It’s no secret that education has always been a damn expensive thing, and today it even drives many graduates and their families into nearly unpayable debt. And, accordingly, it often becomes a source of serious disagreements and even quarrels between parents and children about who will pay off these debts.

For example, the user u/One-Sprinkles3801, the author of the story we’re going to tell you today, recently received an inheritance from his late mother – and planned to put most of it into his own retirement fund. But the author’s adult children, as it turned out, had their own plans for their grandma’s inheritance…

More info: Reddit

The author of the post has 3 adult children, each of whom graduated from college – even at the cost of being in debt

Image credits: Burst (not the actual photo)

The father always helped his kids with books and money for food – but the tuition was always on them

Image credits: u/One-Sprinkles3801

Image credits: Simon Kellogg (not the actual photo)

Recently, the man’s mother passed away and left him her house worth around $500k

Image credits: u/One-Sprinkles3801

Image credits: SHVETS production (not the actual photo)

The man decided to take a vacation for about $10k and then put the rest of the money into his retirement fund

Image credits: u/One-Sprinkles3801

However, all three children were incredibly upset with this decision, expecting him to pay off their debts with the money

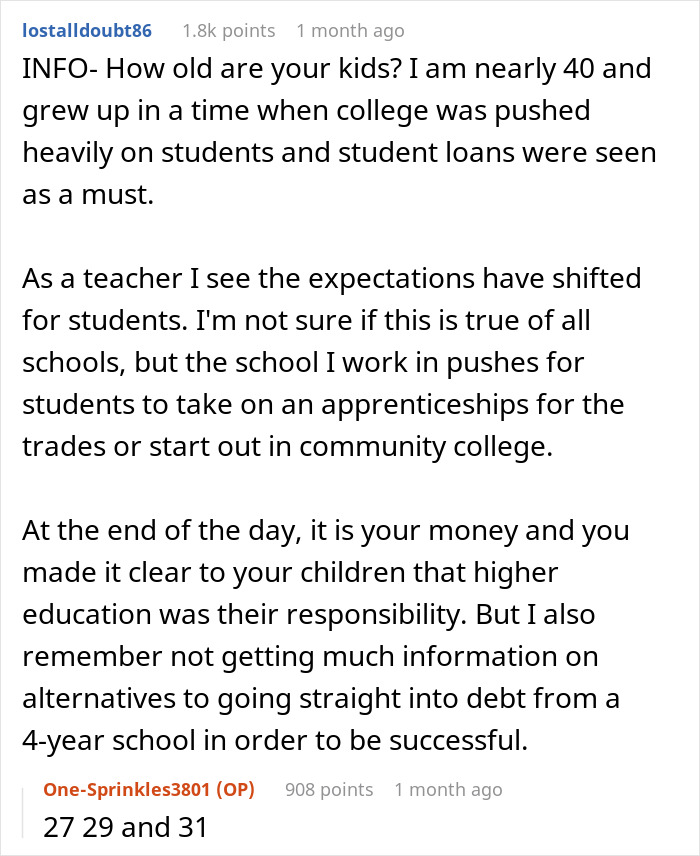

So, the Original Poster (OP) and his wife have three adult children, 27, 29 and 31 years old respectively. All three of them went to college and successfully graduated – albeit at the cost of serious debt. The thing is that, according to the author, the children chose quite prestigious educational institutions – and only his youngest took some community college classes in order to save money.

The father says that he helped the children whenever possible – he bought them books, gave money for a food plan, but the actual tuition was always on them. And now the children are trying to pay off their debts – but, as you probably understand, this is a rather long and difficult process. However, the author himself, in his own words, has not been on vacation for eight years.

