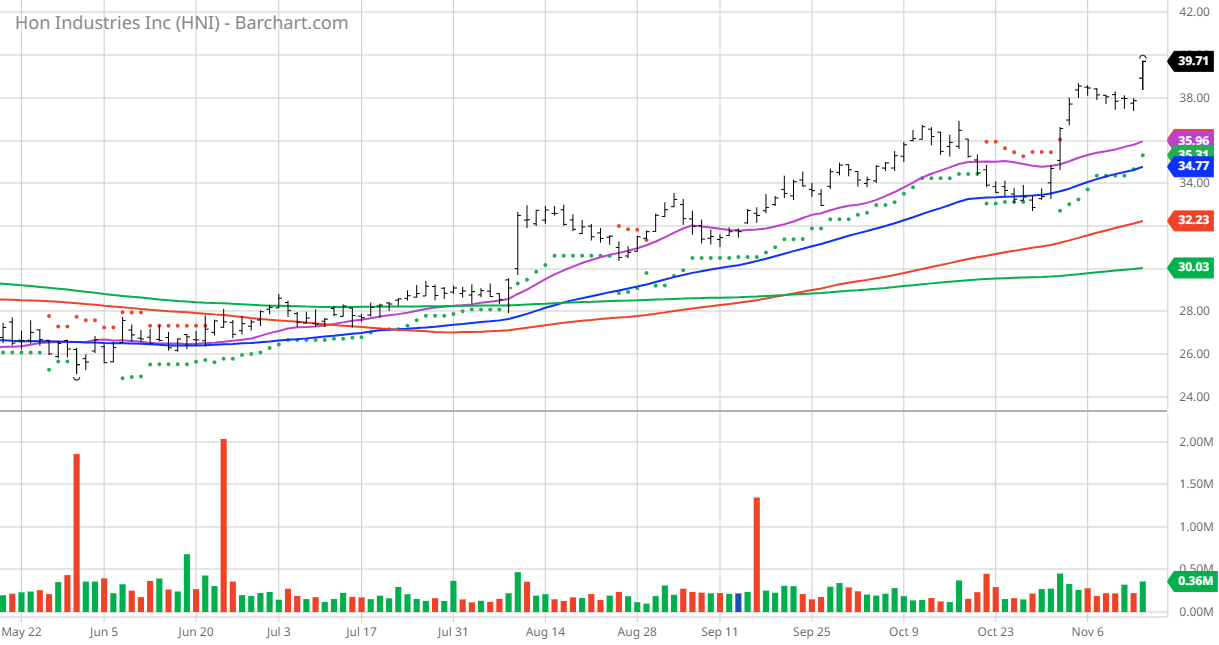

The Chart of the Day belongs to the office furniture and supplies company HNI Corp. (HNI). I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 11/ 2 the stock gained 5.30%.

HNI Corporation, together with its subsidiaries, manufactures, sells, and markets workplace furnishings and residential building products primarily in the United States and Canada. The company operates through two segments, Workplace Furnishings and Residential Building Products. The Workplace Furnishings segment offers a range of commercial and home office furniture, including panel-based and freestanding furniture systems, seating, storage, benching, tables, and architectural products, as well as social collaborative items under the HON, Allsteel, Beyond, Gunlocke, HBF Textiles, HBF, OFM, Respawn, and HNI India brands. This segment sells its products through independent office products dealers, wholesalers, office product distributors, e-commerce focused resellers, and wholesalers, as well as directly to end-user customers and governments. The Residential Building Products segment provides various gas, wood, electric, and pellet-fueled fireplaces; inserts; stoves; facings; outdoor fire pits and fire tables; and accessories. This segment sells its products primarily for home use under the Heatilator, Heat & Glo, Majestic, Monessen, Quadra-Fire, Harman, Vermont Castings, PelPro, SimpliFire, The Outdoor GreatRoom Company, and Stellar brand names through independent dealers and distributors, and corporation-owned distribution and retail outlets. The company was incorporated in 1944 and is headquartered in Muscatine, Iowa.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 49.11+ Weighted Alpha

- 34.43% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 5 new highs and up 11.81% in the last month

- Relative Strength Index 73.01%

- Technical support level at $38.82

- Recently traded at $39.71 with 50 day moving average of $34.77

Fundamental Factors:

- Market Cap $1.76 billion

- P/E 16.95

- Dividend yield 3.38%

- Revenue expected to grow 3.30% this year and another 12.00% next year

- Earning estimated to increase 10.00% this year, an additional 15.30% next year and continue to compound at an annual rate of 10.00% for the next 5 years

Analysts and Investor Sentiment -- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analyst gave 2 strong buy, and 2 hold opinions on the stock

- Analysts' price targets are between $44 and $50 with a consensus of 46.33 for a 17% gain

- The individual investors following the stock on Motley Fool voted 38 to 13 for the stock to beat the market with the more experienced investors voting 5 to 2 for the same result

- Value Line rates its highest rating of 1

- CFRAs MarketScope rates it a hold

- 4,060 investors monitor the stock on Seeking Alpha

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.