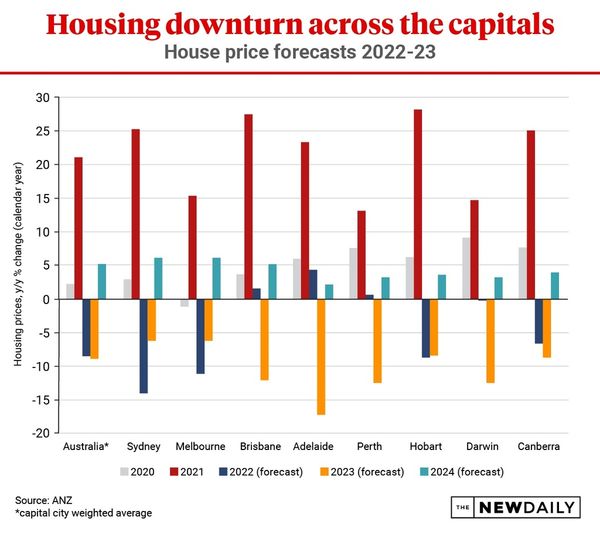

The two biggest housing markets in Australia may have already seen their sharpest declines, some analysts say.

Property market movements in Sydney and Melbourne are still highly dependent on interest rates, however, with all eyes on Reserve Bank’s decision-making over the next few months.

National housing market falls of between 15-20 per cent have been predicted based on interest rate forecasts, including ANZ which anticipates close to a 20 per cent fall before a modest recovery in 2024.

National home values fell by 1.3 per cent in July, according to the latest CoreLogic figures, led by Sydney and Melbourne where values dropped by 2.2 per cent and 1.5 per cent respectively.

CoreLogic’s research director Tim Lawless said the rate of decline was easing slightly in both Sydney and Melbourne, suggesting these markets had already seen their sharpest falls.

However, he said this was highly dependent on how high and fast the central bank planned to hike rates, with the most expensive housing markets typically the most sensitive to rate hikes.

He said Sydney and Melbourne markets certainly had further to fall, based on previous downturns, with Sydney likely only around halfway through its downwards cycle.

Other capital city markets, such as Brisbane, Adelaide and Perth, had so far proven more resilient.

However, Mr Lawless told AAP these markets looked to be flattening out and would likely be in negative territory by the end of the year.

Property economist Andrew Wilson said Sydney, in particular, could be approaching the bottom of its correction based on the latest data from My Housing Market.

He said Australia’s robust economic performance compared to other countries meant the country would see a shallower correction than previously expected.

Dr Wilson pointed to low unemployment rates, which appeared to be driving up wages, but only modestly.

While these wage hikes were not enough to counteract soaring inflation, he said modest wage growth had the benefit of not fuelling inflation and triggering more aggressive interest rate hikes.

“So all those factors would lead you to think that maybe this isn’t going to be even as steep as some of those who have 20-30 per cent predictions,” Dr Wilson told AAP.

He also pointed to the pick up in clearance rates in Sydney and Melbourne, which could also suggest a pick up in market confidence.

Domain boss Jason Pellegrino told the ABC the markets were “tempering” after extreme growth in the wake of COVID-19 lockdowns.

He said the market was not moving into “bear territory” but instead heading back into standard market conditions where demand and supply were better balanced

“Buyers were driving prices higher, chasing acquisitions in an environment where there was a lack of stock. We are starting to see that balance out,” Mr Pellegrino said.