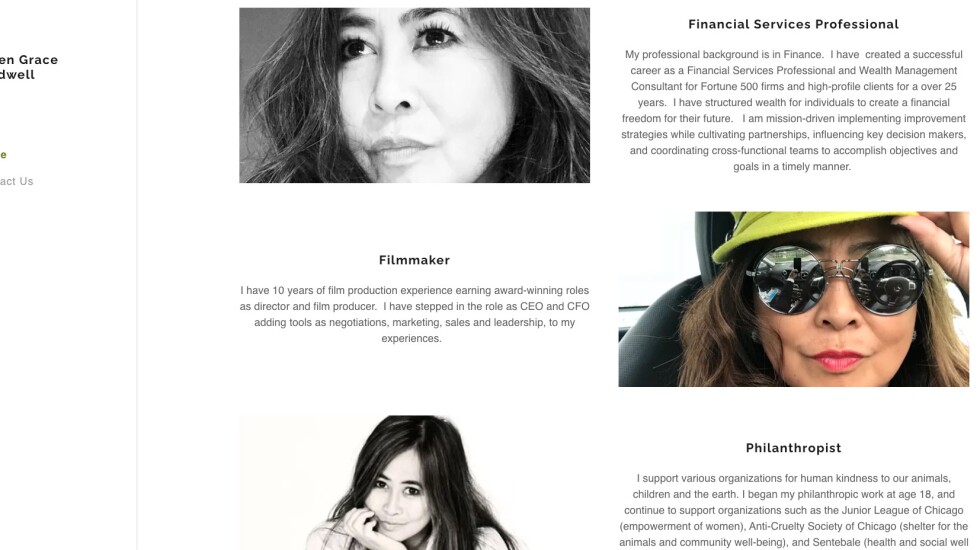

By day, Helen Grace Caldwell was a wealth adviser and a vice president in the downtown Chicago offices of America’s third-largest bank, Citi.

Caldwell also was a movie producer, making horror films featuring vampires, knife-slashing heroes and electroshocked psychiatric patients.

At the crossroads of those two careers, several of her elderly banking clients lost much of their life savings — and the Wall Street banking behemoth was plunged into a legal battle against the backdrop of a national epidemic of elder financial exploitation.

Caldwell, 58, funded her film career in part by persuading Citi clients to invest their savings in her film ventures, an alleged fraud costing them a collective total of as much as $1 million, according to a lawsuit filed against the banking giant and its former vice president by the Cook County public guardian’s office, a government agency created to protect the interests of people no longer capable of managing their affairs.

Caldwell, through her attorney, has denied all allegations of wrongdoing. Citi lawyers also have denied the allegations in court.

The old and frail have long been targeted by swindlers who knock on their doors with offers of a new roof or sweetheart scams or even trusted relatives and healthcare givers who use their access to plunder savings accounts.

Now, growing numbers of financial professionals are preying on their older clients from behind the glass doors of banks, investment houses and wealth-management companies.

Fraud against older Americans in investment schemes accounted for nearly one-third of the $3.1 billion in elder financial exploitation nationwide last year, up from less than 10% three years ago, according to FBI data.

Reported losses from investment scams against older Americans have increased tenfold in the past three years, to nearly $1 billion in 2022.

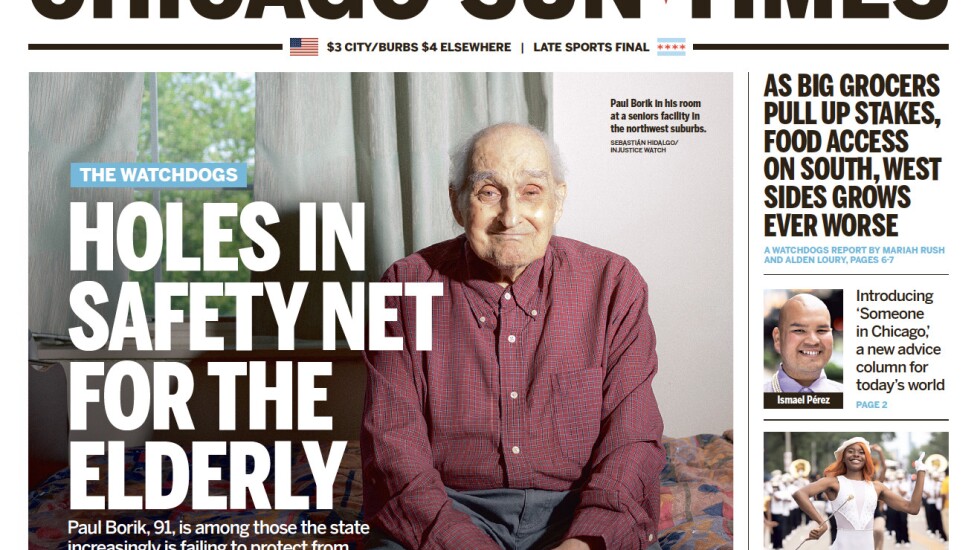

The public guardian’s suit was filed on behalf of one of Caldwell’s older clients, who is now living in a nursing home with dementia.

