/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir Technologies (PLTR) received a vote of confidence on Monday as Citi (C) upgraded the data analytics company to “Buy” from “Neutral.” Citi analyst Tyler Radke raised his price target on PLTR stock to $235 and lifted earnings estimates. Radke is bullish on the expanding commercial adoption of Palantir’s AI platform and momentum in government contracts.

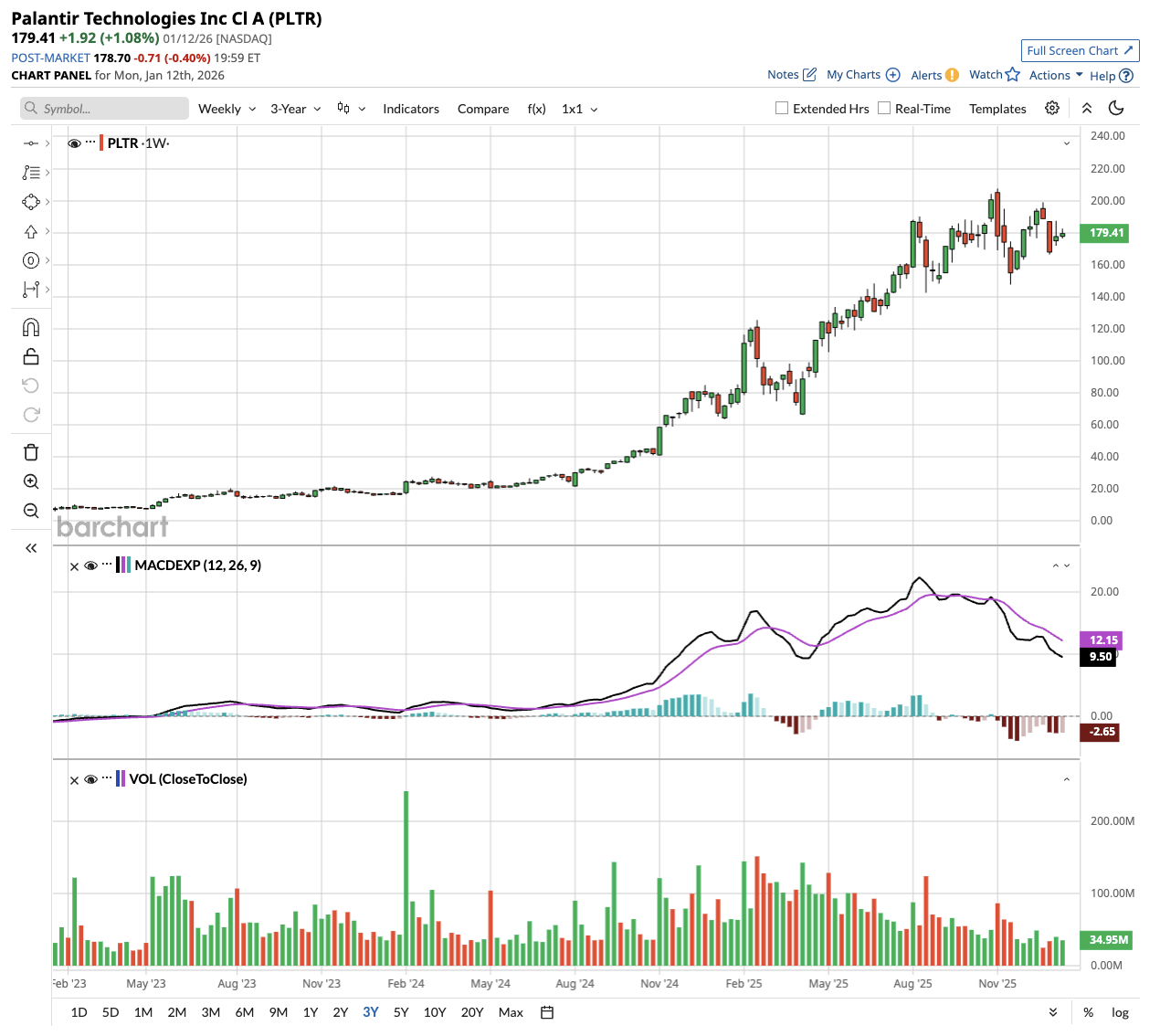

Valued at $427 billion by market cap, PLTR stock has risen 2,455% over the past three years. Citi expects 2026 to be an inflection point for Palantir as it transitions from pilot programs to scaled enterprise deployments across sectors such as defense, healthcare, and energy. Citi projects government revenue could surge 51% year-over-year (YoY) and potentially grow by 70% in 2026, tied to accelerated defense spending.

Let’s see if you should buy PLTR stock right now, given the anticipated supercycle in AI adoption.

Palantir Is Expanding Its AI Moat

In Q3 of 2025, Palantir reported revenue of $1.18 billion, an increase of 63% YoY. Notably, the data analytics giant achieved a Rule of 40 score of 114% as it continues to ride the AI wave, driven by domestic sales, which rose 77%.

The standout performer was Palantir's U.S. commercial business, which grew 121% YoY and now accounts for 34% of total revenue. The company closed a record $2.8 billion in total contract value during the quarter, including 204 deals worth at least $1 million. More impressively, 53 deals exceeded $10 million in value as enterprises moved beyond pilot programs to company-wide AI transformations.

