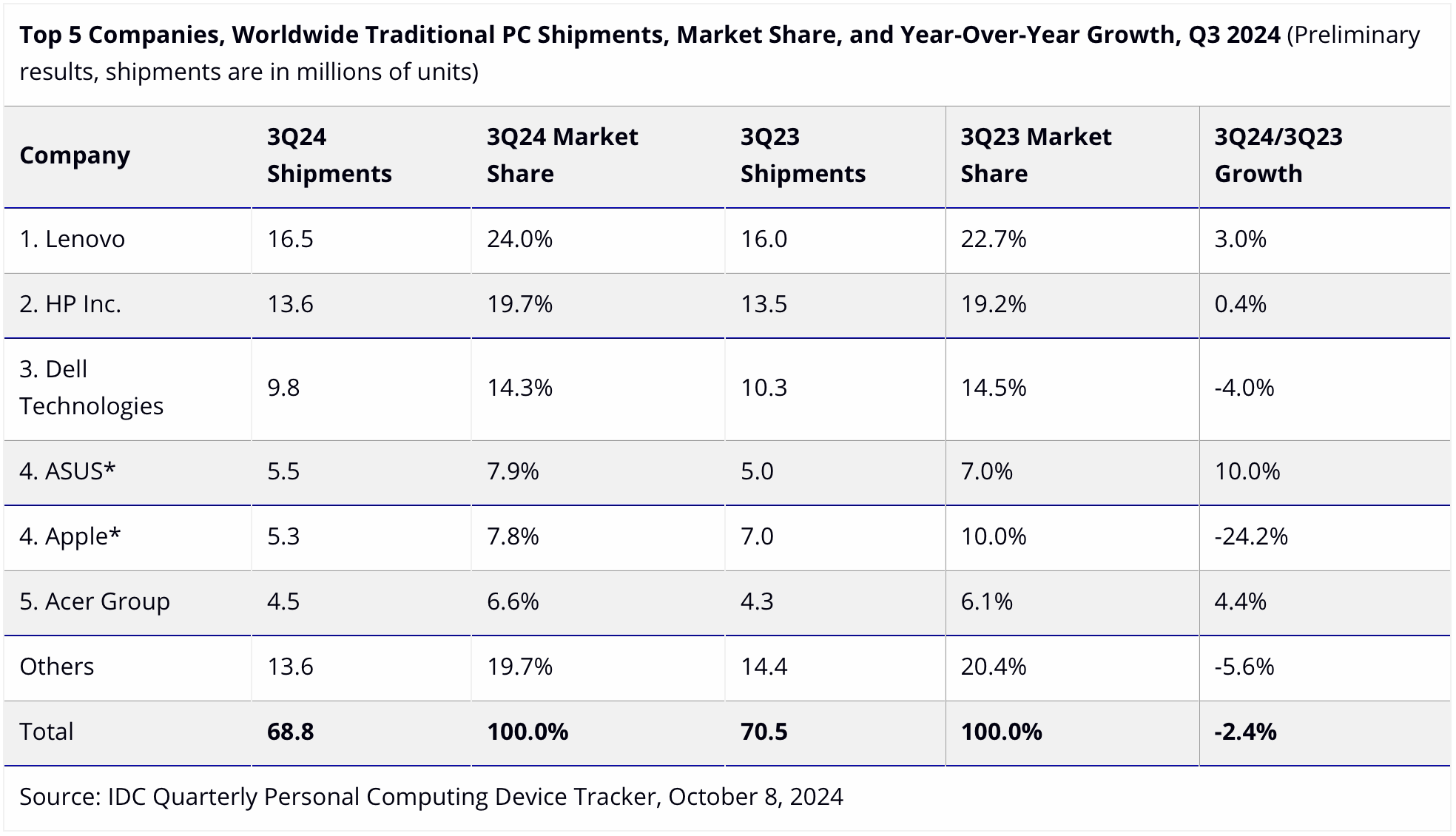

Client PC shipments fell by 2.4% year-over-year in Q3 2024, reaching 68.8 million units, according to the latest report from International Data Corp. Despite signs of economic recovery in the second quarter, IDC says that factors that previously drove a surge in shipments have slowed down sales.

The industry shipped 68.8 million desktops and laptops in the third quarter, which is 2.4% less than 70.5 million in the third quarter of 2023. However, it is significantly more than the 64.9 million supplied by various PC makers in the second quarter, based on data from IDC. The company admits that its Q2 numbers were somewhat inflated due to rising costs and efforts to replenish inventory. The inflated sales in Q2 led to lower estimates in Q3 2024 as the market adjusted, showing that momentum had temporarily cooled off.

There is good news, too. Demand for PCs has picked up in Q3 among consumers and businesses. Still, it remains most substantial in the entry-level segment, supported by North America's economic rebound and the back-to-school season. Yet, new devices with AI badges of various kinds, like Qualcomm's Copilot+ PCs and similar models featuring Intel and AMD processors, as well as next-generation M4-based MacBooks from Apple due in Q4, are anticipated to boost demand for higher-end PCs in the coming months.

