While ChatGPT has been used for everything from answering one's boss at work to planning cheap travel to Europe, things move up a notch when it comes to managing money.

Even though the number of people looking to invest in the company that developed it has soared in tandem with the platform's popularity, most are pretty hesitant to take its advice on when and how to invest.

DON'T MISS: How to Use ChatGPT to Pick the Best Stocks for You

ChatGPT, which was created by OpenAI in 2015 but soared in popularity at the end of last year, is an AI platform that has come much closer to resembling a human voice than its predecessors.

Many are now testing how far it can go in everything from answering eternal philosophical questions to giving real-world advice based on scraped data.

These Stocks Are Recommended By ChatGPT

An online comparison platform based out of the United Kingdom, Finder.com, recently ran an experiment in which it asked ChatGPT to pick 38 companies on the London Stock Exchange for optimal growth over the course of eight weeks.

The platform picked everything from giants like Microsoft (MSFT), Alphabet (GOOGL) and Coca-Cola (KO) to companies that capture the global trends of the day with semiconductor-related companies like ASML (ASML) and Taiwan Semiconductor Manufacturing. (TSM)

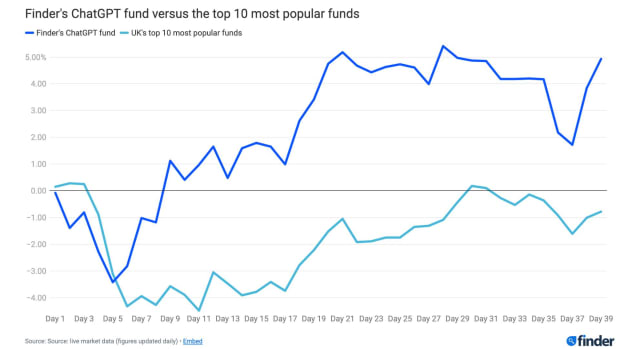

The researchers then tracked the fund's performance for eight weeks starting on March 6, 2023, while also comparing it to the 10 most popular funds in the UK on Interactive Investor.

The trading platform was launched in 1995 and manages over £59 billion ($74.37 billion) in assets.

"The popularity of these funds also indicates that they are well-regarded and trusted by a broad range of investors, making them a reliable reference point for evaluating the performance of the ChatGPT fund," wrote Finder.com's Matt McKenna.

Finder.com

ChatGPT Hedge Fund Actually Did Pretty Well

While the top 10 funds on Interactive Investor fell by 0.78% by the end of the experiment on April 28, the ChatGPT-generated fund had gained 4.93%. By comparison, the S&P 500 rose about 3% in the same time period.

"The ChatGPT fund has outperformed the top 10 most popular funds for 34 of the 39 market days the experiment has been running, or 87% of the time," the Finder.com researcher wrote of the results.

Both the ChatGPT-generated fund and the traditional stocks dropped the most about a week after the experiment started. On March 11, the ChatGPT fund fell 3.42% while the Interactive Investor funds were collectively down 4.32% on March 12.

But overall, the ChatGPT fund went much higher (its peak was 5.41% on April 3 compared to Interactive Investor's 0.27% on March 9) and did not fall as dramatically as the 4.48% drop the top 10 stocks saw on March 17.

While the small scope of the experiment and more diversified portfolio asked of ChatGPT make any widescale conclusions difficult, the strong performance could push many to experiment with using ChatGPT for investment advice. A separate Finder.com study found that while only 8% of people were using ChatGPT for financial advice in 2023, nearly one in five is interested in trying.

"It's not taken the public long to find creative ways of getting ChatGPT to help them in areas where it shouldn't technically do so," Finder CEO Jon Ostler said in a statement announcing the results. "It won't be long until large numbers of consumers try to use it for financial gain."