Property owners in Cook County have a new tool to analyze where their tax money goes.

Cook County Treasurer Maria Pappas on Tuesday unveiled an online education tool that gives property owners a breakdown of their last two years of property tax bills.

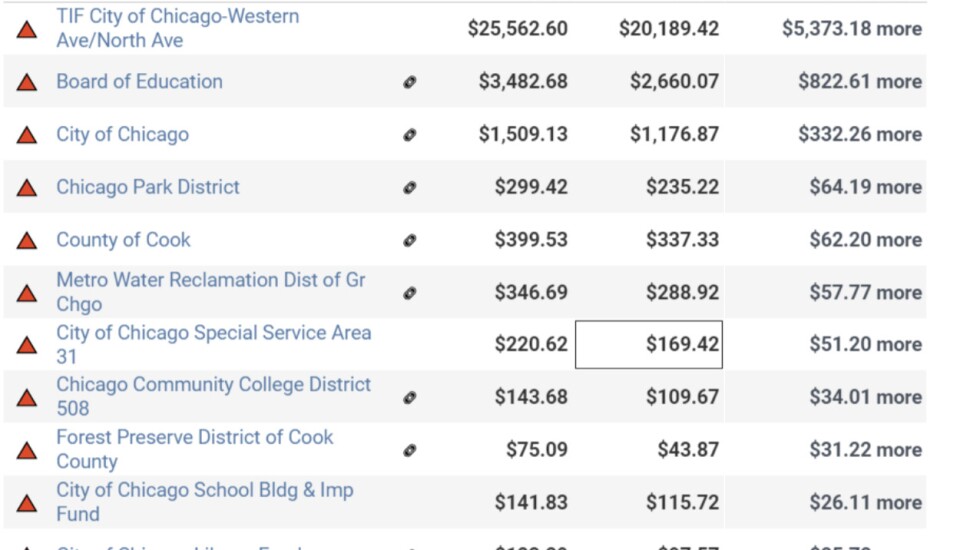

It calculates the money owed to each school district or other local unit of government in the past two years — showing the increase or decrease from the year before.

You can find the tool labeled “Where Your Money Goes” at cookcountytreasurer.com/whereyourmoneygoessearch.aspx

Second installment payments for 2022 are due Dec. 1.

Pappas said her office made the tool for taxpayers upset about rising tax bills.

Property tax bills increased for most homeowners this year as a result of increased levies and a shift of the tax burden to homeowners from businesses that reassessed and lowered their bills.

“People should pay attention to how the amount of money sought by schools and other taxing bodies, combined with changes to property assessments, affects individual bills,” Pappas was quoted as saying in a statement.

Bills also increased due to a provision called recapture, which took effect in the 2021 tax year after a change in state law. Recapture allows taxing districts to recover money refunded to property owners whose assessments were lowered on appeal.

It helped fuel a domino effect, adding nearly $204 million back into the pool of tax bills across the county. That’s almost $73 million more than last year, according to an analysis by Pappas’ office.

The analysis also found that about 72% of the 940 taxing agencies in the county increased taxes.

The north and northwest suburbs saw the greatest tax bill increases this year. The median tax bill for homeowners rose nearly 16%, the largest hike in this area in at least 30 years.