Struggling families say their “mental health is on the ground” as children battle with feelings of shame and guilt amidst soaring living costs.

One mother described skipping meals to make sure her children could still eat, while another said her own son would offer his pocket money to help out.

They’re just two of the distressing experiences shared by single mothers who spoke to The Independent, all of whom are participants of Covid Realities .

The two-year research programme was launched in April 2020 to document the experiences of low-income households.

Parents involved in the scheme said money that was tight before no longer stretches to cover their needs - and their young children are suffering as a result.

According to think tank The Resolution Foundation, around 1.3 million Britons will be pushed into absolute poverty by the cost of living squeeze - including half a million children.

Action for Children says that 47 per cent of children surveyed from low-income backgrounds (less than £20,000 annually) said they worry about their family’s finances, compared with 14 per cent of children from high-income families (more than £70,000 annually).

Here are some of the stories shared by struggling families as the cost of living crisis deepens.

‘My daughter was scared I would die’

Domestic violence survivor Victoria, who did not wish to give her real name, said that while things were tight before the £20 universal credit uplift, this year “money just isn’t stretching”.

Raised on low-income in the nineties, the single mum knows first-hand the trauma that accompanies child poverty.

Forming healthy food relationships and managing budget effectively can be hard when “one’s childhood was full of hunger, cold or fear,” she said.

But nowadays, she gets “a little over half the amount of food for the same budget” adding, “the packaging is smaller, the prices are higher”.

She said: “This month’s shop cost me roughly 35% more for 75% of the amount of food I’d usually get each month.”

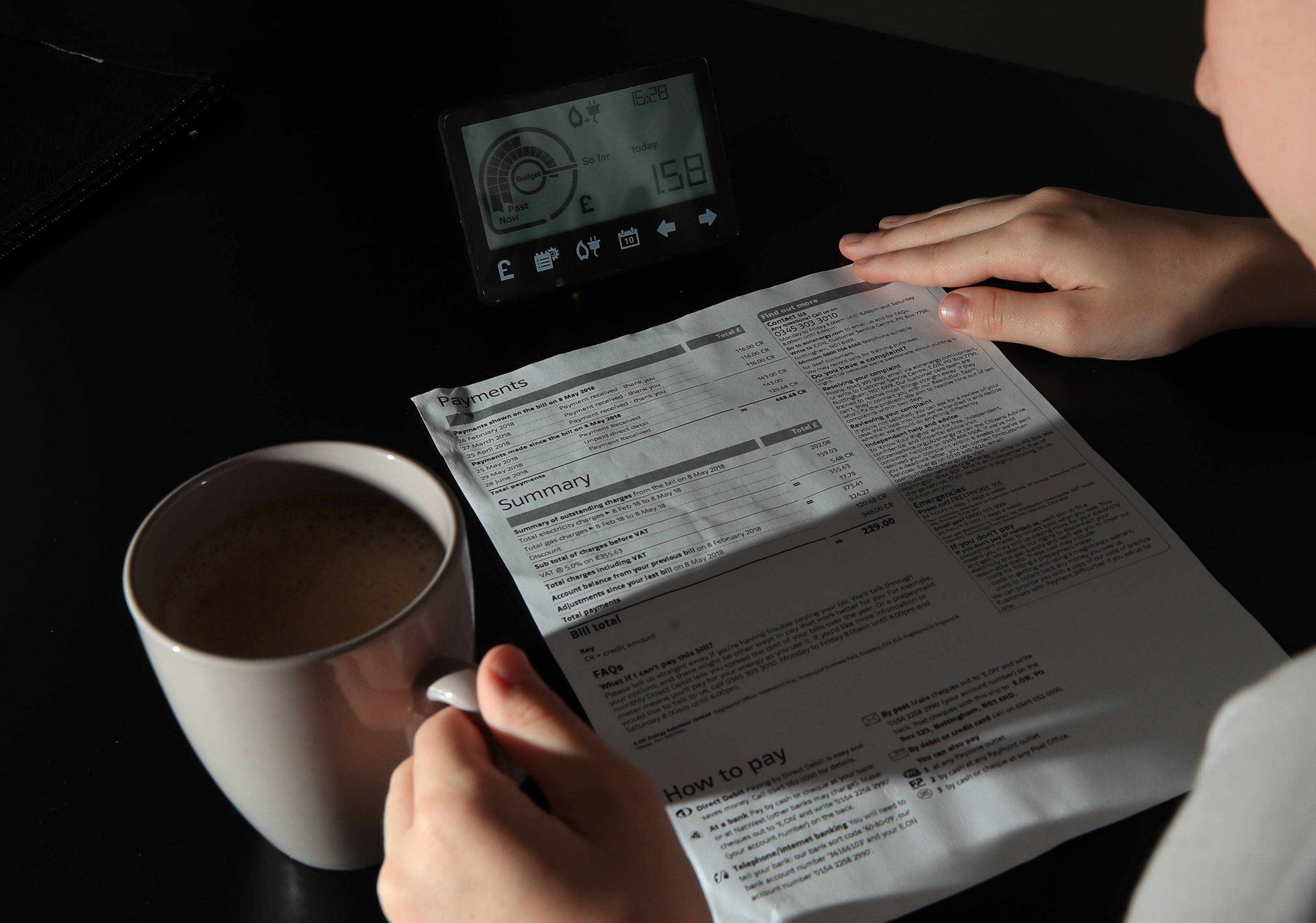

Food and non-alcoholic drink prices were up by 4.2 per cent in the year to December 2021, and between January and November 2021, domestic gas prices increased by twenty-eight per cent while domestic electricity prices rose by nineteen per cent.

