/Cincinnati%20Financial%20Corp_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $25.3 billion, Cincinnati Financial Corporation (CINF) provides a broad range of property casualty, life, and specialty insurance products in the United States. The company operates through five segments: Commercial Lines; Personal Lines; Excess and Surplus Lines; Life Insurance; and Investments, supported by its insurance and financial subsidiaries.

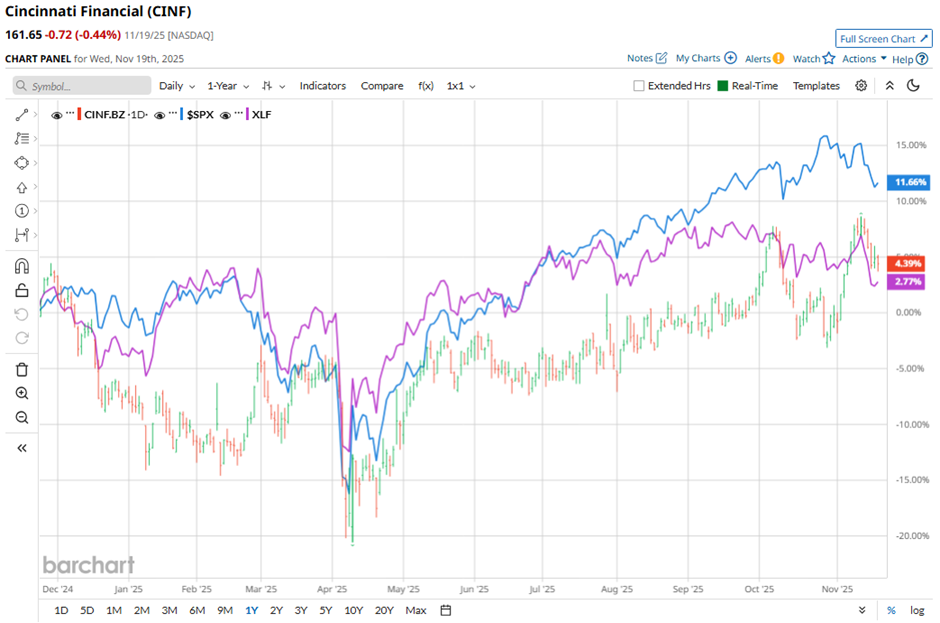

Shares of the Fairfield, Ohio-based company have lagged behind the broader market over the past 52 weeks. CINF stock has risen 7.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.3%. In addiiton, shares of the company are up 12.5% on a YTD basis, compared to SPX’s 12.9% gain.

However, the insurer stock has outperformed the Financial Select Sector SPDR Fund’s (XLF) 3.8% return over the past 52 weeks.

Cincinnati Financial delivered a stronger-than-expected Q3 2025 adjusted EPS of $2.85 on Oct. 27. Net income surged to $1.12 billion, boosted by a $675 million after-tax increase in the fair value of equity securities and a $152 million decrease in after-tax catastrophe losses. However, the stock fell 3.7% the next day.

For the fiscal year ending in December 2025, analysts expect CINF’s adjusted EPS to decline over 5% year-over-year to $7.20. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

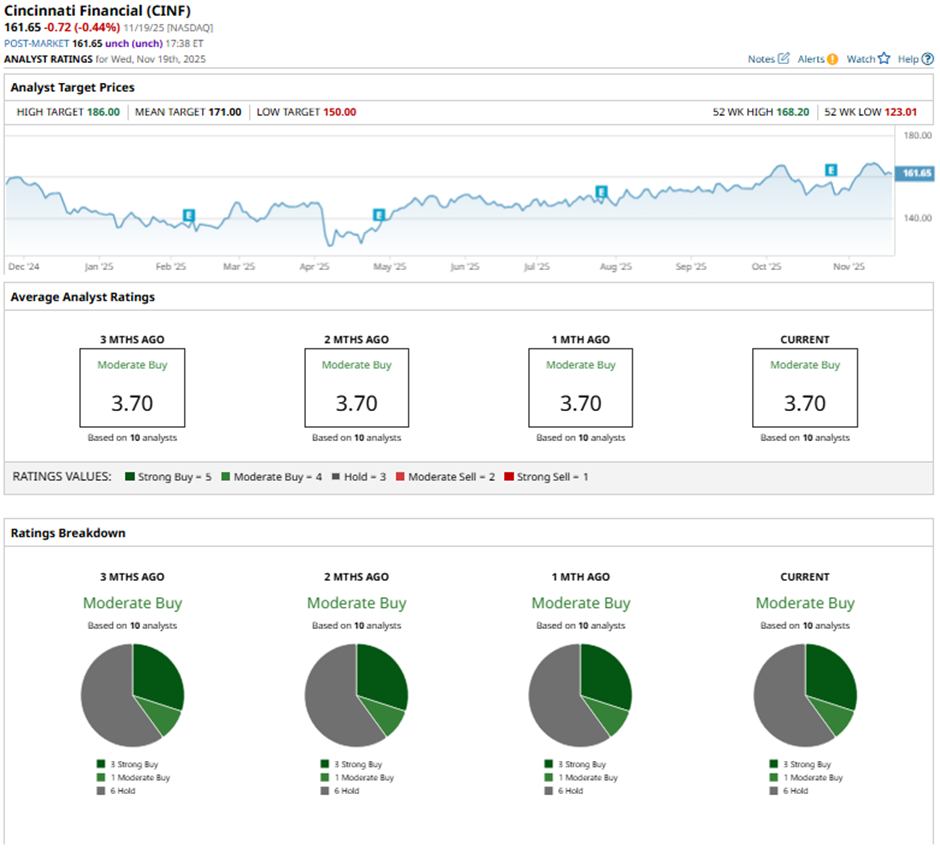

Among the 10 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on three “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

On Oct. 28, BofA analyst Joshua Shanker raised Cincinnati Financial’s price target to $186 and maintained a Buy rating.

The mean price target of $171 represents a 5.8% premium to CINF’s current price levels. The Street-high price target of $186 suggests a 15.1% potential upside.