If investors looked only at First Solar's (FSLR) stock chart, they might think that there are no issues in the broader market.

While tech stocks have been performing well, much of the market has been suffering some large swoons amid a return of volatility.

While the Nasdaq has been trying to break out, the S&P 500 has been trying to hold up amid bank failures and worries about interest rates.

Earlier this week, the Federal Reserve raised interest rates by another 0.25 percentage point. Further commentary from Chairman Jerome Powell and Treasury Secretary Janet Yellen has caused more volatility.

Don't Miss: GameStop Stock Slams Into Resistance. Can It Overcome?

While all this is going on, we have a handful of stocks that continue to trade quite well. Nvidia (NVDA) has been one of the best stocks in the market and it’s had nearly every active investor’s eyes on it.

One stock that seems to be flying under the radar, though? First Solar.

Trading First Solar Stock

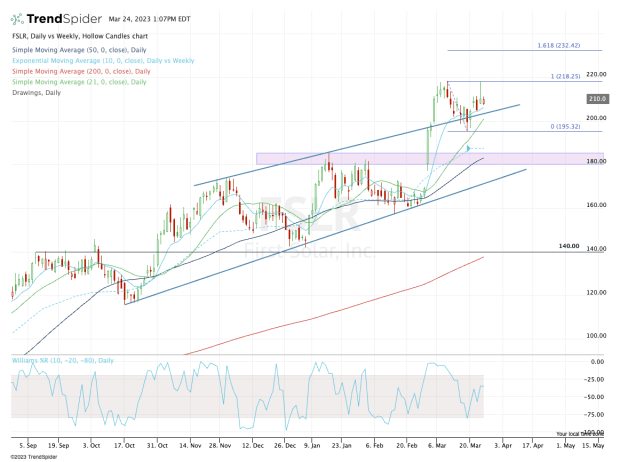

Look at the way First Solar stock has continued to boom higher. It goes on a big rally, pulls back and consolidates, then roars higher again.

In late February, the company reported better-than-expected quarterly results, sending the shares to a multiyear high. The shares rallied 16% in a single day and ultimately climbed 34% amid an eight-day win streak.

The stock had a bit of a harsh correction last week but again found its stride this week, climbing back to the recent highs near $218.

Don't Miss: Realty Income Pays a 5.1% Dividend Yield; Here's When to Buy the Dip

If the market can find its footing and rally from here, we could be looking at another push back up to these highs. A breakout over the $218 to $220 area could open significant upside in First Solar stock.

Specifically, I would have my upside targets around $232, then $250.

The first mark — around $232 — marks the 161.8% extension from the current range. The second target comes into play from the 78.6% retracement of the stock’s full range.

If the stock pulls back further from current levels, the $195 to $200 zone was solid support last time. Further, bulls could look for support from the rising 21-day moving average in that area as well.

Below that and we could be looking at a scenario where First Solar stock dips down into the $180 to $185 zone.