Celestica stock is the IBD Stock of The Day as it retakes a buy point, near a 25-year high. Meanwhile Celestica is seeing earnings sharply accelerate while shares continue to rip higher.

The Toronto-based company engages in contract manufacturing of electronic products for the health care, industrial, aerospace/defense and other markets. On July 24 after the market closes, Celestica will report earnings for the second quarter.

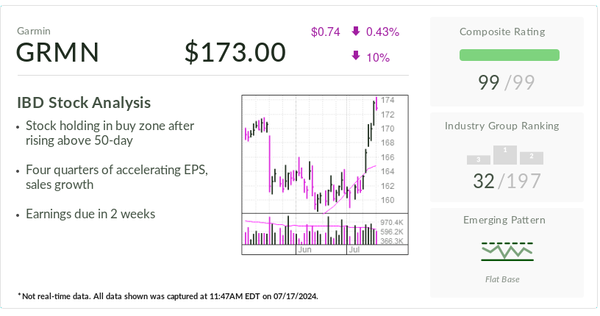

Celestica stock, on the IBD 50 list, bears a perfect Composite Rating of 99.

Celestica Stock Hits Buy Zone After Key Support

Shares of the electronics contract manufacturer popped 3.8% on the stock market today, hitting their highest level since the summer of 2000. Celestica stock regained a 61.06 buy point from a six-week cup base. Celestica, an IBD 50 stock, first cleared that entry last Friday but closed below it, according to MarketSurge charts.

The base formed above short-term support at the 21-day exponential moving average. The 50-day moving average has cradled the entire run-up for Celestica stock from a June 2023 breakout.

Celestica stock has surged 374% from that double-bottom breakout last June. The current pattern is a third-stage base, so investors should use some caution as shares break out again to fresh highs.

Strong Institutional Ownership

Among other favorable signs, CLS stock shows an up/down volume ratio of 1.8, which reflects positive institutional demand. It also enjoys eight quarters of rising fund ownership, according to IBD Stock Checkup. That includes a 6% increase in number of funds owning shares in the latest June quarter.

Invesco Discovery, a member of the IBD Mutual Fund Index, owns Celestica shares. It did trim the position size in June, according to MarketSurge.

However, the relative strength line for Celestica remains just slightly below the peak of the latest consolidation. It would have been a healthy sign if the RS line had caught up with the stock as it broke out on Monday. However, that strength indicator has rallied powerfully in the past year, showing Celestica stock running well ahead of the S&P 500.

Further, Celestica stock earns a 98 Relative Strength Rating out of a best-possible 99. The RS Rating means that Celestica stock has outperformed 98% of all stocks in IBD's database over the past year. However, its brief consolidation has left it down a notch from a perfect 99 four weeks ago.

Year to date, Celestica stock has more than doubled, vaulting 111%.

Celestica Earnings Acceleration

Shares of the electronics contract manufacturer enjoy a 99 Composite Rating, the best-possible score. The Composite Rating combines various technical and fundamental metrics into one easy-to-read score.

Celestica stock also bears a perfect 99 EPS Rating, in part reflecting two straight quarters of accelerating earnings growth.

On April 25, Celestica raised full-year financial guidance after crushing earnings estimates for the first quarter. On a per-share basis, Q1 earnings surged 83% as sales rose 20%.

Both earnings and sales quickened sharply from gains of 36% and 5%, respectively, in the prior quarter.

"We continue to see healthy demand across a number of our major customers, which provides us with the confidence to raise our full-year 2024 outlook," CEO Rob Mionis said in an earnings release.

In full-year 2023, earnings grew 28% on 10% revenue growth, FactSet shows.

For 2024, analysts expect Celestica earnings to jump 38% per share, slowing to a 9% gain in 2025. Sales are seen growing 15% and 9% this year and next, though that is below the three-year rate of 17%.

Celestica agreed in April to acquire NCS Global Services, a U.S.-based IT infrastructure and asset management business, for $36 million. The company said at the time it expected the transaction to close in May or earlier.