Coinbase (COIN) stock on Wednesday is hitting all-time lows, becoming another domino in the slump in growth stocks.

The crypto exchange's shares on the day have lost a quarter of their value. The stock is now down 88% from its high.

The company reported softer-than-expected first-quarter results and provided a weak trading outlook. Given the state of the market — both in crypto and growth stocks — the weak results are not surprising.

The tumble in bitcoin prices and cryptocurrencies continues to add pressure to Coinbase stock. For its part, bitcoin is leaning on a very key support area.

Coinbase Chief Executive Brian Armstrong said, “we have no risk of bankruptcy.” Even addressing that potential as a risk has to have an impact on investors, as they worry about the current state of the company.

As it pertains to Coinbase stock, we’re in uncharted territory.

Trading Coinbase Stock

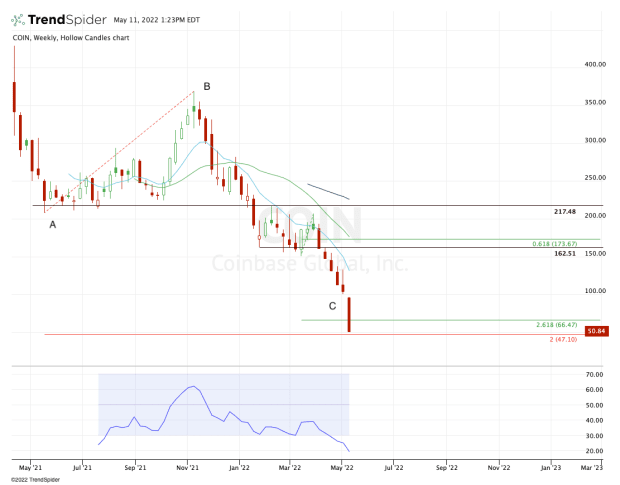

Chart courtesy of TrendSpider.com

This is a falling knife. While we are nearing some key downside extension areas, it’s not clear when support will come into play.

It’s hard to imagine that Coinbase will reverse this week’s losses — down 51% so far — and turn positive. If the losses hold, they would mark the stock’s sixth straight weekly decline.

For now, the stock seems to be finding its footing near $50. Super-aggressive bulls who want to try to catch the falling knife by buying the dip can use $47 as their risk level.

A close below that mark — which is the two-times down extension from the long-term range (From the “B” high to the “A” low) — could usher in even lower prices.

That’s really it on the downside. I don’t see another meaningful measure that would indicate the selling pressure is finished. We’re in a really difficult environment with better setups to follow than a stock like Coinbase tumbling.

Technical analysis is a tool that can be used to find favorable risk/reward setups in the market -- in most but not all environments. This is one such situation where the technicals are doing very little to help.

On the upside, let’s see how Coinbase handles the $60 to $65 area. Back above $66.50 and we could see a vicious snapback rally. The caveat? Bulls would also need tech stocks and bitcoin to rally significantly as well.

There could be an oversold bounce on the way, but it’s no guarantee at the moment.

Just to recoup half of this week’s trading range would be significant for Coinbase stock, putting the $73 to $78 range in play. Back above that will have investors looking for a test of the obvious: $100.