As of early Friday, the University of Michigan announced the preliminary results for October’s Surveys of Consumers.

What Happened: The index for consumer sentiment and current economic conditions slightly rose by 2% and 9.4% month-over-month, respectively. This can be attributed to a 23% improvement in current buying conditions for durables, due to an easing in supply constraints.

The consumer sentiment index is now 9.8 points above the all-time low reached in June, but this improvement remains unsettled as the uncertainty over the future direction of prices, economies and financial markets around the world indicates a rough road ahead for consumers, reported the Surveys of Consumers.

This uncertainty is also reflected in the data, as the index for consumer expectations decreased by 3.1% from September and is still down 17.2% year-over-year.

Why It Matters: The median expected year-ahead inflation rate rose to 5.1%, with increases reported across age, income and education.

As the headline consumer price index rose by 0.4% in September, long-term inflation returned to the range of 2.9%, after falling below the range of 2.9% to 3.1% in September.

The elevated consumer sentiment can be largely attributed to the decline in gas prices over the past three months, as September saw gasoline inflation fall by 4.9%.

Confidence In The Federal Reserve: After Black Monday in 1987, Surveys of Consumers has been tracking consumer confidence in various financial institution.

Consumer confidence in financial institutions such as the Federal Reserve is reading historically low: out of the 11 data points during seven of those periods, consumers were more confident in the Federal Reserve than today.

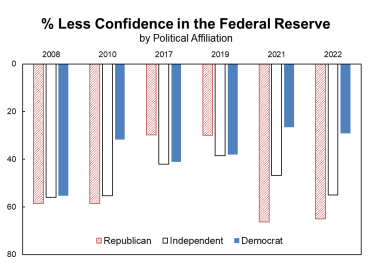

In September 2022, the index of consumer expectations measured with the differences in index points from corresponding full sample means showed consumers were more confident in the Federal Reserve on Black Monday in 1987 and during the 2008 financial crisis. Additionally, 49% of consumers reported declining confidence, parallel to the low readings previously seen during the Great Recession.

The Last Word: Republicans are less confident in the Federal Reserve now than during the 2008 financial crisis, while democrats are more confident in the Fed than during the financial crisis, according to the Surveys of Consumers.

“Confidence in financial institutions is critical for ensuring financial and economic stability, as well as the success of monetary policies,” mentioned Joanne Hsu, director of the Surveys of Consumers.

Source: The University of Michigan Surveys of Consumers Confidence In Financial Institutions Report

Photo: AlexLMX via Shutterstock