With a market cap of $8.9 billion, Conagra Brands, Inc. (CAG) is a leading U.S. consumer packaged foods company that produces and markets a wide range of grocery, frozen, refrigerated, and snack products. Founded in 1919 and headquartered in Chicago, it operates across retail, international, and foodservice channels, with a strong portfolio of well-known brands such as Birds Eye, Duncan Hines, Healthy Choice, and Slim Jim.

Shares of the company have significantly underperformed the broader market over the past 52 weeks. CAG stock has declined 29% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.5%. However, shares of the company are up 6.2% on a YTD basis, compared to SPX’s 1.9% increase.

Narrowing the focus, shares of Conagra Brands have lagged behind the State Street Consumer Staples Select Sector SPDR Fund’s (XLP) 7% rise over the past 52 weeks and 8.8% return in 2026.

Conagra’s shares have lagged the broader market over the past year, largely because the company has struggled with weak fundamentals and soft consumer demand, resulting in declining sales volumes and limited pricing power in a highly competitive packaged-foods sector. Organic net sales and earnings have been pressured by cost inflation, adverse impacts from tariffs and supply chain challenges, and consumers increasingly trading down to private-label alternatives, which has weighed on margins and investor confidence.

As a result, revenue growth expectations have been muted, and sentiment around long-term growth has been cautious, contributing to the stock’s underperformance.

For the fiscal year ending in May 2026, analysts expect CAG’s adjusted EPS to decrease 25.2% year over year to $1.72. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

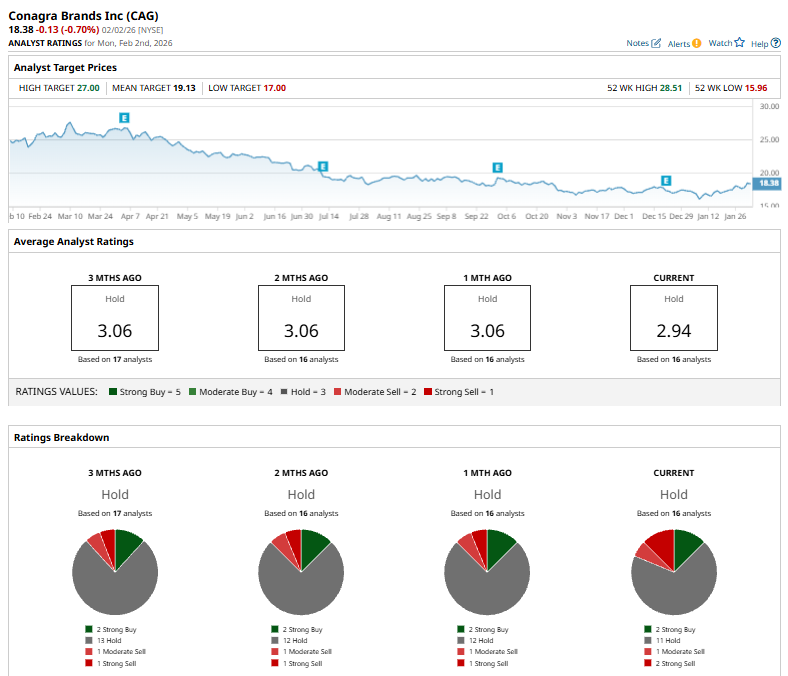

Among the 16 analysts covering the stock, the consensus rating is a “Hold.” That’s based on two “Strong Buy” ratings, 11 “Holds,” one “Moderate Sell,” and two “Strong Sells.”

On January 16, Morgan Stanley analyst Megan Alexander Clapp cut her price target on Conagra Brands to $18 from $19 while maintaining an “Equal-Weight” rating, citing a difficult outlook for U.S. food stocks. She noted that industry conditions remain challenging, with intensifying competition driven by value-focused pricing, heavier promotions, and a resurgence in private-label brands expected to persist into 2026.

The mean price target of $19.13 represents a nearly 4.1% premium to CAG’s current price levels. The Street-high price target of $27 suggests a 45.9% potential upside.