RECAP: Asian equities advanced on Friday amid hopes for China's emergence from the pandemic and an economic lift from renewed travel from the mainland.

The Thai stock market continues to stand out, thanks to China's reopening. Analysts believe the SET Index is likely to hit 1,800 points in 2023.

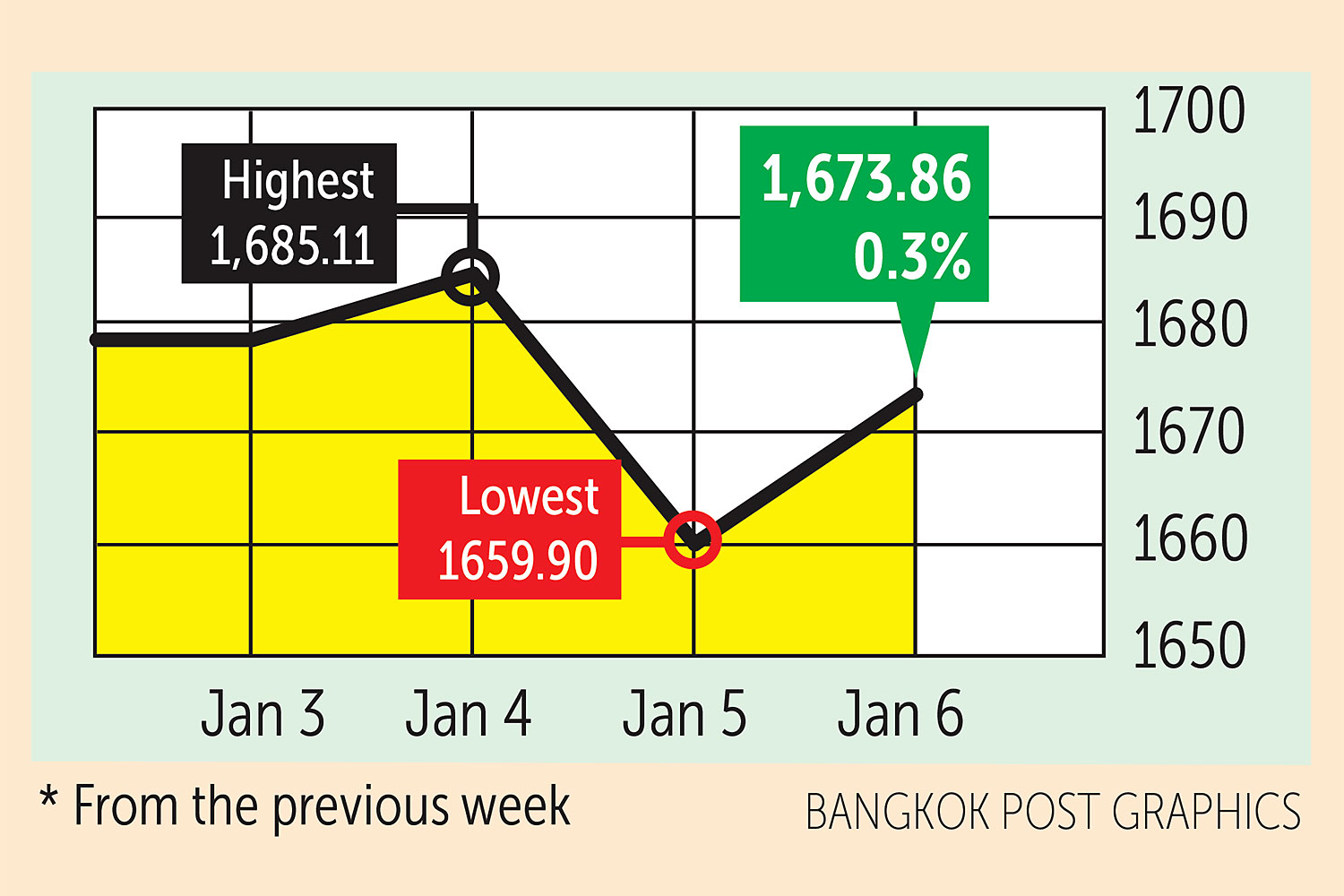

The index moved in a range of 1,685.11 and 1,659.90 points this week before closing yesterday at 1,673.86, up 0.3% from the previous week, in daily turnover averaging 74.69 billion baht.

Foreign investors were net buyers of 2.84 billion baht followed by retail investors at 240.54 million. Institutions were net sellers of 2.23 billion baht and brokers sold 845.89 million baht worth of shares.

NEWSMAKERS: Federal Reserve officials agree they should slow the pace of interest rate increases in order to not hurt the economic recovery, minutes of their December meting showed. The FedWatch Tool forecast now shows a 40.9% likelihood of a 50-basis-point rate hike at the Feb 23 meeting, up from 30.3% earlier.

- US private payrolls rose by 235,000 in December, above market expectations of 153,000 and up from 182,000 the previous month, signalling an improving economy, but also supporting the case for higher interest rates than the market now expects.

- The Chinese government said it would extend measures to cut interest rates for first-home buyers if house prices fall year-on-year and quarter-on-quarter for three consecutive months. New home prices in 100 major Chinese cities fell in 2022 for the first time in nearly eight years.

- The giant developer China Evergrande has pledged to repay its debt this year, as it presses ahead with restructuring following Beijing's crackdown on excessive borrowing and rampant speculation in the property sector.

