Coinbase (COIN) shares are getting smoked on Tuesday following news of an SEC lawsuit.

As reported by Martin Baccardax of TheStreet: “the U.S. Securities and Exchange Commission charged the crypto trading platform with operating as an unregistered broker, exchange and clearing agency.”

Further, “The SEC filed its lawsuit against Coinbase in federal court in Manhattan just 24 hours after it published a damning set of allegations against Binance, the world's biggest crypto exchange.”

Don't Miss: How Far Can SoFi Stock Rally? Chart Provides a Clue.

This is obviously bad news for Coinbase and the stock is reacting accordingly. In fact, it’s bad for the whole crypto space, TheStreet's Luc Olinga reports.

Shares of Coinbase opened lower by 20% on Tuesday, after falling more than 9% on Monday. The shares were down almost 21% at today’s low — bringing the two-day dip to a 28% loss. At last check Coinbase was off 13%.

For its part, bitcoin is down more than 4% so far this week.

Let’s look at the Coinbase chart.

Trading Coinbase Stock

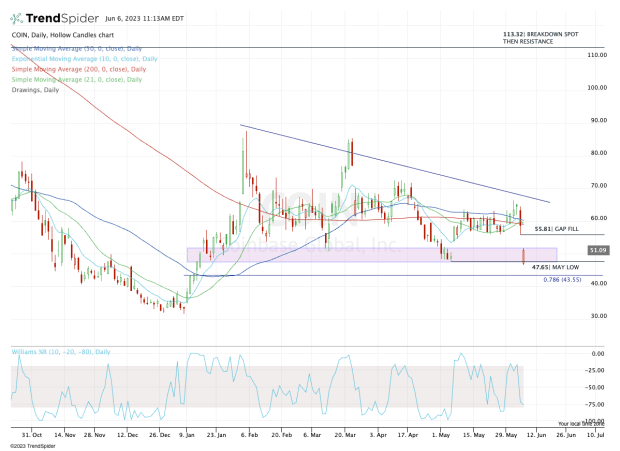

Chart courtesy of TrendSpider.com

While Coinbase stock was actually trading quite well coming into this week — up five days in a row — it had been putting in a series of lower highs.

Before last week’s pop, the shares had also been trading around a cluster of key moving averages, including the 10-day, 21-day, 50-day and 200-day moving averages. All those measures are trading close to $60.

If Coinbase stock continues to bounce off today’s low, traders need to pay attention to the gap-fill level at $55.81, followed by this major cluster of moving averages around $60.

Don't Miss: Apple Stock at Record Ahead of WWDC. Can It Continue Higher?

I suspect that this range — call it $56 to $60 — will be notable resistance, unless the SEC lawsuit is dropped. An event like that is a major unknown and investors do not like unknowns when it comes to stock-picking.

That should create an overhang on Coinbase stock. While it can rally, I suspect that short of a key development in regard the lawsuit, this zone will be resistance.

On the downside, the May low at $47.65 was enough to buoy the stock price. Should the shares fall below below $47.50 and fail to regain this area, that opens the door down to the 78.6% retracement near $43.50.

Below that and sub-$40 could be on its way.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.