While the market weakened late in the week, a number of stocks are trading in or near buy zones. Coinbase surged above a buy point Friday on a bitcoin rebound, while Intuitive Surgical cleared buy points on earnings. Progressive also is in a buy zone while Urban Outfitters and Garmin have pulled just below traditional buy points.

Intuitive Surgical

Intuitive Surgical broke out on Friday after the robotics giant crushed Q2 views late Thursday. Analysts expected a challenging quarter due to product supply constraints, but Intuitive calmed any worries that they would not be able to meet demand.

The company reported more than a 25% increase in earnings while revenue surged 14%. The number of procedures using Intuitive's robotic surgery system, da Vinci, rose 17% compared to last year, which beat estimates for 15% growth. Meanwhile, procedure growth for its lung biopsy machine, Ion, leapt 82%.

Intuitive Surgical was Friday's IBD Stock Of The Day.

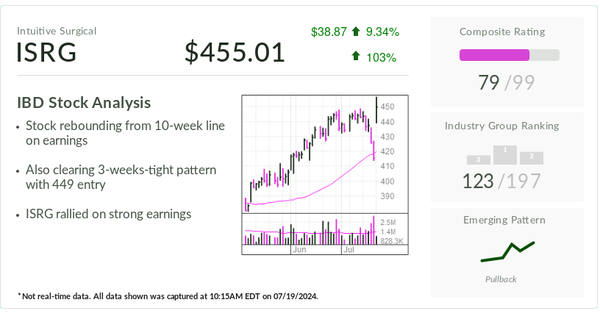

ISRG stock jumped 9.4% Friday to 455.01, surging from just below its 10-week moving average. Shares also cleared a 449 buy point for a three-weeks-tight pattern on the move.

Intuitive Surgical is up nearly 35% this year.

Urban Outfitters

Urban Outfitters has rallied 30% in 2024 and is trading at six-year highs.

The clothing and apparel retailer returned to positive earnings growth the past five quarters, although those gains slowed the last two quarters.

For its most recent Q1 results on May 21, Urban Outfitters reported a 23% earnings increase, which crushed estimates of a 5% decline. Revenue rose 7.8% to a Q1 record $1.2 billion and outpaced expectations for 6% sales growth. CEO Richard Hayne noted that, "customer demand remains robust for its spring and summer fashion lines, which bodes well for continued sales growth in Q2."

FactSet analysts expect Q2 earnings will decline 7.3% on 6% sales growth.

URBN stock gapped up out of a base on July 11, clearing a 47.29 consolidation buy point. Shares have pulled back slightly but the entry is still valid. Investors could view 45.56 as a handle buy point, which would mean Urban Outfitters is actionable now.

Progressive

Progressive is trading in a buy zone after it blew away estimates for the month of June and full Q2 in a report on July 16.

The insurance provider reported that earnings increased nearly 335% to $2.48 per share to mark five consecutive quarters of triple-digit earnings growth. Earnings results were well above analyst estimates of $1.76 per share.

Net premiums written spiked 22% to $17.9 billion. Progressive reported that personal auto and property business policies in force both increased by double digits for the quarter.

The company will host its second-quarter investor event on Aug. 6.

PGR stock is trading in a buy zone for a flat base. Progressive broke out above the 217.77 buy point on July 16 following the release. Shares reversed lower that day, but rebounded July 17 to move into the buy zone, hitting a record 229 the following session.

Progressive stock fell Friday, but closed at 219.35, in buy range. It's bolted almost 38% higher this year.

Garmin

GPS and watch maker Garmin leapt 32% this year and is closing in on record highs.

Garmin reported accelerating earnings growth the last four quarters, leading up to a 39% jump for its Q1 results on May 1. Sales growth has also accelerated during that time with 20% growth in the first quarter.

However, analysts expect that streak to end for its Q2 report on July 31. FactSet estimates earnings dipped about 1% to $1.43 per share while sales grew 10%.

GRMN stock is trading near a 171.64 buy point for a flat base. Shares passed that entry early last week before easing.

Garmin is not too far off its all-time high of 178.81.

Coinbase Stock

Crypto exchange Coinbase is a member of the IBD Big Cap 20.

Coinbase stock has rallied with the crypto markets this past week as former President Donald Trump's reelection odds jumped following an assassination attempt at a July 13 rally. Digital assets were also boosted by the nomination of crypto-friendly Senator J.D. Vance (R-Ohio) for vice president.

Elsewhere, bitcoin on Friday bolted above $67,000 as conflicting reports said that President Joe Biden is increasingly likely to drop out of the race.

Meanwhile, Coinbase is scheduled to report its Q2 results on Aug. 1. FactSet expects earnings to improve to 93 cents per share from a loss of 42 cents last year. Analysts forecast revenue will spike 94% to $1.38 billion.

COIN stock spiked 9.8% Friday and bounced off its 50-day moving average.

Shares cleared a trendline entry, using a short-term high of 255.90 as a specific trigger. Aggressive investors could find another early entry at 263.80.

The two trendline entries are within a larger, 16-week consolidation with a 283.48 buy point.

Coinbase stock spiked 48% in 2024.

You can follow Harrison Miller for more stock news and updates on X/Twitter @IBD_Harrison