- Foreign investors withdrew more money from equities in emerging Asia in 2022 than in any year since 2008, as rising US interest rates pulled funds towards dollar assets. Thailand was an exception, with foreign net buying of 202.7 billion baht. It was the first time since 2016 that foreigners had not been net sellers on the SET.

- US prosecutors are investigating an alleged cybercrime that drained $370 million from the crypto exchange FTX hours after it filed for bankruptcy. The probe is separate from the fraud case against FTX co-founder Sam Bankman-Fried, who pleaded not guilty on Tuesday to several criminal charges.

- Real wages in Japan fell 3.8% year-on-year, the most in eight years, in November as a result of higher inflation, data showed this week. Prime Minister Fumio Kishida has urged companies to give their workers increases that exceed inflation.

- India eclipsed Japan in automobile sales last year, making it the world's third-largest auto market for the first time. New vehicle sales totalled 4.25 million units, versus 4.2 million sold in Japan.

- Sony Group this week unveiled a prototype of its Afeela electric vehicle, being developed with Honda, at the CES 2023 tech show in Las Vegas. It is slated to go on sale in the US in 2025.

- Capital Nomura Securities forecasts the Bank of Thailand will raise its policy rate by another 25 basis points to 1.5% at its Jan 25 meeting and maintain that rate for the rest of 2023.

- Headline inflation rose 5.9% year-on-year in December, in line with forecasts, driven by higher energy and food prices. That brought the final figure for the year to 6.1%, a 24-year high.

- The Bank of Thailand expects headline inflation this year to average 3%, with core inflation at 2.5%.

- The Consumer Confidence Index rose to 50.4 points in December, the highest in two and a half years, from 49.9 the previous month, as the domestic economic recovery continued.

- Fund flows into the Thai stock market for seven consecutive days totalling 22.4 billion baht should help push the SET Index forward to its 2023 target of 1,800 points, says Capital Nomura Securities.

- The baht reached an 8-month high of 33.78 to the US dollar on Thursday amid foreign capital inflows into Thai bonds and sales of gold for profit taking after gold approached $1,870 an ounce this week.

- A 35.7% surge in shares of Delta Electronics (Thailand) Plc since Dec 1 have given it the highest market capitalisation on the SET at 1.14 trillion baht, ahead of PTT and AOT.

- The Oil Fuel Fund Office is considering seeking an additional 30-billion-baht loan to repay debts incurred to subsidise diesel and liquefied petroleum gas prices. Global oil prices have weakened, but the fund is still 121 billion baht in the red.

- Thailand is expected to attract more than 20 million foreign arrivals this year after reaching 11.8 million in 2022, says Chamnan Srisawat, head of the Tourism Council of Thailand.

- All visitors to the country must show proof of at least two Covid vaccinations under revised rules that coincide with the revival of travel from China, authorities said on Thursday. Those travelling rom Thailand to countries that require proof of negative PCR tests -- China among them -- must also have heath insurance.

- Krungthai Card (KTC), the Krungthai Bank credit-card affiliate, plans to offer personal loans via KTB's Pao Tang mobile app this year. KTC aims to add 110,000 personal loan customers and grow its loan portfolio by 7% this year.

- Zen Corporation Plc (ZEN), the operator of the Zen, AKA and Tummour restaurant chains, plans to spend 300 million baht to expand this year. Of the total, 200 million is earmarked for 10-15 new AKA restaurants in provincial markets, bringing its overall total to 25-30.

- The National Broadcasting and Telecommunications Commission says the Computer-related Crime Act and the NBTC Act may have to be amended to help govern over-the-top (OTT) platforms to ensure fairness and competition.

COMING UP: Euro zone unemployment data for November will be released on Monday, followed by US wholesale inventories for the same month. China will report December consumer and producer price on Thursday. Locally, the Federation of Thai Capital Market Organizations (Fetco) will release its Investor Confidence Index and the SET will release its 2023 outlook.

STOCKS TO WATCH: Capital Nomura Securities recommends stocks that benefit from a strong baht, which is positive for companies with foreign debts, and importers. Those include airlines (AAV, BA); power plants (GPSC, GULF, BGRIM); energy (PTTGC, TOP, IVL, PTT); industrial estates (AMATA, WHA); and importers (TOAICHI, SABINA, JUBILE, JMART, COM7, SYNEX, SIS). Its top pick is AAV, seen as the biggest beneficiary from baht appreciation, China reopening and lower oil prices.

- Other China reopening plays are AOT, AMATA, AWC, AAV, ERW, BAFS, CENTEL, MINT, SNNP, WHA, SCGP, SPA, EKH and MC. Petrochemical stocks with potential are PTTGC, IRPC and SCC. Speculative plays are consumer stocks that benefit from government stimulus measure, and stocks expected to gain from election-related activity. These include CRC, COM7, HMPRO, MAKRO, BJC, CPALL, BBL, M, ADVANC, TRUE, AEONTS, KTC, SC, SIRI and AMATA.

- For the medium to long term, stocks to accumulate are MATA, CRC, GPSC, AP, AAV, BE8 and SCGP.

- The Investment Analysts Association's portfolio recommendation for 2023 is 12% cash and short-term deposits, 20.12% fixed-income funds, 28.52% Thai stocks or Thai stock funds, 23.60 stocks or foreign stock funds, 7.52% real estate funds or REITs, 7.92% gold or gold funds, and 0.32% others. Its consensus stock picks are ADVANC, AOT, BBL, COM7 and CPALL.

TECHNICAL VIEW: Thanachart Securities sees support at 1,660 points and resistance at 1,698. ASL Securities sees support at 1,649 and resistance at 1,700.