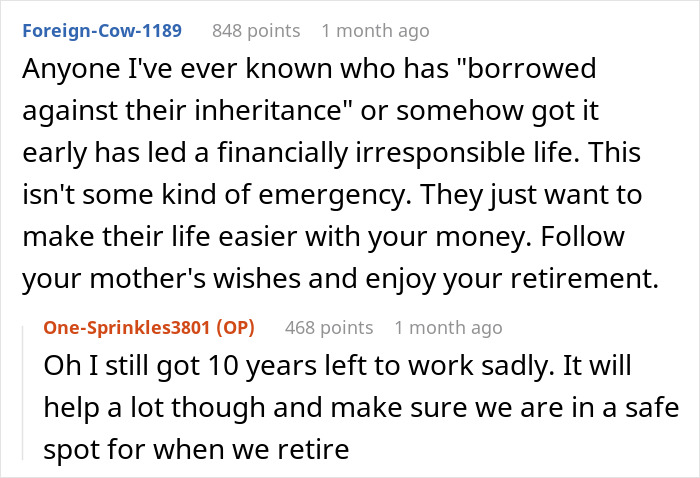

And recently, the original poster’s mom passed away and left him her house. The estimated selling price of it is around $500K – and our hero really plans to sell it. Part of the money – about $10,000, he wants to spend on having a vacation, and put the rest into his retirement fund. After all, in our time, aging is no less expensive than education.

Before telling the children about his plan, the father invited them to look at the house – and this, quite possibly, became a strategic mistake. After that, the kids criticized their dad for being ‘selfish’ and for his unwillingness to help them pay off their college debts. In turn, the father understood perfectly well that he could do this – but then it would take away almost 3/4th of the inheritance.

As a result, the OP remained adamant, although the children were incredibly upset. But our hero realized that he would hardly get another such opportunity to provide himself with a decent retirement. And he also deserved his first vacation in eight years. So he said “No” again – but decided to ask netizens what they thought about this situation.

Image credits: Asad Photo Maldives (not the actual photo)

“Financial literacy is, first of all, a person’s ability to correctly assess their own financial capabilities, rational choice of expenses and assessment of possible risks,” says Olga Kopylova, Ph.D., associate professor of economics at Odessa National Maritime University, with whom Bored Panda got in touch for a comment here. “And the ability to create a ‘cash safety net’ for old age also relates to financial literacy.”

“Aging, in turn, implies a lot of different expenses – often unforeseen, so it is quite reasonable that this person wants to insure himself for the future. In turn, I suppose his children will also be able to pay off their student debts sooner or later – even if it takes a long time. After all, it was their father who was named in the will.”

“I can’t say anything about the moral and ethical component of this situation, but from an economic point of view, this father is acting correctly and quite reasonably. In any case, after he passes away himself, his fortune will go to his children – but for now he’s alive, quite healthy and wants to spend his remaining years decently. And his mother’s inheritance should help him with this,” Olga summarizes.

