MicroStrategy Inc., a software maker that’s better-known for being the largest public holder of Bitcoin, looks like a stronger bet for investors to make when compared to cryptocurrency-trading platform Coinbase Global Inc.

That’s according to Berenberg Capital Markets analyst Mark Palmer, who believes that the US Securities and Exchange Commission will likely file an enforcement action against the trading platform after the regulator sent it a Wells notice in March.

“Given the heightened uncertainty that Coinbase faces, we believe investors would be much better served investing in shares of MicroStrategy,” Palmer wrote in his initiation note on Coinbase.

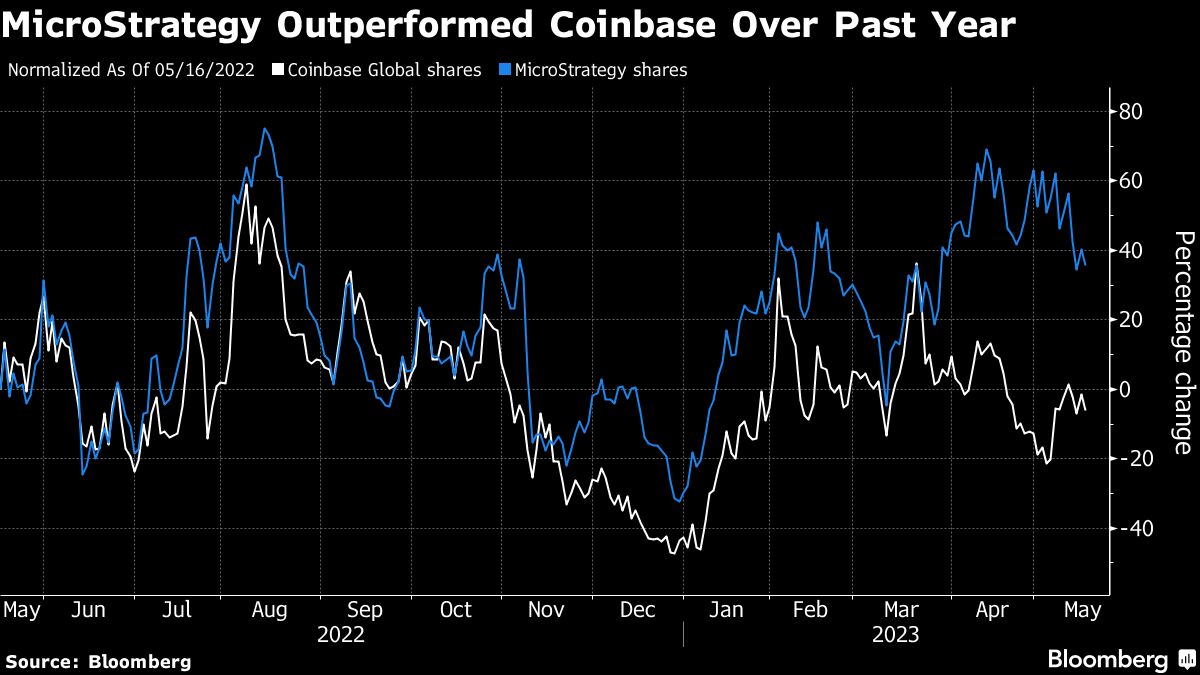

Over the past year, MicroStrategy has risen about 36%, while Coinbase has fallen 6%. But both firms slid on Tuesday, as a dip in Bitcoin prices weighed on cryptocurrency-linked stocks. The world’s largest cryptocurrency by market value declined about 1.5% to trade below $27,000 as of 4 p.m. in New York.

Palmer’s one of two analysts tracked by Bloomberg with a buy rating on MicroStrategy and maintains a Street-high price target of $430. He initiated coverage on the firm in late April saying it “offers a unique business model focused on the acquisition and holding of bitcoins.”

MicroStrategy has benefited from Bitcoin’s rebound in recent months. The company is an “attractive alternative” to Coinbase given the regulatory pressures on the latter, Palmer wrote.

“The SEC has characterized bitcoin as a commodity while asserting that most (if not all) other crypto tokens are unregistered securities, putting bitcoin and MSTR in advantaged positions amidst the regulatory onslaught,” he wrote.

At least 37% of Coinbase’s $736 million in net revenue the company reported from transaction fees and spreads it posted by trading crypto tokens other than Bitcoin in the US and fees generated by its US staking service could be at risk if the SEC takes action, according to Palmer. He said actions against crypto platforms Bittrex and Kraken earlier this year could be a preview of the regulator’s approach to Coinbase.

“We believe investors should be focusing on whether the company would have the ability to successfully pivot its business model and geographic focus if it were forced to curtail or cease a large portion of its activities in the US,” Palmer wrote.

Responding to a request for comment, a spokesperson for Coinbase pointed to public remarks by the firm’s chief financial officer from the latest earnings call and to a March statement on the Wells notice in which the company said it was “confident in the legality of our assets and services.”

“We have many different revenues that we are looking to grow on our platform, and we’re looking for revenue diversification,” said Coinbase Chief Financial Officer Alesia Haas in an earnings call earlier this month.

--With assistance from Philip Sanders.

©2023 Bloomberg L.P.