According to the lawsuit, Caldwell misappropriated hundreds of thousands of dollars from the savings of three other clients as well, using the money in her film ventures.

Last month, the U.S. Financial Industry Regulatory Authority permanently barred Caldwell from working in the securities industry, citing her refusal to provide on-the-record testimony for its investigation into cases when she steered “several” Citi clients “to invest in her outside business activity.”

Citi executives declined to be interviewed or respond to detailed questions regarding Caldwell.

In court, a Citi attorney has argued that the bank shouldn’t be held liable for damages that might have been caused by its former vice president’s conduct.

“My clients don’t believe the public guardian has claims against my client,” a lawyer representing Citi said at a recent appearance in Cook County probate court, where the guardian’s suit is being litigated.

The U.S. attorney’s office in Chicago also is investigating the circumstances of client losses, according to interviews and documents reviewed by Injustice Watch.

Federal authorities did not respond to requests for comment.

Caldwell hasn’t been charged with any crime.

She declined to answer questions provided to her and her attorney.

‘Such an injustice’

To examine Caldwell’s case, Injustice Watch reviewed the probate court file as well as records obtained through confidential sources — including reports from the Illinois Department on Aging, internal Citi check registers, Caldwell’s Citi personnel file and email correspondence as well as production files from her film projects.

“If the public guardian’s court allegations are accurate, the bank is at fault here in not exercising appropriate oversight over their advisers. That is clearly wrong,” said Rohit Deshpandé, a Harvard Business School professor who was one of five experts on banking and business ethics interviewed by Injustice Watch.

Citi annually approved Caldwell’s outside film company business during the same years the suit says she was using her client’s funds, records show.

Experts say that, if the allegations are true, the bank failed in its fiduciary responsibility to protect their customers from such conflicts.

Citi reported Caldwell’s activity to the state Department on Aging’s Adult Protective Services division, known as the APS, in March 2022 — after years of complaints by a family member of one of her bank clients and four months after Caldwell left her job at Citi, according to court records.

Illinois officials declined to act on Citi’s report, citing jurisdictional grounds. APS — created to investigate abuse of older and disabled adults — refused to take action because the client “was not being exploited by a family member, roommate or caregiver,” Citi wrote in probate court documents.

It wasn’t until six weeks later that Citi officials sent a second report to APS — this time not identifying misconduct by its own officer but alleging $7,000 in other misspending, court records show.

That’s when the case landed on the desk of Joyce Austin, a veteran APS investigator with the Chicago nonprofit Metropolitan Family Services, one of dozens of social service agencies the state hires to investigate exploitation of disabled and older adults.

Austin’s inquiries triggered the public guardian’s investigation into the case of 77-year-old Priscilla Eddings, who, according to court records wrote 13 checks totaling $400,500 to Caldwell’s film ventures between 2018 and 2020.

“I will tell you this is really personal for me. As a Black woman, I saw myself,” Austin said in an interview. “It makes you a little angry, where you have to do something because it’s such an injustice.”

A long court battle

In court, Citi fought for months to prevent disclosure of its internal investigation report on Caldwell.

Cook County Public Guardian Charles Golbert’s office wants the report to help it recover losses of Eddings and other “similarly situated victims,” court records show.

“Depositors would be astounded to learn that, if a bank official steals their money, the bank is going to hire lawyers and slam the door in their face when they try to get their money back,” Golbert said in an interview. “Citi hired very expensive lawyers who fought us at every step of the way, and we are having to sue.”

Cook County Circuit Judge Jesse Outlaw has told Citi it must turn over the report and has given the bank until October to do so.

Other internal Citi records indicate Caldwell’s alleged conflicts of interest went unchecked at the bank for years, including one email chain in the court record.

In February 2018, that email exchange shows, a Citi fraud analyst asked about a $75,000 check that Eddings wrote from a Citi account to one of Caldwell’s film production companies.

“The account has not had a check written on it for over two years,” the Citi analyst wrote. “The account is overdrawn, as well.”

It isn’t clear from available records what became of the bank’s internal inquiry.

By then, Caldwell was listed as the “responsible party” for Eddings’ monthly bills at Brookdale Senior Living on North Lake Shore Drive. Brookdale’s internal “Account History Report” shows the bills were sent to Caldwell’s Citi office at 100 S. Michigan Ave.

As Citi was questioning Caldwell about that first Eddings transaction, Peter Duenas-Brckovich was coming forward with questions about Caldwell’s dealings with his 83-year-old mother.

“Helen was always super-charming, and she figured out that my mom didn’t like to be embarrassed or make other people look bad,” Duenas-Brckovich said.

He said his mother gave Caldwell $18,000 for a 16% stake in a movie company Caldwell helped finance and provided records to show that.

“Using that manipulation really bothers me,” said Duenas-Brckovich, a banking executive living overseas. “She was taking advantage of my mom’s personality. Clearly, she knew that something was off with my mom. I hated how Helen did that.”