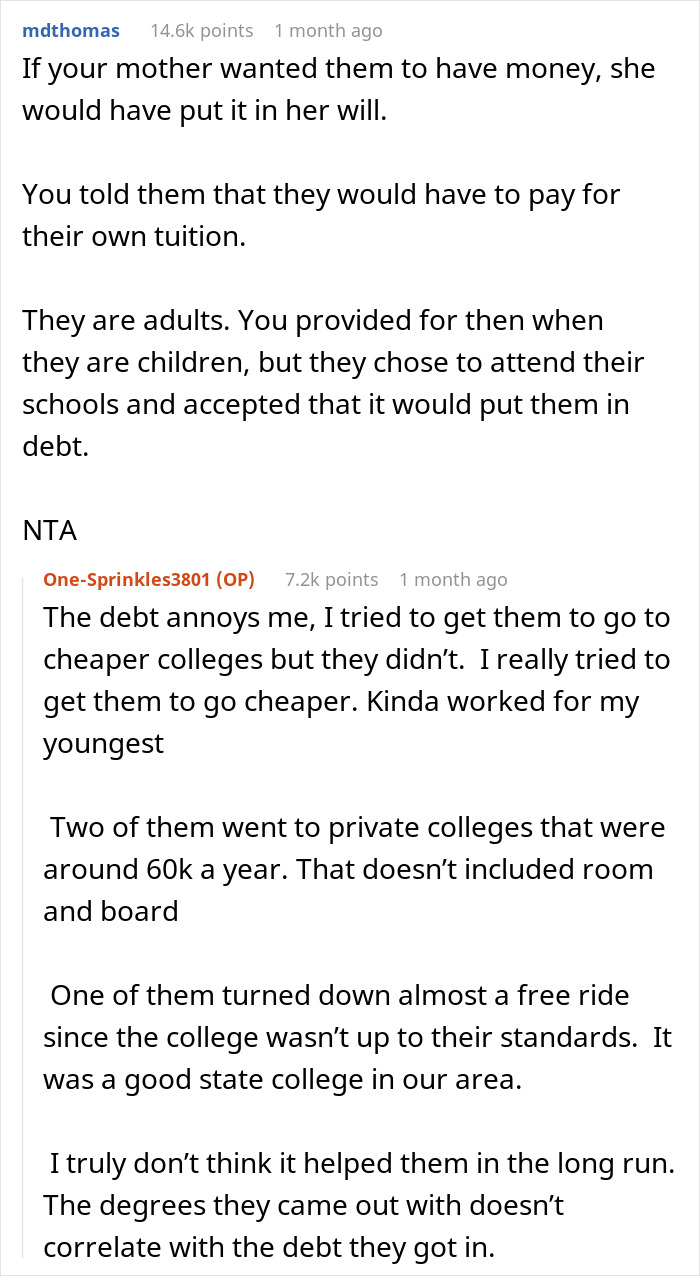

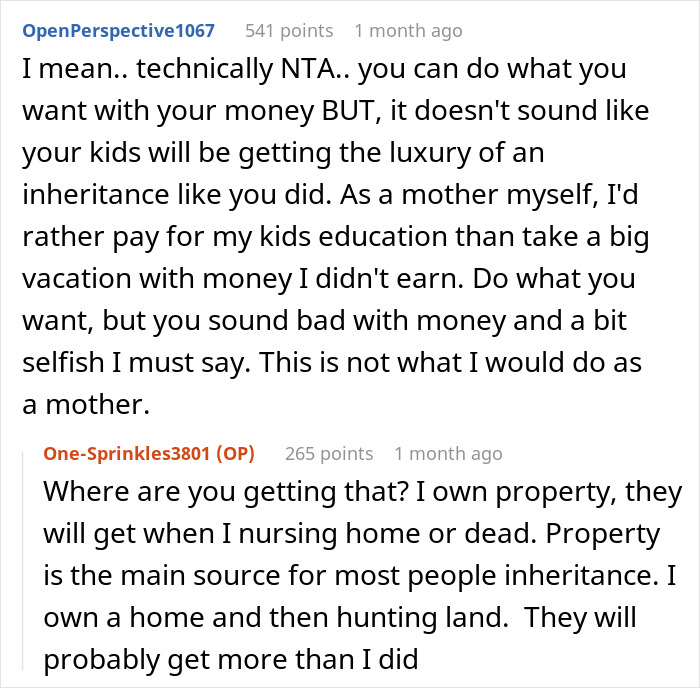

As for commenters on the original post, most people here are inclined to believe that since it was the author who was named in the will and not his children, then so be it. “If your mother wanted them to have money, she would have put it in her will,” one of the responders wrote. “They are adults. You provided for them when they were children, but they chose to attend their schools and accepted that it would put them in debt.”

Be that as it may, it is now the original poster’s money – and he is free to spend it as he wishes, the commenters are pretty sure. “They just want to make their life easier with your money. Follow your mother’s wishes and enjoy your retirement,” someone probably formulated the general idea of all the people in the comments. And what do you, our dear readers, think about this as well?

In fact, almost all the commenters sided with the author, claiming that he should just follow his late mom’s wishes and enjoy his upcoming retirement