Chevron (CVX) shares slipped lower Friday after the oil major posted softer-than-expected fourth quarter earnings just days after unveiling plans for a $75 billion buyback.

Chevron said adjusted earnings for the three months ending in December came in at $7.9 billion, or $4.09 per share, up nearly than 60% from the same period last year but notably shy of the Street consensus forecast of $4.38 per share.

Group revenues, the company said, rose 14% from last year to $55 billion, just ahead of analysts' estimates of a $54.6 billion tally.

West Texas Intermediate crude prices traded in a reasonably narrow range of between $79 and $81 dollars per barrel over the three months ending in December -- with a spike to as high as $94 per barrel in early November -- a range that was around 8% higher than the same period last year.

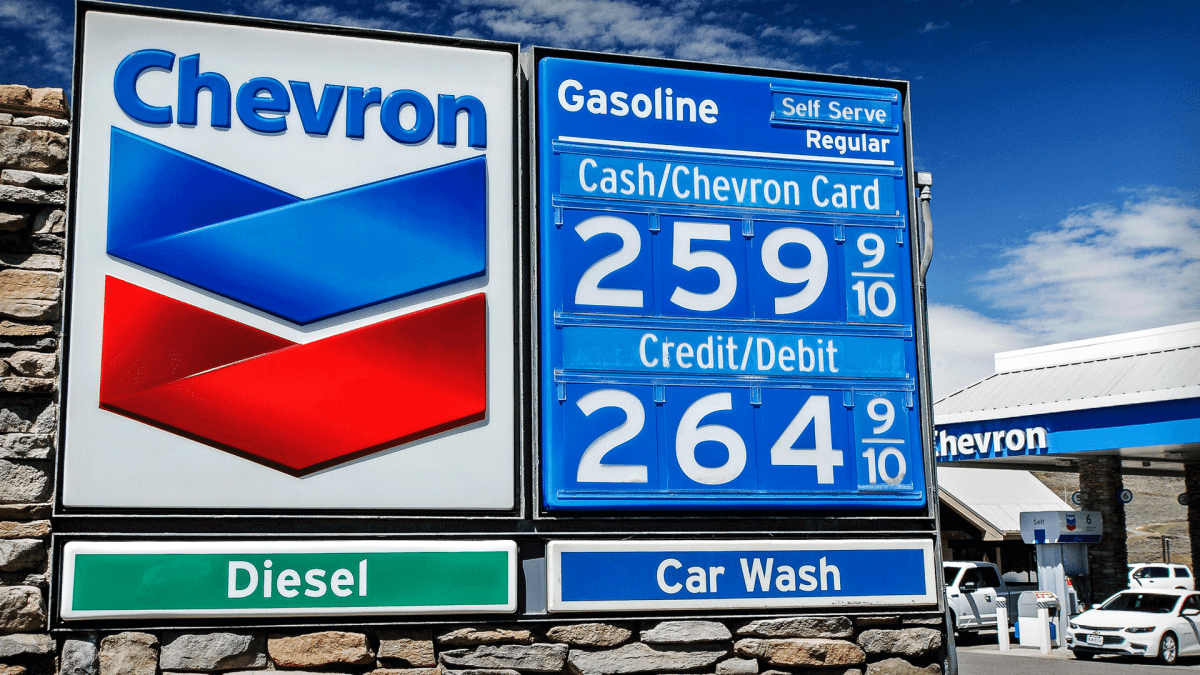

Domestic U.S. gas prices were also notably higher than last year, hitting a peak of $4 per gallon in early November as well.

“We delivered record earnings and cash flow in 2022, while increasing investments and growing U.S. production to a company record,” said CEO Mike Wirth. “Again in 2022, we delivered on our financial priorities: returning cash to shareholders, investing capital efficiently, and paying down debt.”

Chevron shares were marked 3.75% lower in early afternoon trading Friday following the earnings release to change hands at $180.65 each, a move that trims the stock's six-month gain to around 21%.

Earlier this week, Chevron said it would boost its quarterly dividend and buyback as much as $75 billion worth of company stock.

Chevron said it would pay a quarter dividend of $1.51 per share, up from $1.42 per share, while tripling its share buyback plans with a new $75 billion authorization. The dividend is payable to payable on March 10 to holders of record on February 16.

Chevron, as well as other U.S. oil companies, has faced sharp criticism from President Joe Biden, who has accused them of profit-gouging during a time of crisis and failing to use their excess cash to boost production and lower gas prices.

White House spokesman Abdullah Hasan said Thursday that ''FFor a company that claimed not too long ago that it was ‘working hard’ to increase oil production, handing out $75 billion to executives and wealthy shareholders sure is an odd way to show it."

“We continue to call on oil companies to use their record profits to increase supply, and reduce costs for the American people,” he added.