CEOs are personally leading enterprise-wide deployments of Palantir's AI platform rather than testing it in isolated departments. One medical device manufacturer expanded its contract eightfold just five months after signing, while insurance companies are using the technology to reimagine everything from underwriting to claims processing.

U.S. government revenue rose 52% YoY. Its recent contract wins include a three-year renewal with France's domestic intelligence agency and a $448 million partnership with the U.S. Navy. Early results from pilot programs have been stunning, with submarine schedule planning reduced from 160 hours to under 10 minutes.

Palantir raised its full-year revenue guidance to $4.4 billion, representing 53% growth, and increased its U.S. commercial forecast to at least 104% growth. The company also boosted its operating margin guidance while generating $2 billion in trailing twelve-month free cash flow for the first time.

Beyond traditional sectors, Palantir is expanding into unexpected markets through partnerships like Teton Ridge for rodeo analytics and Northslope for applied AI solutions. Palantir’s robust technology stack is built around the proprietary Ontology platform, which differentiates it from competitors that are still struggling to deliver tangible value.

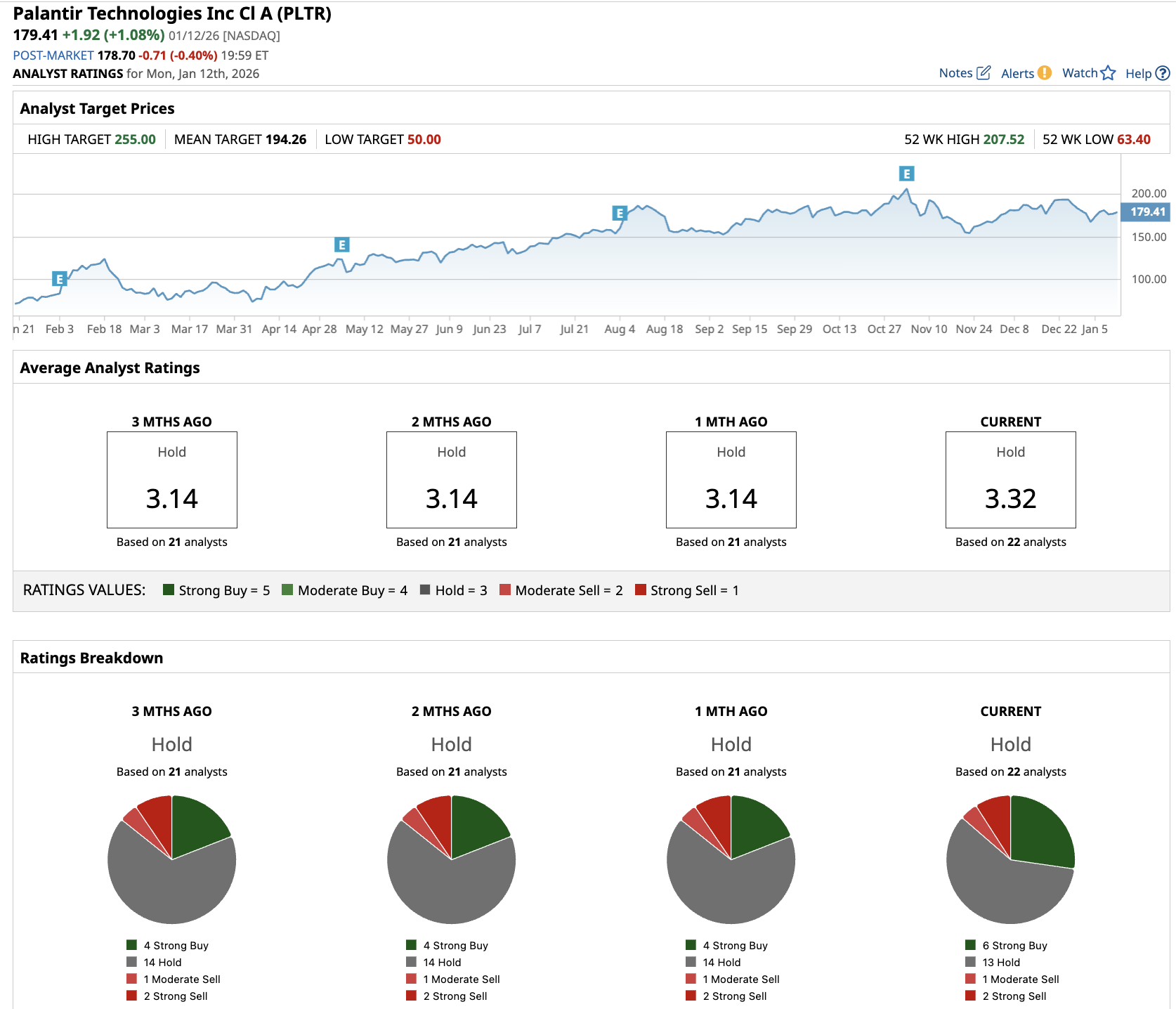

What Is the PLTR Stock Price Target?

Palantir’s monstrous run has meant that the tech stock trades at 193x forward earnings, which is expensive. However, the accelerating adoption across commercial and government segments could drive PLTR stock higher over the next 12 months.

Out of the 22 analysts covering PLTR stock, six recommend “Strong Buy,” 13 recommend “Hold,” one recommends “Moderate Sell,” and two recommend “Strong Sell.” The average Palantir stock price is $194.26, above the current price of about $179.