Responding to questions via email, Caldwell’s attorney Jasmani Francis disputed Duenas-Brckovich’s account, accusing him of launching a “frivolous campaign to defame and vilify” Caldwell.

Adviser’s duty to clients

As an investment adviser, Caldwell owed a fiduciary duty to Eddings: to act in good faith and show loyalty and care, according to William J. Wilhelm Jr., a University of Virginia business professor.

“It’s hard for me to imagine that Citi would view this as acceptable behavior,” Wilhelm said. “It does suggest to me a significant failure in their compliance system.”

That fiduciary duty is the basis of the “best interest” regulation of the U.S. Securities and Exchange Commission, and it extended to Citi, said Georgetown University associate professor James J. Angel.

FINRA instructs banks to seek a trusted contact for the accounts of clients older than 65. Yet Duenas-Brckovich said Citi stonewalled him as he sought answers about Caldwell’s film investments and his mother’s account balance.

“I’ve worked in finance for 30 years,” Duenas-Brckovich said. “If Helen did disclose her outside interest, that means she should have definitely asked Citi for permission to let my mom do that investment in the film ‘Hunter’ — which, by the way, was written off to zero.

“It’s not like Helen had a little operation on the side that was hidden. She had a visible online presence.”

Past complaints

Before she came to Citi in 2012, soon after beginning her first job at a Chicago brokerage firm in 1991, at 26, records show Caldwell’s clients “claim(ed) that their accounts were short,” according to FINRA reports that say Caldwell responded that any errors had been made by her bosses.

In 2008, when she was a broker in a JPMorgan Chase investment division, the global banking giant settled another complaint by paying her clients more than $300,000 after they alleged she made misrepresentations and an unsuitable recommendation in a securities investment, records show.

In 2012, Citi hired Caldwell as a financial adviser for its brokerage and retail banking divisions, internal Citi documents show.

In court filings, Citi acknowledged Caldwell’s “dual-hat” role, which might help explain Citi’s alleged oversight failures. Injustice Watch found that Caldwell’s clients were writing checks to her film ventures from their Citibank checking accounts, but those transactions weren’t listed in their Citiglobal investment portfolios. The two bank divisions weren’t sharing information about her film ventures, court records state.

By 2013, Caldwell was meeting with film producers and saying she could raise money to invest in films through a company she launched named Canal Productions LLC, according to records and interviews with her film partners.

Canal Productions “provided funding to way beyond the level we ever thought possible up to that point,” scriptwriter Jason Kellerman said in an interview with an online blog. Kellerman wrote the script for the film “Hunter,” about a former martial artist who battles the undead to avenge his murdered family.

Kellerman’s film script was listed among the 50 best horror/thrillers at the South by Southwest screenplay competition.

The movie — filmed in part at Caldwell’s Humboldt Park home beginning in 2014 — was released four years later with Caldwell credited as a producer. It was selected as “Best Horror Feature” at the 2018 Manhattan Film Fest and “Best Feature” at the Freakshow Horror Film Fest.

Caldwell’s Canal Productions was incorporated in January 2014, and records show Citi supervisors annually approved this outside business affiliation.

Caldwell’s credits include 14 projects and films, according to her online biography on IMDb.com.

Records also show Caldwell used her position at Citi to conduct film business. In one 2015 chain copied to her Citi email account, Caldwell offered to meet a School of the Art Institute of Chicago filmmaker at Citi to discuss financing his documentary.

“I am in my office this Friday on Michigan Ave next to yours,” she wrote in the email. “If you’d like to come by to talk briefly, I can in the morning.”

‘Taking advantage of my mom’

One of Caldwell’s clients was Catherine Duenas, now 83, who invested $18,000 in a film project with Caldwell, according to her son, who provided a tax form showing the investment.

Duenas-Brckovich said he became aware of the movie investment during a meeting that he and his mother had with Caldwell in the summer of 2017 at her Citi office on South Michigan Avenue. He said he had no idea at the time the film was Caldwell’s vampire film.

At the meeting, he said, Caldwell rebuffed his requests for term sheets — the standard investment report showing corporate governance and investor payout or exit strategies.

“I go, ‘A structured note? I’d like to know how it works,’ ” Duenas-Brckovich said. “Helen is, like, ‘Oh, I can’t tell you.’ ”

Duenas-Brckovich said Caldwell turned to his mother and said: “ ‘Oh, Catherine, you know about that!’ My mom is, ‘Of course, of course.’ ”

Duenas-Brckovich said he finally obtained a tax report showing his mother held a worthless 16% interest in a company that helped produce “Hunter.”

“That was my WTF moment,” Duenas-Brckovich said.

Amid Duenas-Brckovich’s complaints to Citi, Caldwell left the banking behemoth in November 2021 and registered as a broker with Wells Fargo Clearing Services in Chicago, FINRA reports and internal Citi records show.

She was discharged by Wells Fargo in September 2022 “following an internal review concerning the accuracy of disclosures that Caldwell made to the firm” about her outside business activities, FINRA records show.

A Wells Fargo spokesperson wouldn’t comment.

READ MORE