High-rolling investors have positioned themselves bullish on Boeing (NYSE:BA), and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in BA often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 10 options trades for Boeing. This is not a typical pattern.

The sentiment among these major traders is split, with 40% bullish and 40% bearish. Among all the options we identified, there was one put, amounting to $30,345, and 9 calls, totaling $1,204,245.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $170.0 for Boeing during the past quarter.

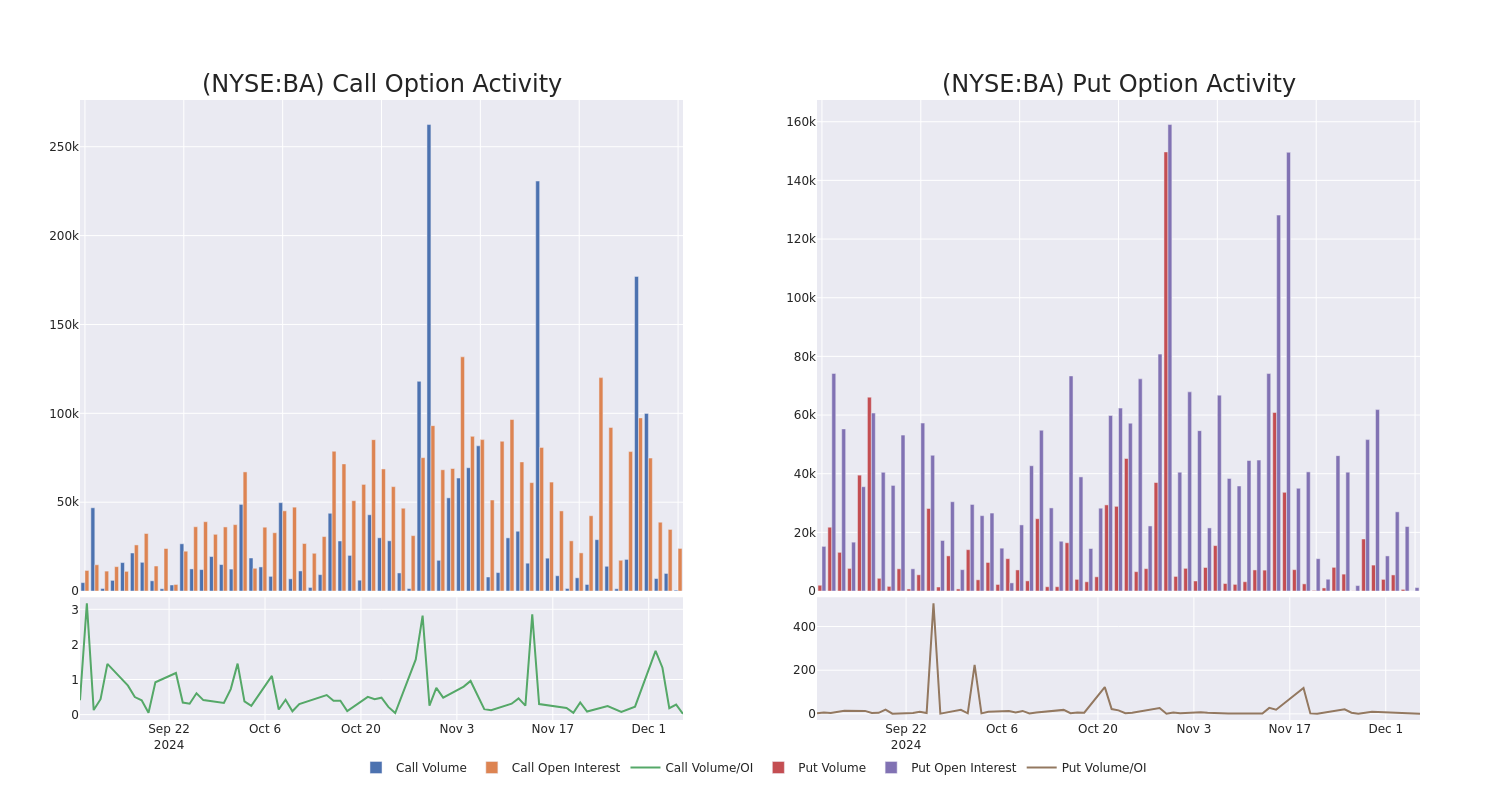

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Boeing's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Boeing's significant trades, within a strike price range of $75.0 to $170.0, over the past month.

Boeing Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BA | CALL | SWEEP | BULLISH | 12/20/24 | $6.0 | $5.05 | $6.0 | $155.00 | $573.6K | 7.8K | 295 |

| BA | CALL | SWEEP | BULLISH | 12/20/24 | $6.0 | $6.0 | $6.0 | $155.00 | $176.4K | 7.8K | 1 |

| BA | CALL | TRADE | BEARISH | 01/17/25 | $86.7 | $83.2 | $83.17 | $75.00 | $124.7K | 95 | 15 |

| BA | CALL | TRADE | BULLISH | 06/18/26 | $42.25 | $42.05 | $42.25 | $140.00 | $105.6K | 296 | 25 |

| BA | CALL | SWEEP | BULLISH | 02/21/25 | $13.15 | $12.65 | $13.15 | $155.00 | $56.5K | 3.0K | 43 |

About Boeing

Boeing is a major aerospace and defense firm. It operates in three segments: commercial airplanes; defense, space, and security; and Global services. Boeing's commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing's defense, space, and security segment competes with Lockheed, Northrop, and several other firms to create military aircraft, satellites, and weaponry. Global services provides aftermarket support to airlines.

Boeing's Current Market Status

- Trading volume stands at 1,208,439, with BA's price up by 0.07%, positioned at $156.78.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 54 days.

Professional Analyst Ratings for Boeing

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $190.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from JP Morgan has decided to maintain their Overweight rating on Boeing, which currently sits at a price target of $190.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Boeing with Benzinga Pro for real-time alerts.