After closing on his re-merger of Dish Network and EchoStar last week, company chairman Charlie Ergen outlined Wednesday a series of strategic asset shifts that shield certain spectrum assets, as well as the cash generated by about 3 million Dish pay TV subscribers, from existing creditors.

Wednesday’s EchoStar press release said the moves “further unlock incremental strategic, financial and operating flexibility for its business following completion of its merger” with Dish Network.

EchoStar also announced that it has hired financial advisory group Houlihan Lokey and law firm White & Case LLP to help it evaluate “potential strategic alternatives,” which could include the possible sale of EchoStar Wireless.

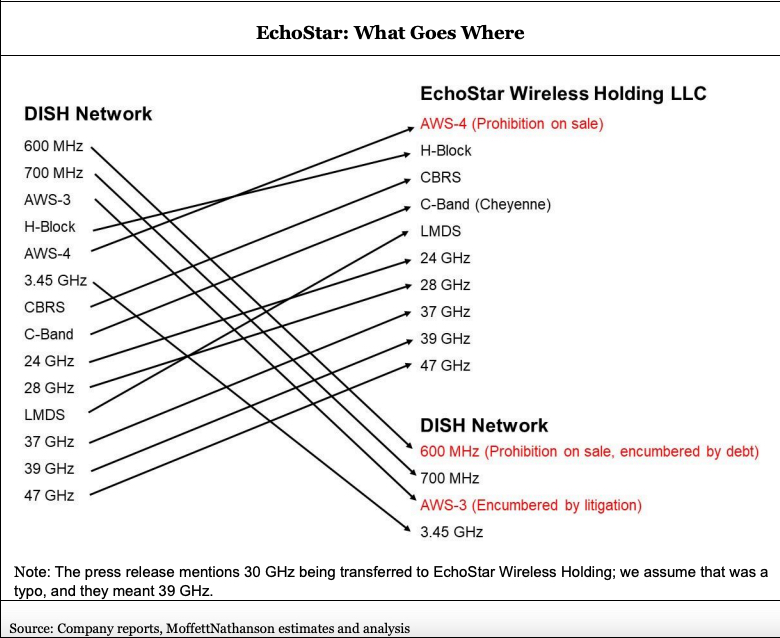

EchoStar investors seemed to react favorably to the news, which divides the company's spectrum assets between Dish Network and a new entity called “EchoStar Wireless Holding LLC.” EchoStar stock spiked more than 35% as of midday trading Wednesday.

But in an investor note headlined, “Making Sense of the Inscrutable,” equity analyst Craig Moffett labeled the announcement “bewilderingly complicated,” while noting the conspicuous absence of a follow-up conference call by Ergen and his team to explain the “why” behind the moves. Moffett also referenced the collapse of the Dish Network bond market, with investors worried about the company's more than $20 billion of debt.

Trying to make sense of what spectrum goes into what bucket, Moffett noted that the EchoStar press release indicates that “unencumbered” spectrum bands are being placed in the newly created EchoStar Wireless Holdings.

But “unencumbered” does not mean, in this case, that the spectrum is part of the Justice Department's T-Mobile-Sprint merger-related consent decree, which restricts Dish from selling the spectrum to AT&T, Verizon or T-Mobile through 2026.

“The encumbrance that EchoStar is referring to appears simply to be whether a given band has already been used as loan collateral,” Moffett wrote.

So essentially, Moffett believes EchoStar is simply optimizing the positioning of its assets to ensure that as much cash and credit are available as possible as Ergen continues his financially perilous quest to build out a national 5G wireless network from scratch.

“What is most important here is that the assets simply aren’t being divided up in a way that would facilitate a sale,” Moffett wrote.

As Bloomberg noted, “Shuffling assets and creating unrestricted subsidiaries are often preludes to money-raising deals that hurt existing creditors by weakening their claims to collateral.”

John Dixon, a managing director and bond trader at brokerage Dinosaur Financial Group, told the news service, “These kinds of maneuvers often result in what we call creditor-on-creditor violence, where new lenders appear and provide funds backed by the same assets that were just taken from the reach of existing debt holders.”