’

The future lies in impact investing

While these initiatives are crucial, focusing on data disclosure is not sufficient. Even if we quickly agree on disclosure frameworks and measurements around biodiversity, disclosures that are voluntary and not supported by regulation are vulnerable to greenwashing which is widespread in the ESG space.

We need to encourage more targeted investments in nature-positive solutions that reverse biodiversity loss. Impact investing — investing money with the intention to benefit society and the environment — offers a framework for this.

Impact investing starts with identifying a societal challenge and then screens for investment opportunities that provide measurable solutions. But impact investments remain very small relative to other responsible investment strategies. Many impact investors use the UN Sustainable Development Goals (SDGs) to set their impact goals and measure outcomes.

To tackle biodiversity loss, we need more investments in SDG14 (life below water) and SDG15 (life on land). Despite the importance of ocean ecosystems for local livelihoods, food security and carbon sequestration, SDG14 receives the least amount of funding of any of the SDGs.

Canada is a global leader in clean tech innovation and many companies at the nexus of nature and climate are emerging across the country, including innovation in ocean tech, clean marine transportation and regenerative agriculture.

But financing remains a challenge, especially at early stages when risk is high and scale is lacking to attract large investors. More innovative financing mechanisms and instruments are needed to fill this gap.

Investing in Indigenous-led projects can also advance both reconciliation and biodiversity goals, because Indigenous lands contain 80 per cent of the world’s remaining biodiversity.

The Finance and Biodiversity Day at COP15 stimulated important discussions on how to align financial flows with the new biodiversity framework, but real actions remain to be seen. We need action now, as time is not on our side.

Basma Majerbi receives funding from Canada's Social Sciences and Humanities Research Council (SSHRC), Mitacs and the Pacific Institute for Climate Solutions (PICS) at the University of Victoria. She's a volunteer Board member with the South Island Prosperity Partnership and a member of the Research Advisory Council of the Institute for Sustainable Finance.

This article was originally published on The Conversation. Read the original article.