As a result, Victoria often skips meals- sometimes for days- to ensure her children have enough food and to protect them from inheriting poverty-related mental health issues. But despite her efforts to shelter her children, they still worry for her.

“Over breakfast, my eldest said she was worried because she hadn’t seen me eat all weekend. She said she’s scared I’ll get ill or die.”

“Children aren’t immune to these fears,” she added. “They aren’t ignorant.”

‘They don’t care about us’

“I’m shivering now as I speak,” Jo Barker-Marsh said on a phone call in February as she revealed how cold she and her son constantly feel in their house where “there’s not enough carpet, not enough radiators and lots of drafts”.

The 49-year-old former film producer from Greater Manchester said her son, only 12-years-old, had “intellectualised” their poverty for the first time earlier this year: “His face broke into a million pieces and he said ‘Our house is so cold. I am so sick of this. I am so sick of being cold’.”

It comes as energy bills are set to rise by more than 50 per cent in April, but this will be compounded by an additional rise of more than £800 in October, pushing the average energy bill towards £2,800.

Harry, who has special educational needs, told his mum that “going outside is no different from being inside” and unable to increase the heating, Ms Barker-Marsh said that her son registered “how wrong it is for energy companies to be recording record profits at a time when we’re not even warm”.

Speaking on the impact this had on his mental health, Ms Barker-Marsh said: “We’re so dehumanised now and he is absolutely aware of that.”

She added: “I don’t have mould running up my walls or sleeping under a silver sheet so you feel you have to perform your poverty, but that’s very exhausting for a child.

“He just wants something done. He think some people just want to be rich and they don’t care about us.”

‘Your children will suffer the most’

Left with no savings after her divorce, Angie- not her real name- said she is forced to rely on benefits but by the time she finishes paying all of her bills and repayments, “most of it is gone”.

The mother-of-two is studying to be a teaching assistant while she lives in a council flat Southwark, London with her four-year-old son and two-year-old daughter.

She receives roughly £1,270 a month in benefits, but with pressure of £124 weekly rent, increasingly expensive energy bills- not forgetting nappy and formula costs, food shopping, internet, council tax, debts left behind by her ex and travel to her son’s school- she is out of pocket by the end of the month.

“People think, ‘You get a grand a month in benefits, that’s so much’ but actually, it’s nothing”, she said, admitting that she has to rely on top-ups from family, without whom she would not be able to survive.

To try to keep the food costs down, Angie buys just enough food to fill their stomachs, but she said her son notices that there is less food in the cupboards and complains of hunger.

He has even offered to buy food with small coins he gets for pocket money, she revealed.

“You don’t plan to get divorced, you don’t plan to be a single mum, you don’t plan to have the public holding you up when you’re at your lowest and have nothing to your name,” Angie said. “In spite of all this, you won’t be suffering the most, it will be your children.”

‘Children tend to blame themselves’

Jane Williams, founder of The Magpie Project-a Newham charity that support mothers with children under five- said that children feel “shame and guilty for wanting and asking for things”.

She explained that children from low-income households notice that they “can’t have what their friends have” adding: “It’s just impossible to understand why that kind of inequality exists and children will tend to blame themselves.

“A mum told me that her seven-year-old son said to her, ‘Mummy, we’re poor aren’t we? We’re poor’. She told him, ‘No, we’ve got lots of love, we’re rich in love’.

“Even if the younger children don’t understand in terms of words, they know when they’re cold,” she said. “They know when they haven’t eaten.”

It comes as the the Office for Budget Responsibility (OBR) say households are facing the biggest squeeze in living standards since records began in the 1950s.

Two thirds of adults in Britain reported their cost of living increased in the past month, with 79 per cent of those citing higher gas and electricity bills as a cause, according to the Office for National Statistics (ONS).

Further strains on household finances are expected from April 2022 with a planned increase in National Insurance Contributions.

Despite a 5p cut on fuel duty and a rise in the National Insurance threshold by £3000, the average working family is set to lose £1,100- a four per cent fall in their income next financial year, analysis of the chancellor’s Spring Statement showed.

Dean Johnstone, Chief Executive of Minds Ahead- a social enterprise supporting the mental health needs of pupils, staff and parents in schools- said his mental health practitioners have noticed that more families are identifying as vulnerable.

One in six children aged 5-16 years have a probable mental health disorder- which is an increase from one in nine in 2017, according to figures for 2021 from NHS Digital.

The data also showed that children with a probable mental health disorder were more than twice as likely to live in a household that had fallen behind with payments, compared to children unlikely to have a mental disorder.

Mr Johnstone added that the transition into poverty is a mental health risk factor as it is a “forced change” which creates stress and anxiety in the house, as “you don’t know where you’re going to end up or how far it will go”.

To tackle the worrying rise in children’s mental health issues, the government has promised nearly three hundred million children and young people will have 400 mental health support teams in schools across the country by 2023.

A government spokesperson said: “The latest official figures show there were 300,000 fewer children in poverty after housing costs than in 2010 and we continue to provide extensive support to reduce this number further, recognising the pressures people are facing with the cost of living and providing support worth £22 billion this financial year and next to help.”

This include putting “an average of £1,000 more per year into the pockets of working families via changes to universal credit, cutting fuel duty and helping households with their energy bills through [their] £9.1 billion Energy Bills Rebate” as well as a £1 billion household support fund to help “the most vulnerable with essential costs”.