Whether you are investing in stocks, bonds, commodities or cryptocurrencies, it can be very stressful. Not being able to withdraw or transfer your funds if so desired on your chosen platform can even be more stressful.

That was the scenario for customers of the Celsius exchange Monday. Of course, this had a negative impact on the publicly traded Coinbase Global Inc. (NASDAQ:COIN), which is the PreMarket Prep Stock of the Day.

Coinbase Rebounds, Then Retreats: Coinbase made its all-time high off its IPO in April 2021 at $429.54. When the issue bottomed on May 12 at $40.83, that marked a 90% decline in its value. The issue was able to more than double off that low when it peaked on May 31 at $83.32. Yet it rolled over with the broad markets and ended last week at $58.71.

Say What? On Sunday night, with the crypto markets already under extreme selling pressure, the highly leveraged crypto lender Celsius shocked investors when it announced it was pausing all customer withdrawals, swaps and transfers. Since the announcement took place before the commencement of premarket trading, shareholders and traders of Coinbase could not react until 4 a.m. EST.

Coinbase's Premarket Price Action: Aggressive premarket traders were ready to pounce on Coinbase at the 4 a.m. opening for premarket trading. The first print was nearly $4 lower than Friday’s close ($54.98 vs. $58.71) and the decline was just getting started.

In fact, the issue continued to deteriorate along with Bitcoin (CRYPTO: BTC) and did not find a bottom until 4 minutes ahead of the opening bell at $45.

Coinbase's Regular Session Price Action: After a much lower open, the issue made an attempt to reach the premarket low but found buyers ahead of it at $46 and sharply reversed course. It surpassed $50 in less than 10 minutes and paused.

Around 11 a.m., it mounted another rally from the $50 area and went on to make a new high for the day at $54.30 as of 2 p.m.

That was well shy of the bottom of Friday’s range at $57.55. The stock was trading down nearly 12% ahead of the close in the $51 handle.

Coinbase Moving Forward: The good news is the issue founds buyers well ahead of its all-time low and mounted a substantial rally.

The bad news is that issue is in a major downtrend that is fueled by the rapidly declining price of Bitcoin and other cryptocurrencies.

In order to avid a new all-time closing low, the issue would need to close above $58.50, which is nearly $7 away.

Investors attempting to “buy the dip” have only two downside levels to lean on. The first one is the current low for Monday ($46) and the second one is the all-time low of $40.83.

Monday’s closing price should also be a good barometer to use in the future to determine if the “buy the dip” mentality will be more than a one-day wonder off today’s depressed open.

Needless to say, a sustained rally in Bitcoin would be a strong catalyst that would enable the issue to distance itself from all-time lows.

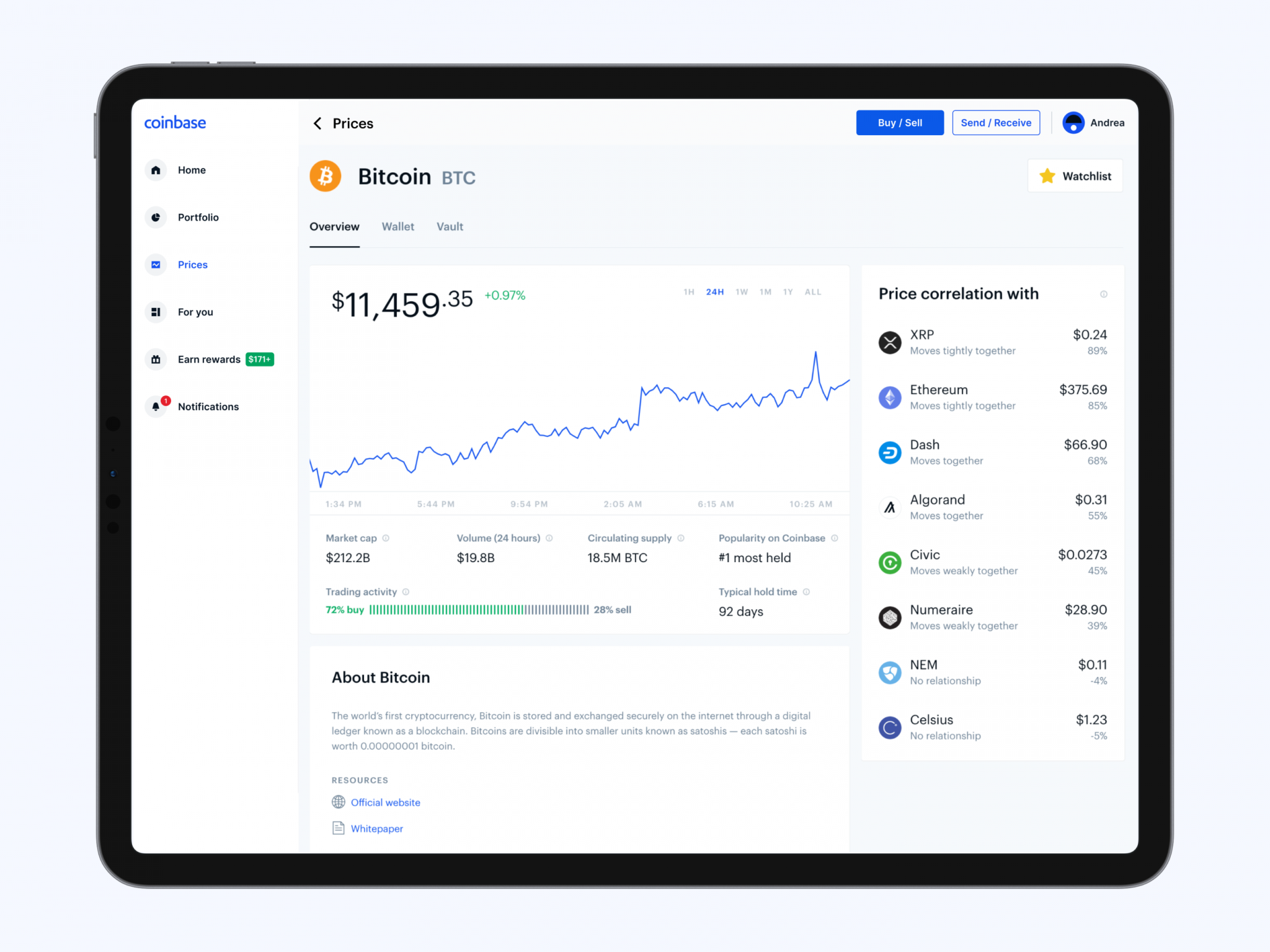

Photo courtesy of Coinbase.