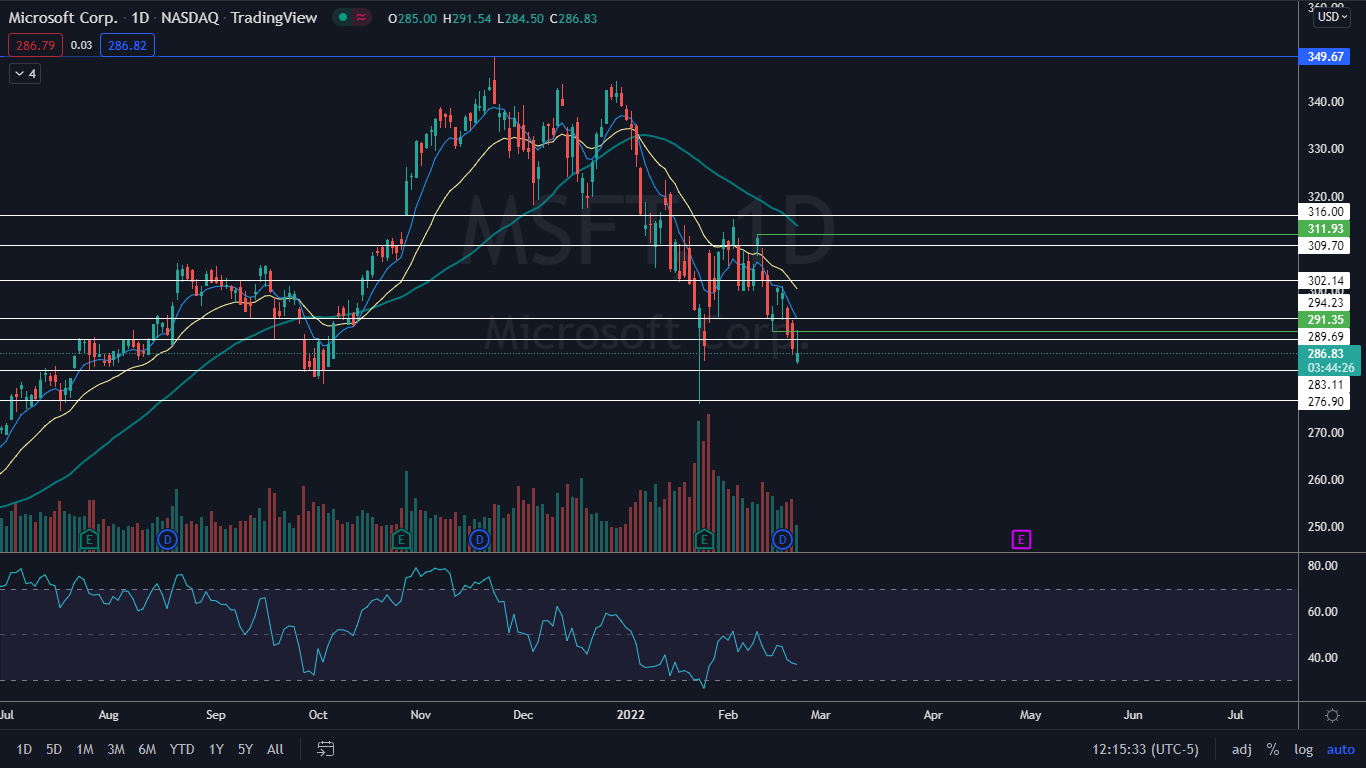

Microsoft Corporation (NASDAQ:MSFT) and Roblox Corporation (NYSE:RBLX) have been trading in steep downtrends since reaching all-time highs of $349.67 and $141.60, respectively, on Nov. 22, 2021.

Roblox has been hit harder by the bear cycle, plummeting over 65% since that date compared to Microsoft, which has declined about 18%.

On Tuesday, Microsoft gapped down about 1% lower to start the trading session but by late morning the stock was trading higher off the open, while the general markets were falling. Roblox, on the other hand, opened lower and by late morning had fallen over 7% to a new all-time low near the $45 level.

Both Microsoft and Roblox need to signal a reversal is coming over the coming days, otherwise, a larger move to the downside may be in the cards. Microsoft is heading toward a key resistance level, while Roblox has no support in terms of price history below.

It should be noted, however, that events affecting the general markets, negative or positive reactions to earnings prints and news headlines about a stock can quickly invalidate patterns and breakouts. As the saying goes, "the trend is your friend until it isn't" and any trader in a position should have a clear stop set in place and manage their risk versus reward.

In The News: On Jan. 18, Microsoft announced it would acquire beleaguered gaming company Activision Blizzard, Inc (NASDAQ:ATVI) in a deal worth $68.7 billion. The acquisition triggered federal and state regulators to broaden their investigations into allegations of workplace harassment at Activision Blizzard, which Microsoft may eventually have to deal with.

Roblox recently dealt with its own allegations of misconduct when on Feb. 3 when a short report labeled the company as “the leading platform for pedophiles,” a claim Roblox denies.

The Microsoft Chart: Microsoft has been trading in a confirmed downtrend since Feb. 2, with the most recent lower high printed on Feb. 9 and $311.93 and the most recent lower low created at the $291.35 mark on Feb. 14.

- On Tuesday, Microsoft was trading slightly lower on lower-than-average, which is a good sign for the bulls because it indicates there are not an overwhelming number of sellers.

- Microsoft’s relative strength index (RSI) is measuring low at about 36%, which can indicate a bounce may come over the following days. When a stock’s RSI nears or reaches the 30% level it becomes oversold, which can be a buy signal for technical traders.

- Microsoft has resistance above at $289.69 and $294.23 and support below at $283.11 and $276.90.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Roblox Chart: On Feb. 18, Roblox lost support at $53.63, which indicated more downside was likely in the cards because when a stock falls to an all-time low there are no key support zones below.

- Roblox has been trading in a falling channel on the daily chart since reaching its Nov. 22 high. If the stock continues to fall lower it may find support at the bottom descending trendline of the pattern, which is currently aligned with about the $28 price level and represents a further 38% move to the downside.

- Roblox’s RSI has reached oversold territory, which indicates that like Microsoft, a bounce to the upside is likely to come although the stock is likely to find heavy resistance at the upper trendline of the falling channel.

- Roblox has resistance in the form of price history at $48.13 and $53.63 and the stock has no support below in the form of price history.