Semiconductor equipment spending got a big boost in 2023 from Chinese chipmakers loading up on manufacturing gear. But that tailwind is likely to end in the first half of 2024.

Chip-gear stocks have experienced a lift recently from better-than-expected third-quarter reports fueled by robust spending in China. Chinese foundry SMIC and other chipmakers have been buying gear to make mature-node logic and DRAM memory chips.

But the heightened level of spending in China is not sustainable and will slow in 2024, Wall Street analysts say. The good news is that other geographies could pick up the slack next year, they say.

"The strength from China may sustain for another 6 months," Bernstein Research analyst Mark Li and colleagues said in a note Tuesday. "Our recent China trip suggested continued appetite from China, but (there is) poor visibility into second-half 2024."

Semiconductor equipment spending will get an assist from domestic chipmaking initiatives in the U.S. and Europe, but that may not show up in sales until 2025, Li said.

Also, Taiwan Semiconductor Manufacturing, the world's top contract chipmaker, isn't likely to accelerate spending until 2025, when it prepares for 2-nanometer chip production in 2026, Li said.

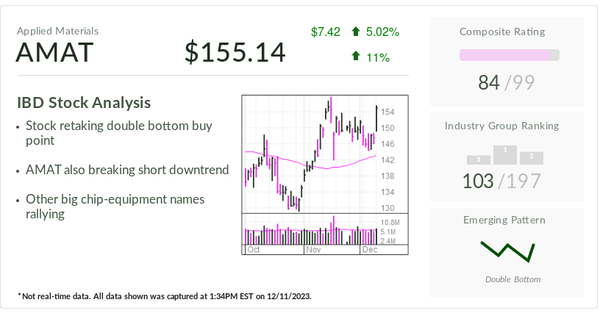

AMAT Stock Tops In Semiconductor Equipment

Among semiconductor equipment stocks, Bernstein rates Applied Materials as outperform. But it has market perform, or neutral, ratings on ASML and Lam Research.

Deutsche Bank analyst Sidney Ho is cautious on the semiconductor equipment market heading into 2024. He said 2024 is a "show-me story."

He rates Applied Materials a buy but KLA and Lam Research as hold.

"Investors appear to be willing to look past uncertainties in 2024 and look forward to a strong recovery in wafer fab equipment (WFE) spending in 2025," Ho said in a client note Monday. "2024 is the year to see if industry spending is tracking to those high expectations, even if that means a full recovery is not until 2025."

Chip-Gear Spending Rebound Forecast

Chip industry trade group SEMI predicts that global sales of semiconductor equipment will rise in 2024 after falling 6.1% to $100 billion in 2023. It forecasts record chip-gear sales of $124 billion in 2025.

"2024 will be a transition year," SEMI Chief Executive Ajit Manocha said in a news release. "We then expect a strong rebound in 2025, driven by capacity expansion, new fab projects, and high demand for advanced technologies and solutions across the front-end and back-end segments."

Chip-gear spending in China will see a "mild contraction in 2024 after heavy investments in 2023," SEMI said.

Photronics Stock Surges On Earnings Beat

On Wednesday, shares of chip-gear firm Photronics jumped after the maker of photomask technology beat estimates for its fiscal fourth quarter. Its guidance for the current period was in-line with views for earnings but above estimates for sales.

Photronics earned an adjusted 60 cents a share, up 18%, in the quarter ended Oct. 31. Its sales rose 18% to $227.5 million in the period. Analysts polled by FactSet had expected earnings of 53 cents a share on sales of $224 million.

On the stock market today, Photronics stock surged 21.3% to close at 26.24.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.