Commercial interest outside the education market remains robust, with many businesses upgrading their systems ahead of Windows 10's end-of-life, according to IDC. Japan is leading the trend in PC refreshes, with notable double-digit growth in Q3 2024, and other regions are likely to follow in the coming quarters, IDC claims.

"Demand, without a doubt, has returned for PCs amongst consumers and commercial buyers," said Jitesh Ubrani, research manager with IDC's Worldwide Mobile Device Trackers. "However, much of the demand was still concentrated at the entry level thanks to a recovering economy and the back-to-school season in North America. That said, newer AI PCs such as Copilot+ PCs from Qualcomm along with Intel and AMD's equivalent chips and Apple's expected M4-based Macs are expected to drive the premium segment in coming months."

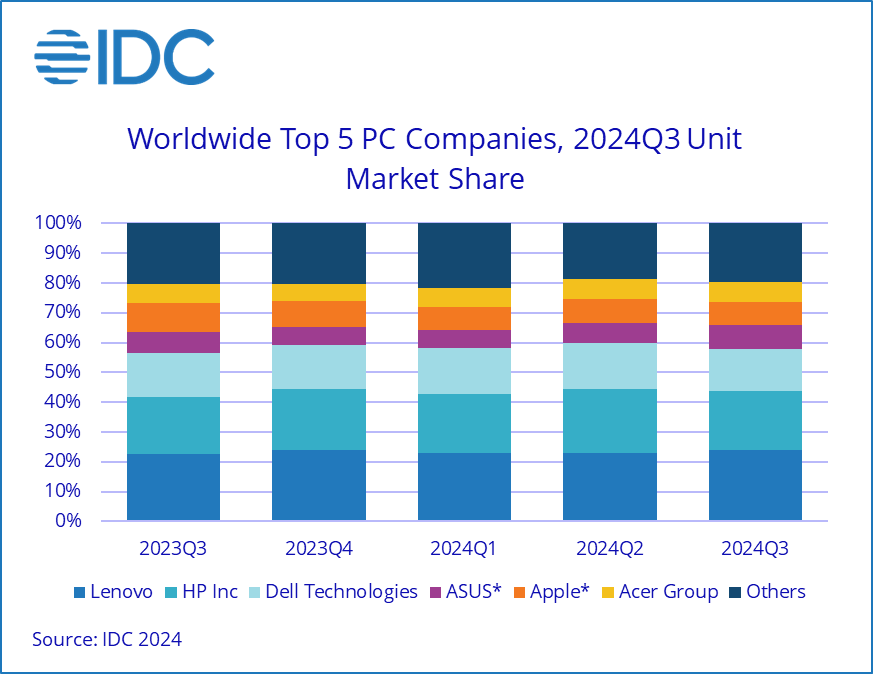

Lenovo remained the top PC supplier in Q3 2024, with shipments reaching 16.5 million units, securing a 24% market share. The company achieved a 3.0% year-over-year growth and increased its market share from 22.7% in the same period last year.

HP maintained its position as the second-largest player in the PC market in the third quarter, with a 19.7% market share as its sales reached 13.6 million units. The company's performance showed a slight year-over-year growth of 0.4%, which indicates stable demand. HP's market share also grew slightly from 19.2% in Q3 2023.

By contrast, Dell faced a sales decline in Q3 2024 as its shipments fell to 9.8 million units from 10.1 million in the previous quarter and 10.3 million in the same quarter a year before. The company commanded a 14.3% market share in Q3 2024, down from 15.5% a quarter before, but about flat with the same quarter last year (14.5%). Despite its position as the third-largest player, Dell's performance lagged behind other competitors in the market.

Although Apple launched multiple new PCs based on its M3-series processors in early 2024, this only helped the company to increase its PC shipments in Q1 (when it sold 4.8 million units, up from 4.2 million units in Q1 2023) and Q2 (when its shipments totaled 5.7 million units, up from 4.7 million in the same quarter a year before). In Q3, Apple's PC sales dropped to 5.3 million, down from 7 million in the third quarter of 2023. The company's market share declined to 7.8%, down 1% sequentially and 2.8% year-over-year.

By contrast, Asus showed strong growth in Q3 2024, with its PC shipments increasing to 5.5 million units (a significant 10% year-over-year growth) and capturing a 7.9% market share (up from a 7.0% share in the same period last year). During the quarter, Asus not only returned to the Top five PC makers but also outsold Apple for the first time in years.

As far as Acer is concerned, the company achieved moderate growth in Q3 2024, with shipments rising to 4.5 million units, which marks a 4.4% increase in year-over-year shipments. The company's sales accounted for a 6.6% market share compared to its 6.1% share in the same period last year.